Short Term Rental

Study – 2018 Ed.

City of New Orleans

City Planning Commission

Robert D. Rivers, Executive Director

Leslie T. Alley, Deputy Director

Prepared on: September 18, 2018

Prepared By:

Brooke Perry

Kelly Butler

Rachael Berg

Paul Cramer

James Gillie

Nicholas Kindel

Larry W. Massey, Jr.

Table of Contents

A. Executive Summary....................................................................................................... 3

Introduction ................................................................................................................................................ 3

Key Findings ............................................................................................................................................... 4

Recommendations ................................................................................................................................... 9

Next Steps ................................................................................................................................................. 15

B. Short Term Rental History & Current Regulations ................................................. 16

History of Short Term Rental Regulations in New Orleans ..................................................... 16

Current Short Term Rental Regulations ......................................................................................... 19

City Code Regulations .......................................................................................................................... 27

C. Current STR Administration ....................................................................................... 33

Administration ......................................................................................................................................... 33

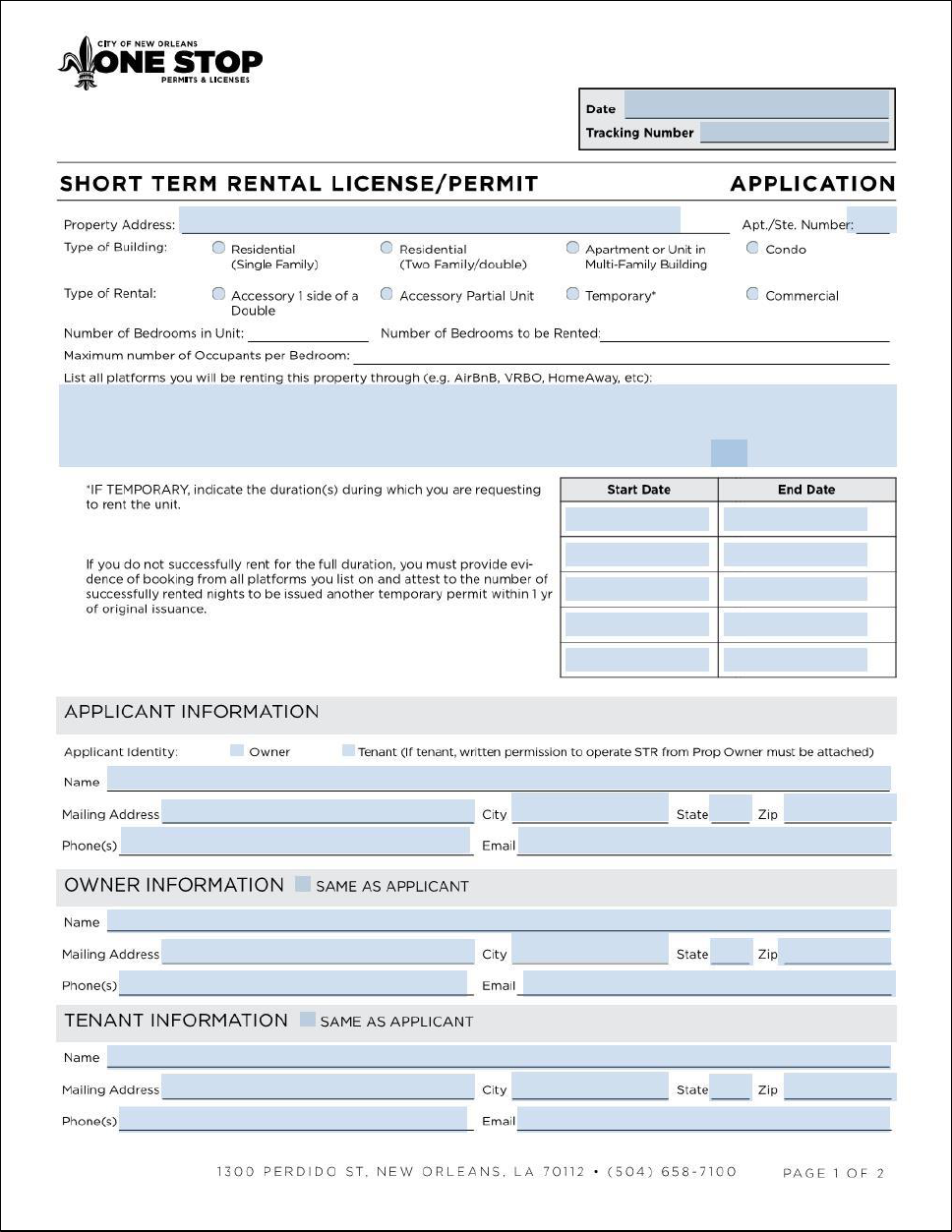

Permitting & Licensing ......................................................................................................................... 35

Enforcement ............................................................................................................................................. 41

Finance ....................................................................................................................................................... 47

D. Short Term Rental Data .............................................................................................. 53

E. Short Term Rentals Industry ...................................................................................... 59

Platforms .................................................................................................................................................... 59

STR Operators .......................................................................................................................................... 59

F. Best Practices ............................................................................................................... 61

Austin, Texas ............................................................................................................................................. 61

Charleston, South Carolina.................................................................................................................. 63

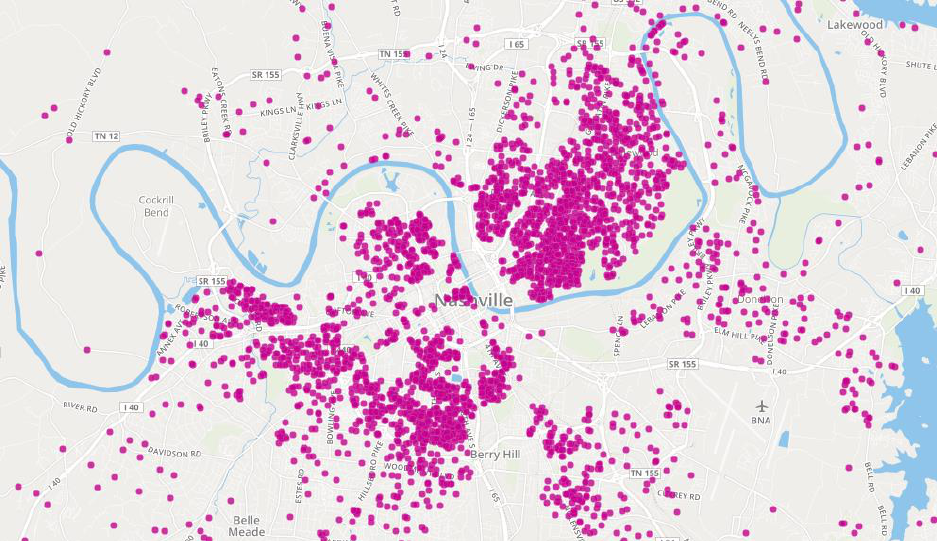

Nashville, Tennessee.............................................................................................................................. 67

Savannah, Georgia ................................................................................................................................. 70

Boston, Massachusetts ......................................................................................................................... 73

Chicago, Illinois ....................................................................................................................................... 73

New York City, New York ..................................................................................................................... 74

San Antonio, Texas ................................................................................................................................. 74

San Francisco, California ...................................................................................................................... 75

Santa Monica, California ...................................................................................................................... 75

Analysis ....................................................................................................................................................... 76

Best Practices Findings: ........................................................................................................................ 78

G. Information Sources & Studies ................................................................................. 79

Inside Airbnb ............................................................................................................................................ 79

“Short Term Rentals, Long Term Impacts”..................................................................................... 79

Local News Coverage ............................................................................................................................ 79

University of New Orleans Study ...................................................................................................... 79

Economic Impact of Commercial Short-Term Rentals in New Orleans .............................. 80

H. Public Input ................................................................................................................. 81

Public Hearings and Written Comments ........................................................................................ 81

Stakeholder Meetings ........................................................................................................................... 83

I. Short Term Rental Regulation Issues & Analysis ..................................................... 85

Land Use Regulations............................................................................................................................ 85

Accessory Short Term Rentals ............................................................................................................ 94

Requiring Homestead Exemptions/Prohibiting Corporate Ownership............................... 96

Zoning Changes for the Purpose of Authorizing Commercial STRs .................................... 96

Affordable Housing Impacts ............................................................................................................... 97

Neighborhood Character and Quality of Life Issues................................................................115

Permitting & Licensing Issues ..........................................................................................................120

Enforcement Limitations ....................................................................................................................127

Platform Accountability ......................................................................................................................129

Revenue....................................................................................................................................................138

J. Summary of Recommendations & Text Changes .................................................. 141

Proposed Comprehensive Zoning Ordinance Text ..................................................................141

City Code .................................................................................................................................................148

Further Study ..........................................................................................................................................153

Next Steps ...............................................................................................................................................153

K. Appendix .................................................................................................................... 155

Page 3 of 155

A. Executive Summary

Introduction

The City of New Orleans implemented its new short term rental (STR) regulations in April of 2017 after

the City Planning Commission studied and provided recommendations to City Council. Three years after

the first study and nearly a year and a half after the implementation of the first STR regulations, the City

Planning Commission is reevaluating the short term rental regulations, acknowledging the proliferation of

the industry, and the unintended effects of the current short term rental requirements.

In March 2018, the City Council passed Motion M-18-86 directing the City Planning Commission to

reevaluate the current STR regulations that were codified in 2017, to provide recommendations for

necessary amendments among growing concerns regarding the affects STRs have on the communities and

neighborhoods in which they are located. Motion M-18-86 was rescinded when City Council passed Motion

M-18-194 in May, 2018, directing the City Planning Commission to reexamine the current STR regulations,

but with an emphasis on analyzing four specific cities’ regulations in order to extract any successful policies

that may influence new STR regulations in New Orleans. In the same meeting, the City Council introduced

the Short Term Rental Interim Zoning District (IZD) covering all lots within the Historic Core and Historic

Urban zoning districts, Central Business District zoning districts, MU-1 Medium Intensity Mixed Use and

MU-2 High Intensity Mixed Use Districts. The IZD prohibited: (1) the issuance or renewal of a Temporary

Short Term Rental permit or license, and (2) any issuance of a Commercial Short Term Rental permit or

license for STR-use on the first floor of a multi-story building that can or may contain residential uses on

subsequent floors.

With relatively lenient STR regulations currently in place, the City Planning Commission staff recognizes

the need to strengthen regulations, protecting New Orleans’ housing stock, ensuring New Orleans remains

a place first and foremost for its citizens, and protecting the character of New Orleans’ unique

neighborhoods.

Study Goals:

Goals from Original Study:

• Ensure the safety of visitors;

• Protect neighborhood character and minimize impacts to residential areas;

• Enable economic opportunities;

• Create equitable regulations for the hospitality industry;

• Create regulations based on best practices that respond to the unique circumstances in New

Orleans;

• Generate revenue for the City;

• Facilitate public notice and information;

• Allow short term rentals based on their impact;

• Propose regulations that respond to the unique impacts of each short term rental type to

minimize nuisances;

• Propose enforceable regulations;

• Prioritize enforcement; and

• Implement a system where problem operators would not vest property rights.

Page 4 of 152

Specific Requests from Motion M-18-194:

Study the City’s existing regulations and STR data to:

• Determine if amendments to existing laws are warranted and necessary;

• Reduce any unintended secondary effects of STRs relative to the residential fabric of the City;

• Ensure platform accountability;

• Amend categories and definitions;

• Make revisions to permitted/prohibited zoning categories;

• Update fee structure to more adequately address housing affordability;

• Create possible remedies to the illegal operation of STRs;

• Adopt the use of parcels, as opposed to municipal addresses, in issuing permits and licenses;

• Modify Commercial STR licensing regulations that would encourage the development of

multi-story commercial buildings containing retail or other commercial uses on the first floor

and residential uses, including Commercial STR, on subsequent floors; and

• Enforce additional/new prohibitions, if needed, including capping measures (such as limiting

the number of licenses or creating restrictions based on block-face, spacing, or census tract),

compliance standards, the use of homestead exemptions in issuing permits and licenses, data

collection, enforcement mechanisms, and any applicable regulations that may be available

relative to the internet platforms that provide STR listings.

Key Findings

Based on the review of nationwide practices and the analysis of the situation in New Orleans, the following

key findings informed the Short Term Rental Study recommendations:

Short Term Rental History

In their previous study, the City Planning Commission staff recommended four types of Short Term

Rentals; Accessory, Temporary, Principal Residential, and Commercial. The City Planning

Commission recommended eliminating the Principal Residential type due to concerns about

allowing whole-home short term rentals in residential districts where there the operator is not

present onsite to manage and monitor the short term rental.

The City Council made a number of modifications to what was initially recommended by the City

Planning Commission. While the City Council maintained the prohibition on the Principal

Residential Short Term Rental type, it expanded the use of the Temporary Short Term Rental type.

The limit on the number of days per year was increased from 30 days to 90 days, and perhaps more

significantly, the Temporary Short Term Rental was no longer required to be someone’s occupied

dwelling unit, which allowed every dwelling unit to potentially become a short term rental without

any limits on density. In addition, City Council voted to eliminate the recommendation that short

term rentals be allowed in the French Quarter (except for the VCE District along Bourbon Street),

among other minor changes.

Since the regulations went into effect on April 1, 2017, there have been a few relatively minor

permanent modifications and a significant temporary change. When modifications to the Riverfront

Design Overlay District were adopted on March 6, 2018, Commercial Short Term Rentals were

prohibited in the Marigny and Bywater portions of the Riverfront Overlay District. Another

modification was adopted on April 11, 2018 which placed a “soft cap” on Commercial Short Term

Rentals in the HU-B1 and HU-MU Districts, where only the first two Commercial Short Term

Rentals per property are a permitted use and any more than two require a conditional use.

Page 5 of 152

Current Short Term Rental Data

The City had a total of 4,210 active Short Term Rental licenses as of May 23, 2018. This roughly

equates to 2.17% of total housing units in New Orleans. Over half of the licenses active at this time

were Temporary licenses (51%), and the remaining split between Accessory (26%), and

Commercial licenses (23%).

The major concentrations of STR licenses are within residential district groupings in the Historic

Core and Historic Urban neighborhoods. Over half (51.1%) of all active licenses are within a

Historic Urban Neighborhoods Residential District, and an additional 14.8% are located within

Historic Core Neighborhoods Residential Districts.

The Central Business District has, in total and proportionately, the greatest concentration of Short

Term Rental licenses with 19.2% of housing units holding a STR license. Other neighborhoods

with high proportions include the Marigny (11.7% of housing units), Bywater (7.7%), Treme-

Lafitte (7.1%), and East Riverside (6%).

Enforcement

Violations of the STR regulations are determined at administrative adjudication hearings by

administrative hearing officers. Currently there are only two hearing officers, which are shared

between the Department of Safety and Permits and Code Enforcement.

In addition to short term rental violations, administrative adjudication hearings for the One Stop

Shop also include violations relating to the Zoning Division, Historic District Landmarks

Commission, and Vieux Carré Commission. The current pool of administrative hearing officers is

very limited. There are only two staff in the One Stop Shop dedicated to adjudications. The hearings

must be shared with other violations. Processing of violations requires significant administrative

support; thus, the amount of short term rental violations that can be adjudicated at a given time is

limited.

After determining that a violation has occurred, an administrative hearing officer may levy fines,

costs, and penalties for each violation of the regulations for short term rentals. The fines that may

be imposed by the hearing officer are limited to $500 per day for each violation of the ordinance

by state law. For many short term rental operators, these fines are not a deterrent.

The City has not collected the majority of fines that have been levied related to STR violations.

The City may place liens on the property for uncollected fines; however, this necessitates

significant staff time and City resources to administer. Additionally, any person determined by the

hearing officer to be liable for a code violation may appeal the determination to Civil District Court

within 30 days of the hearing officer's order. To date there have been 31 appeals to Civil District

Court of short term rental violations, some of which resulted in the fines being dismissed or

lowered.

Platform Accountability

Pursuant to the City Code, short term rental hosting platforms that list short term rentals in the City

must provide certain information about activity on the platform on a monthly basis to the City of

New Orleans. Currently the only platforms that have submitted the required monthly reports are

Airbnb and Expedia.

The current data reporting requirements are inadequate to determine violations other than the 90-

day limit for temporary licenses. The information provided in the reports is not sufficient to take

enforcement action against a particular property because it does not provide any identifiable

information. While a subpoena process is available, the information provided in the responses is

Page 6 of 152

inadequate for effective enforcement. Processing the reports, issuing subpoenas, and tracking

information, takes significant staff time and City resources to administer.

Unlike in the past, the most popular platforms with STR hosts and visitors facilitate not only the

short term rental advertisement, but also the commercial transaction. The commercial transaction

aspect of the service between local hosts, platforms, and visitors has provided a new avenue to

require licensure and data sharing of the platforms with listings in New Orleans.

Operator Accountability

One issue that has been identified since the short term rental regulations were enacted is the lack

of accountability for local property managers or operators of short term rentals. Many people who

have a short term rental license pay a property manager or operator to rent and operate the short

term rental. There are not issues with most operators, but when there is a problem with an operator

it is very difficult to hold him or her accountable. The City is able to cite the property owner and/or

the license holder, but if the operator is neither of those, then it is nearly impossible to hold them

accountable.

This can be especially problematic if there is a license holder that lives out of town and relies on

the property manager or operator to manage all aspects of the short term rental. In some cases, the

operator is renting the short term rental beyond the maximum guest limit, over the 90 night

maximum for Temporary Short Term Rentals, or is using a valid license number for one unit to

rent out other units without licenses. The property owner or license holder might not be aware of

the property manager’s activity until they receive a violation notice from the Department of Safety

and Permits.

Best Practices

Many cities have enacted short term rental regulations in the past few years, but have since amended

their policies with further restrictions to counteract and help mitigate the unanticipated negative

effects STRs have had on the communities in which they are located.

The different cities researched utilize different policy tools to regulate short term rentals. Each

approach has been catered to their specific city’s needs. There is no one-size-fits-all policy for

STRs.

Many of the cities studied require a host on-site during the stay of the STR guests. Requiring a host

during the stay of STR guests helps to mitigate negative impacts sometimes associated with short

term rentals such as noise, trash and inappropriate behavior. Ostensibly, a host who lives in the

property has greater agency than an off-site manager.

Short term rental platforms have cited several legal issues with sharing information and complying

with local zoning regulations including the First Amendment, Communication Decency Act, and

the Stored Communications Act. San Francisco and Santa Monica demonstrate clear examples of

municipalities that have successfully regulated platforms and overcome court challenges because

their regulations are focused on the transaction and not the content of the listing. While there is no

guarantee that these regulations will continue to be upheld if they are appealed to higher courts or

that courts in Louisiana will decide the same way as courts in California, the City should explore

this possibility.

Other cities utilize third party vendors to enhance enforcement, helping City staff to find,

adjudicate, and fine illegally operating STRs.

Page 7 of 152

Public Input

The City Planning Commission held two public hearings, the staff has met with multiple

stakeholders, and received hundreds of written public comments to obtain input on the STR study.

Proponents of STRs assert the benefits of STRs include creating additional income for residents or

renters, providing jobs for service providers (housekeeping, maintenance workers, etc.), spurring

redevelopment of blighted properties, allowing tourists to interact with local hosts, providing an

alternative option for traveling families, and the economic development spurred by visiting STR

guests.

The opponents of STRs state the disadvantages include diminishing housing stock for permanent

residents, increasing home prices and taxes attributed to STRs, loss of permanent residents and

neighborhood character, impacts to quality of life including noise and trash generated by whole-

home STRs, and lack of a permanent resident on-premises to mitigate the potential negative effects

of STRs.

Nuances among STR proponents include some commercial operators who believe that only STRs

within residential neighborhoods pose a problem. Similarly, some STR operators in residential

neighborhoods believe that out-of-city and corporate owners are the source of STR negative

impacts.

Commercial STRs

Citizens expressed a number of concerns related to the Commercial STR type based on several

factors. Commercial STRs are only authorized in non-residential zoning districts and may operate

365 days per year. The zoning districts that authorize Commercial STRs include neighborhood

business and low-intensity mixed use districts that – especially in the City’s Historic Core and

Historic Urban places – can be found on corners surrounded by residences or small nodes and

corridors within the hearts of neighborhoods.

Another concern is the extent to which Commercial STRs may occupy multiple units within multi-

family residential or mixed use structures. A good portion of the City’s apartments or

condominiums are found within Mixed Use or Neighborhood Business zoning districts, which

allow a variety of businesses as well as Commercial STRs. With an unlimited percentage of the

building allowed as STRs, some buildings have become entirely occupied by STRs.

Temporary STRs

The Temporary Short Term Rental license was intended to be a minimally impactful short term

rental type that is only utilized during major events, such as Mardi Gras, or Jazz Fest for permanent

residents. The City Planning Commission originally recommended allowing a resident to rent out

a whole unit for a predetermined time via the Temporary Use Permit process.

The lack of a permanent resident requirement, the generous 90-day limit, and the absence of density

restrictions has led to a proliferation of temporary STR licenses. The Temporary Short Term Rental

license type has become a de-facto whole-home rental, with no permanent resident or owner

present. This has led to quality of life issues, such as noise, loss of neighborhood character, and

other impacts discussed further in this report. These negative impacts are exacerbated in residential

areas, where most of the temporary licenses are located.

Page 8 of 152

Accessory STRs

Of the three types of short term rentals, there is general consensus that the Accessory Short Term

Rental is the least problematic type since there is a requirement for a Homestead Exemption and

the property owner is present during the time of the rental.

Currently the Accessory STR is only permitted in a two-family dwelling where the owner lives in

one half and the other half is licensed as a short term rental. While doubles are one of the most

common housing types in the City, there are other housing types (small multi-family and lots with

more than one dwelling structure) that are unable to take advantage of the regulations.

The current name “Accessory” is confusing to the public. The word “accessory” is intended to

imply that the STR is accessory to the main use of the property, which is a residential dwelling. It

has been interpreted by many that it allows the rental of an accessory structure, which is prohibited

by the definition and use standards.

There has been some criticism of renters being excluded from this STR type since they are the most

impacted by displacement and rising rents.

Capping Measures

Certain neighborhoods, especially in the Historic Core and Historic Urban Neighborhoods, have

high concentrations of short term rental licenses. These neighborhoods typically have higher

densities of residential units due to the compact development pattern. Most of these areas were

constructed before the automobile and are walking distance to tourist attractions and destinations,

which make them desirable to tourists. The most common license type in these neighborhoods is

the Temporary Short Term Rental. Currently, there is no limit on the number of temporary licenses

per lot, which exacerbates this problem.

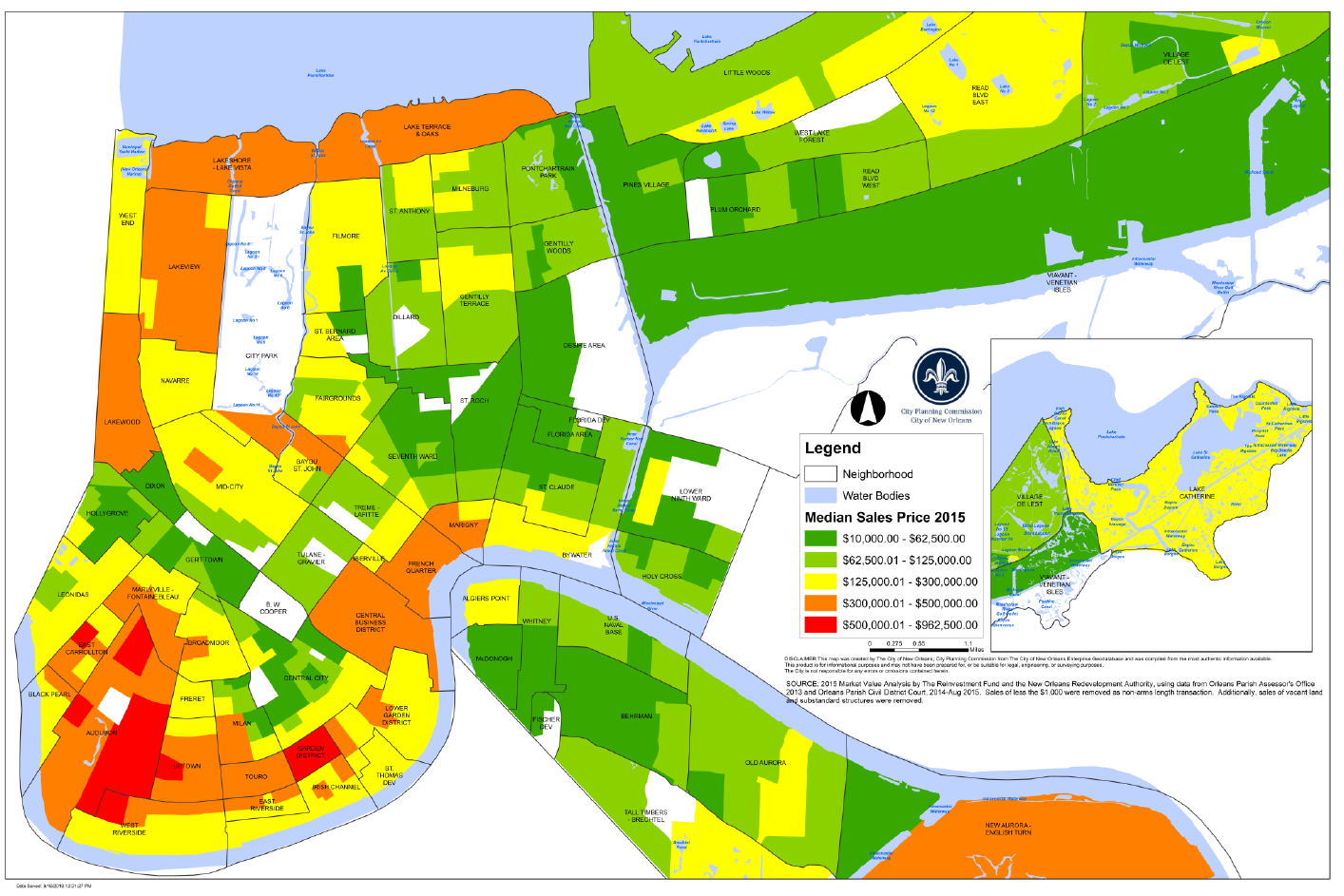

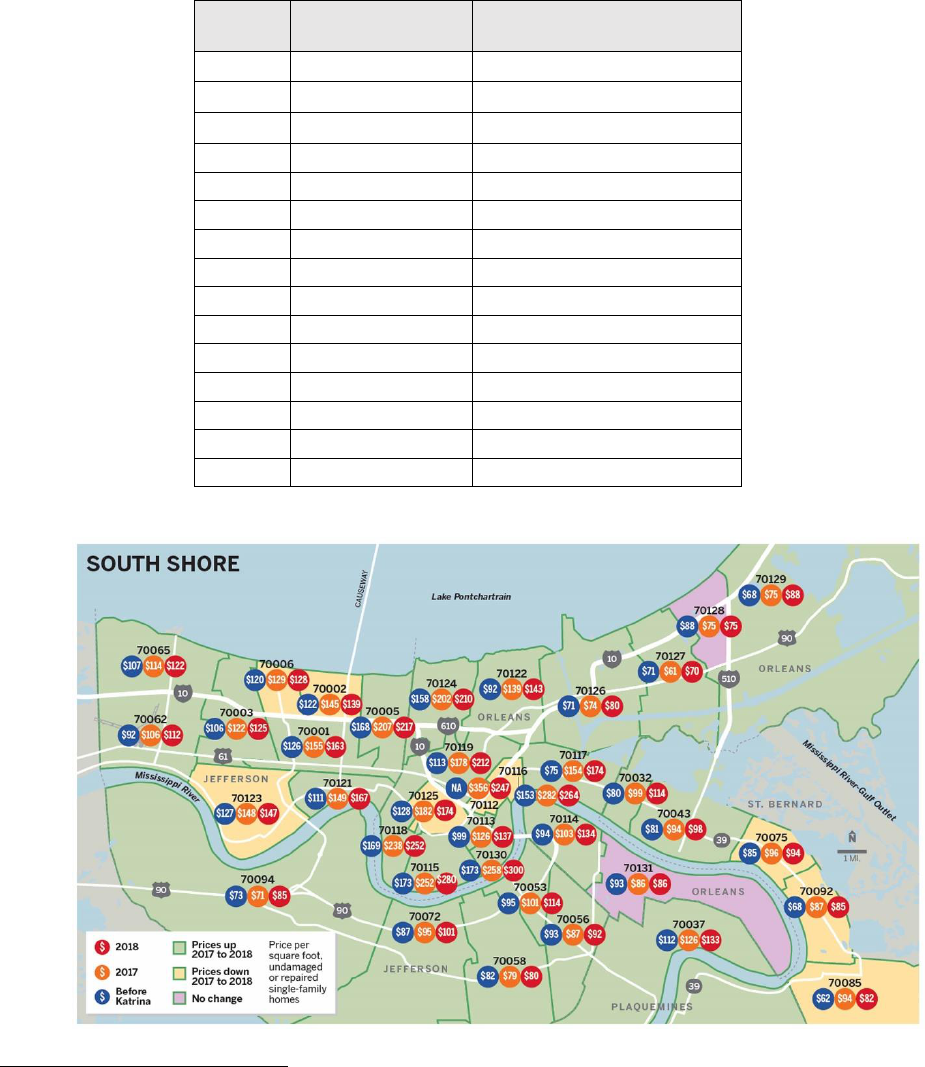

Affordable Housing

There is no conclusive evidence demonstrating that STRs are the cause of housing unaffordability

in New Orleans. There are a number of broader factors which have affected the housing market

over the last decade which have led to increased housing costs. That being said, there is sufficient

anecdotal evidence that STRs have exacerbated an already difficult market especially in the

Historic Core, Historic Urban, and Central Business District neighborhoods where concentrations

of STRs have been greatest.

Finding a home to rent or purchase within an affordable range has become a significant challenge

for many New Orleans residents. This reality has been escalating since the destruction and

devastation to the city’s housing stock from Hurricane Katrina in 2005 and in the policy decisions

made by the City, State and federal government in the years following. In 2008, the nationwide

recession and credit crisis intensified the affordable housing shortage.

The city’s housing condition has now escalated into a crisis level situation where the lack of

affordable housing is affecting residents at the very-low, low, median, and in some cases the above-

median income levels – this is especially difficult for those who need to live in high opportunity

neighborhoods, which are categorized as such due to their proximity to jobs, services, schools, and

public transportation.

These neighborhoods are located in the Central Business District, Historic Core, and Historic Urban

neighborhoods of the City’s Comprehensive Zoning Ordinance, which have high concentrations of

STR licenses, and include the Bywater, Marigny, St. Claude, French Quarter, Treme, Algier’s

Point, Central Business District, Mid City, Bayou St. John, Tulane-Gravier, Lower Garden District,

Garden District, and the Irish Chanel neighborhoods. This is not to say other neighborhoods aren’t

Page 9 of 152

experiencing housing price increases and shortages; in fact, over the past decade, most of city’s

neighborhoods have become unaffordable to its residents.

It is nearly impossible to estimate how many rental units have been taken off the long-term rental

market and converted to STRs or to estimate how many tenants have been evicted or not had their

lease extended to free up units for STR. At the same time, it is also difficult to definitively state

that the reason that rental housing is being lost is solely due to STRs. But what is clear, given the

city’s housing situation, is that residents are feeling the cumulative effects of the loss of available

and affordable housing options.

Neighborhood Housing Improvement Fund

As of June 18, 2018, $652,721 was collected by the Department of Finance, Bureau of Revenue

for the NHIF and includes all fees collected since the May 1, 2017 STR implementation date.

The Office of Community Development (OCD) manages the NHIF disbursements. In the 2018

budget proposal presented to the City Council in November 2017, OCD projected that the 2018

NHIF would take in $3.5 million, which included $500,000 raised through the short term rental fee.

OCD allocated the funds to the following uses; Administrative Costs, Code Enforcement, Special

Needs Home Repair Program, Home Match, Affordable Housing Development, Low Barrier

Shelter, and Aging in Place Program.

OCD allocated $610,000, which was to be combined with approximately $2.5 million from prior

year rollovers for affordable housing development. In meetings with stakeholders, including

housing advocates, neighbors, and STR operators the staff learned that there is general consensus

for raising the NHIF fee on nightly STR rentals to create more affordable housing.

Gap Financing

There are development projects in the city that have been made possible, according to STR

operators, because they signed long-term leases for certain units in the development to be used as

STRs. The projects, one of which included affordable housing units, were apparently at risk of

losing their funding or were not able to secure the proper financing until the STR leases were in

place. The leases provided the security that there would be a guaranteed revenue stream for the

project.

Recommendations

Land Use & Zoning

Definitions

The City Planning Commission proposes to modify the Short Term Rental definition to create two (2) types

of Short Term Rentals: Residential (Partial and Whole Unit), and Commercial.

Short Term Rental. Rental of all or any portion thereof of a residential dwelling unit for dwelling,

lodging or sleeping purposes to one party with duration of occupancy of less than thirty (30) consecutive

days. Hotels, motels, bed and breakfasts, and other land uses explicitly defined and regulated in this

ordinance separately from short term rentals are not considered to be short term rentals. Common

bathroom facilities may be provided rather than private baths for each guest bedroom. A short term

rental is further defined as follows:

A. Short Term Rental, Residential. A short term rental where the owner or resident has his or

her permanent primary residential dwelling unit onsite and is present during the guest's stay.

Page 10 of 152

1. Partial-Unit Residential Short Term Rental. An owner- or permanent resident-

occupied dwelling with a principal use as a permanent dwelling unit and which rents a

portion of the dwelling unit, no more than three (3) guest bedrooms and six (6) total

guests, for overnight paid occupancy as an accessory use.

2. Whole-Unit Residential Short Term Rental. An owner-occupied lot with no more

than four (4) dwelling units where one (1) unit is the owner's permanent residential

dwelling unit and where only one (1) dwelling unit per lot is rented with no more than

three (3) guest bedrooms and six (6) total guests for overnight paid occupancy as an

accessory use.

B. Short Term Rental, Commercial. An entire dwelling unit in a non-residential district that

rents no more than five (5) guest bedrooms for overnight paid occupancy.

A third type of short term rental could be allowed so that permanent residents could benefit from short term

rentals during predetermined periods of the year; however, this would be incredibly labor-intensive for staff

to process and enforce. The practice of using day limits has proven ineffective in the past and would be

easy to exploit. If the City Council desires to allow this type of STR, there should be standards in place to

prevent manipulation of the regulations and resources should be dedicated to processing the licenses and

enforcement:

C. Short Term Rental, Special Event. An owner- or permanent resident-occupied dwelling with

a principal use as a permanent residential dwelling unit and which rents the entire unit with no

more than five (5) guest rooms for overnight paid occupancy as a temporary use not to exceed

fourteen (14) days per year, with a maximum of two (2) permits per year.

Permitted Districts

The staff believes that the Residential and Special Event Short Term Rental types should be allowed in any

zoning district where dwellings are permitted by the Comprehensive Zoning Ordinance, provided that all

requirements of the City Code and Comprehensive Zoning Ordinance are met. The staff believes that the

French Quarter and Garden District should be treated similarly to the other historic neighborhoods in the

City, especially given the above recommendation effectively prohibiting whole-home STRs in residential

districts. Therefore, the staff recommends the same regulations that correspond to the different zoning

districts in the historic neighborhoods also apply to the French Quarter.

Residential Short Term Rentals shall be permitted in any district where dwelling units are permitted

by the Comprehensive Zoning Ordinance.

City Planning staff believes the impacts of Commercial STRs have proven more significant than many of

the neighborhood-friendly uses authorized in neighborhood business zoning districts. This warrants a

structure of zoning district permissions somewhat more restrictive than currently written.

Prohibit Commercial Short Term Rentals in the least intensive neighborhood business districts.

To preserve ground floor commercial that is critical to the pedestrian environment in historic commercial

corridors, the staff recommends a restriction on the first floor of multi-story buildings in certain zoning

districts.

Prohibit Commercial STR licenses on the first floor of a multi-story building that can or may

contain residential uses on subsequent floors, in historic commercial corridor districts.

Page 11 of 152

The staff believes there should be a limitation on the number of Commercial Short Term Rentals permitted

in each building in certain districts to preserve long-term housing units and prevent the conversion of multi-

family buildings to commercial uses. This cap should not apply to districts or areas where development on

upper floors has been complicated in the past, such as along Canal Street or in the VCE District.

The staff recommends imposing a cap of 1 unit or 25% of all units per lot or within a single building

constructed across lot lines, whichever is greater in certain zoning districts. The City should further

explore using Commercial STRs above the cap as an incentive for the provision of affordable

housing units within the same building or lot.

This cap should not apply to the VCE District or properties with frontage along Canal Street

between the River and Rampart Street.

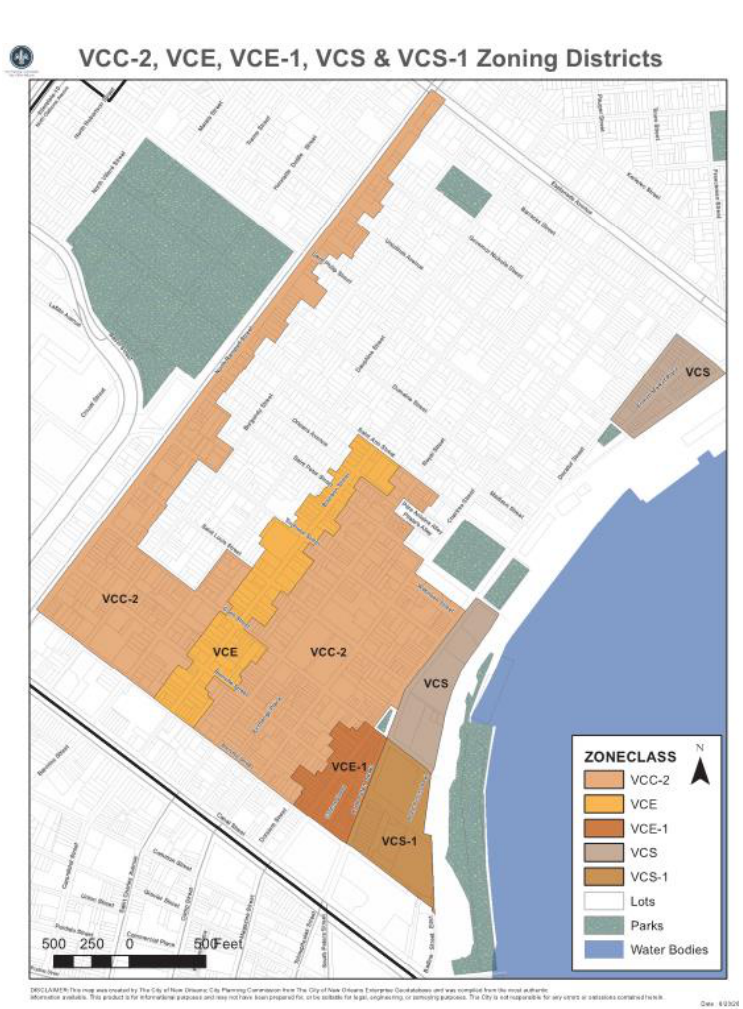

The table below summarizes recommended district permissions and new standards for Commercial STRs.

If a district is not listed, Commercial STRs are recommended as prohibited.

Place

Designation

Zoning District

Permitted?

New Standards/Limitations

Rural

Development

Districts

M-MU Maritime Mixed

Use

Yes*

*25% cap

Historic Core

Neighborhoods

Non-

Residential

Districts

VCE Vieux Carré

Entertainment

Yes*

*Ground floor restriction – no cap

VCE-1 Vieux Carré

Entertainment

Yes*

*25% cap and ground floor restrictions

VCC-1 Vieux Carré

Commercial

No

N/A

VCC-2 Vieux Carré

Commercial

Yes*

*25% cap and ground floor restrictions

VCS Vieux Carré Service

Yes*

*25% cap and ground floor restrictions

VCS-1 Vieux Carré

Service

Yes*

*25% cap and ground floor restrictions

HMC-1 Historic Marigny,

Treme, Bywater

Commercial

No

N/A

HMC-2 Historic Marigny,

Treme, Bywater

Commercial

Yes*

*25% cap and ground floor restrictions

HM-MU Historic

Marigny, Treme, Bywater

Mixed Use

Yes*

*25% cap and ground floor restrictions

Historic Urban

Neighborhoods

Non-

Residential

Districts

HU-B1A Historic Urban

Neighborhood Business

No

N/A

HU-B1 Historic Urban

Neighborhood Business

Yes*

*25% cap and ground floor restrictions

HU-MU Historic Urban

Mixed Use

Yes*

*25% cap and ground floor restrictions

Suburban

Neighborhoods

S-B1 Suburban

Neighborhood Business

No

N/A

Page 12 of 152

Place

Designation

Zoning District

Permitted?

New Standards/Limitations

Non-

Residential

Districts

S-LB1 Suburban Lake

Area Neighborhood

Business

No

N/A

S-B2 Suburban Pedestrian

Corridor Business

Yes*

*25% cap and ground floor restrictions

S-LB2 Suburban Lake

Area Neighborhood

Business

Yes*

*25% cap and ground floor restrictions

LC Lake Area

Commercial

Yes*

*25% cap and ground floor restrictions

Commercial

Center and

Institutional

Campus

Districts

C-1 General Commercial

Yes*

*25% cap and ground floor restrictions

C-2 Auto Oriented

Commercial

Yes*

*25% cap and ground floor restrictions

C-3 Heavy Commercial

Yes*

*25% cap and ground floor restrictions

MU-1 Mixed Use

Medium Intensity

Yes*

*25% cap and ground floor restrictions

MU-2 Mixed Use High

Intensity

Yes*

*25% cap and ground floor restrictions

EC Educational Campus

Yes

None

MC Medical Campus

Yes

None

LS Life Sciences

Yes

None

Centers for

Industry

MI Maritime Industrial

Commercial &

Recreational Subdistrict

Yes

None

Central

Business

Districts

CBD-1 Core Central

Business

Yes*

*25% cap

CBD-2 Historic

Commercial and Mixed

Use

Yes*

*25% cap

CBD-3 Cultural Arts

Yes*

*25% cap

CBD-4 Exposition

Yes*

*25% cap

CBD-5 Urban Core

Neighborhood Lower

Intensity Mixed Use

Yes*

*25% cap

CBD-6 Urban Core

Neighborhood Mixed Use

Yes*

*25% cap

CBD-7 Bio-Science

Yes*

*25% cap

Permitting & Licensing

Application Submittal Requirements

The City should require additional documentation by the applicant at the time of application to

verify information about the short term rental, which could include a site plan, floor plan with unit

layout with all rooms listed and smoke detectors and fire extinguishers locations, proof of

insurance, property owner permission form (if applicable), links to existing listings, and interior

and exterior photographs.

Page 13 of 152

Applications should include a Nuisance Prevention and Response Plan requirement, which could

include a noise monitoring system.

If residency is required, two documents to include at least one Louisiana state-issued identification

(i.e driver’s license), and should include a second form that could include voter registration, bank

statement, pay stub, W2 form, or utility bill mailing address.

Applicants should provide listing data including platforms used and identification numbers used

on any platform.

Renters can stand to benefit from being a partial unit STR operator, helping to insulate them from

rising housing costs. If a renter is the short term rental operator of a partial-unit Residential Short

Term Rental, then the applicant shall submit a form provided by the Department of Safety and

Permits that is signed by the property owner and notarized. The form should grant permission for

the renter to operate a partial-unit short term rental, confirm that the renter will reside in the

dwelling unit for the term of the license, and serve as notice that the property owner could held

responsible for any violations associated with this short term rental.

Renewals should require all of the same information documentation, attestations, and/or

inspections as the original application submittal. In addition, the short term rental operator should

report the number of nights rented the previous year and provide proof of tax payment in the form

of a tax clearance from the Department of Finance and/or documentation from the platform

verifying that the correct amount of taxes remitted to the City for the licensed short term rental.

The Department of Safety and Permits should not renew licenses for short term rentals with open

violations and unpaid taxes or fines. In addition, the Department of Safety and Permits should

develop a policy and appeal process for the revocation and non-renewal of licenses for owners

and/or operators with a history of noncompliance with the regulations.

License Review Process Recommendations

Notice should be provided once the license has been issued to surrounding property owners or

occupants, which should include the license number, type, limitation, contact information, and how

to report violations.

A zoning review should be required by the Zoning Division of the Department of Safety and

Permits to confirm that all the requirements of the Comprehensive Zoning Ordinance have been

met prior to issuance of a short term rental license.

Inspections could be required for all short term rental applications; however, this would require

additional license review time, require additional resources for the Department of Safety and

Permits, and could be a disincentive for some people to apply which would reduce the compliance

rate.

The City Council shall budget adequate resources for personnel and other operating expenses to

the Department of Safety and Permits for short term rental license review.

Enforcement

The Department of Safety and Permits should develop a separate administrative adjudication

process for short term rental violations.

The City Council should ensure there is adequate funding in the Department of Safety and Permits

and the City Attorney’s office to process adjudications, pay for administrative hearing officers,

follow up on judgments, and defend appeals to Civil District Court.

Page 14 of 152

The City should provide additional funding for proactive STR enforcement, to identify violations

of the regulations via web scraping or other techniques. This could be provided by a third-party

provider or achieved with ongoing education of City staff.

Develop a 24/7 mechanism where citizens can report suspected violations of the STR regulations.

Staff inspectors during the evenings, weekends, and during large tourist events to respond in real-

time to complaints.

To effectively enforce short term rentals, the City needs to advocate for the amendment of State

Law to increase the maximum daily fine to above $500.

Criteria for revocation of STR, Platform, and Operator licenses should be developed and enforced.

Platform Accountability, Compliance, and Cooperation

Platforms shall be required to register with the City and obtain an annual license.

The City Council should amend the City Code to require that all platforms and booking agents

(internet-based or not) that facilitate or make a STR transaction possible collect and remit the

applicable taxes to the City of New Orleans. This shall not absolve the STR operators from any

requirements for record keeping, reporting to the City, and paying any taxes that have not been

remitted by the platforms.

The City should require platforms to share additional data including addresses, listing identification

or link, and license numbers in the monthly reports.

Listings shall include license numbers.

Listings not identified by owner/operator as part of the license application shall be presumed to be

illegally operating.

Revenue

To ensure that short term rental operators are paying all applicable taxes and fees, every STR license holder

should be required to register with the Department of Finance, Bureau of Revenue as a prerequisite to

obtaining a license.

Require STR operators to register with the Bureau of Revenue as a prerequisite to obtaining a

license.

The short term rental operator shall keep a log of short term rental activity which includes date the

unit was rented on a short term basis and fees for the rental. This log shall be maintained up to date

and is subject to inspection by the City upon request and during the license renewal.

Upon renewal, the operator shall present the Department of Safety and Permits with verification

that all applicable taxes and fees have been paid.

Affordable Housing

The per night fee for the NHIF required by STR license holders should be increased to $8.00 per

occupied night, while keeping the per night fee for partial rentals at $1.00.

The money raised in the NHIF by STRs should be dedicated to affordable housing development

and administrative fees to develop the affordable housing and should not be used for code

enforcement regulation or other code compliance.

Any person or entity submitting an application for a short term rental license shall complete an

Affordable Housing Impact Analysis (AHIS) form. This form shall be required for an application

to be considered complete.

Page 15 of 152

In accordance with the City’s housing policies, including affordable housing and home buyer

programs, the Administration and City Council could consider leveraging Commercial STRs above

the cap in exchange for an affordable housing unit or by creating a program to assist potential

homebuyers in securing gap financing.

Operator Requirements

To ensure that short term rentals are properly licensed and operate in a responsible manner, the following

regulations should be put into place:

The Department of Safety and Permits should license the people who act as short term rental

operators. There shall be two types of Short Term Rental Operator licenses, one for on-site

Residential (Residential STR operators) and one for Commercial STR operators.

The Short Term Rental Operator license holder must be a natural person and not a corporation.

Short term rental operators shall reside within a certain driving distance from the short term rental

location.

The license will require a fee and passing an online or in-person test to ensure knowledge of the

short term rental regulations and the responsibilities of an operator.

It should be a violation to be a short term rental operator without a license and operate a short term

rental in violation of the short term rental regulations in the Comprehensive Zoning Ordinance and

City Code.

Next Steps

The 2018 Short Term Rental Study directed by City Council Motion M-18-194 will be presented to the

City Planning Commission on September 25, 2018. Before it considers the Study, the CPC must first hold

a public hearing; special rules were adopted at the September 11, 2018 meeting that will (1) limit each

speaker to a maximum of one (1) minute, and (2) disallow speakers from ceding time to another speaker.

Taking public input into mind, the CPC can choose to forward the Study to the City Council with or without

changes to the staff recommendations. If the CPC chooses to modify the Study recommendations, the staff

will incorporate those recommendations and forward the revised Study to the City Council by the deadline

of October 5, 2018. The City Council may choose to hold its own public hearing on the Study, though it is

not required. The City Council may then direct the CPC to consider all or part of the recommendations as

text changes to the Comprehensive Zoning Ordinance. If that is done, the CPC will docket the request and

write a staff report with recommendations for specific zoning text changes. The zoning docket would

require an additional public hearing before the CPC and again the CPC may choose to recommend text

changes to the City Council with or without modification of the staff recommendations, or they could

recommend denial of the proposal. Next, the City Council must hold a public hearing before considering

adoption of zoning text changes. The Council may adopt, adopt with modifications, or deny the

recommendations of the CPC.

The Short Term Rental Study also makes recommendations for changes to the City Code, processes around

Short Term Rental administration, and advocacy at the State level. The City Planning Commission would

not be formally involved in implementation of those changes.

As noted earlier, a Short Term Rental Interim Zoning District is in effect and has prohibited the issuance

and renewal of Temporary STR licenses in much of the city. Any STR type or non-qualifying structure

prohibited under new regulations may continue to operate under a previously-issued license until the

expiration of that license. If the Temporary STR license type is eliminated as recommended, most of those

licenses will have expired by the time new regulations go into effect.

Page 16 of 152

B. Short Term Rental History & Current Regulations

History of Short Term Rental Regulations in New Orleans

What are Short Term Rentals?

In general, short term rentals are residential dwelling units that are rented for overnight lodging purposes.

Short term rental are different from long-term rentals in that they are rented to visitors and many not be

someone’s place of residence. The Comprehensive Zoning Ordinance (CZO) defines short term rentals as

being rented for less than 30 consecutive days, which is a common distinction between short and long-term

rentals used throughout the United States.

Short term rentals are not the only defined lodging use in the CZO, which includes bed and breakfasts,

hostels, hotels/motels, and timeshares. Short term rentals are most similar to bed and breakfasts, which are

both located in residential dwelling units. The largest difference between short term rentals and bed and

breakfasts is that short term rentals are generally rented out as an entire dwelling unit while bed and

breakfasts are required to have an owner or operator who lives in the dwelling and are typically rented per

room.

1

A hotel/motel is an establishment that provides sleep accommodations and has customary lodging services,

such as a lobby, concierge services, pools, conference and meeting facilities, restaurants, and bars.

Hotels/motels typically rent rooms that do not have kitchen facilities, so they are not renting dwelling units.

Hostels are similar to hotels/motels, except a guest can rent a room or a bed in a common dormitory style

room and often have shared bathrooms and/or shared kitchen facilities. A timeshare building can be similar

to certain types of short term rentals, in that they can be dwelling units. The difference between a timeshare

and a short term rental is that in a timeshare the person has either an ownership stake or right of use for

certain period of the year.

In summary, short term rentals are intended to provide temporary sleeping accommodations for visitors to

New Orleans and are different from long-term rentals in that short term rentals are rented for less than 30

days. In addition, short term rentals are different from other temporary sleeping accommodations in that

they are typically an entire dwelling unit that is rented to a single party of guests.

Regulations Prior to Original Short Term Rental Study

The City Planning Commission first studied short term rentals in fall of 2015, and the first study was

approved by the Planning Commission on January 26, 2016. During this first study, CPC found that there

were very limited regulations on short term rentals and they were not allowed in most parts of the City. At

this time, the definition for a short term rental was as follows:

“Short Term Rentals. Rentals of a premises or any portion thereof for dwelling, lodging or

sleeping purposes with duration of occupancy of less than sixty (60) consecutive days in the Vieux

Carré and less than thirty (30) consecutive days outside the Vieux Carré. Hotels, motels, bed and

1

The exception to this is the partial unit Accessory Short Term Rental where a party rents up to 3 bedrooms of an

owner occupied dwelling unit, which is very similar to an Accessory Bed and Breakfast.

Page 17 of 152

breakfasts, and other land uses explicitly defined and regulated in this ordinance separately from

short term rentals are not considered to be short term rentals.”

The short term rental definition was not specific to what a short term rental was, it essentially renting

something for sleeping purposes that was not defined as another specific land use in the CZO. In addition,

short term rental were allowed in very few areas. Short term rental were a permitted use in the S-LC District,

a subdistrict of the MI District, and the CBD-7 District, and a conditional use in 9 other zoning districts.

2

Despite being permitted in only a few districts, the number of short term rentals were proliferating as

platforms like Airbnb made listing and renting short term rentals safer and easier, and short term rentals

became much more popular. In addition, the City had lax enforcement of the short term rental regulations,

so there was little disincentive for people to rent their properties on a short-term basis without a license.

The CPC staff estimated that there were between 2,400 and 4,000 unique short term rentals at that time,

70% of which were rentals of an entire dwelling unit.

2016 Short Term Rental Study

In the 2016 Short Term Rental Study, the City Planning Commission staff recommended a regulatory

framework for short term rentals. CPC staff recommended creating 4 categories of short term rentals based

on the type and location of the short term rental, which were generally as follows:

Accessory Short Term Rental: required someone to be onsite at the time of the rental either as a

partial dwelling unit or in one unit of an owner-occupied double;

Temporary Short Term Rental: an occupied dwelling unit, the entire of which could be rented

up 30 days per year when the permanent resident was not present;

Principal Residential Short Term Rental: An entire dwelling unit in a residential district that

could be rented year-round but required approval of a temporary conditional use and was limited

in density to 2-4 per block; and

Commercial Short Term Rental: an entire dwelling unit in a non-residential district that can be

rented year-round with limited restrictions.

The CPC staff made recommendations for definitions, permitted and conditional use district permissions,

use standards, temporary use standards, and parking requirements for these four types of proposed short

term rentals. In addition, CPC staff suggested permitting and license requirements, a fee, tax and fine

structure, and enforcement recommendations in City Code. The CPC staff submitted the study to the

Planning Commission for its considerations. The Planning Commission recommended eliminating the

proposed Principal Residential Short Term Rental type and recommended approval of the modified study

at their January 26, 2016 meeting. The Planning Commission recommended eliminating the Principal

Residential Short Term Rental type due to concerns about allowing whole-home short term rentals in

residential districts where there the operator is not present onsite to manage and monitor the short term

rental. The Planning Commission’s recommendations, included the elimination of the Principal Residential

Short Term Rental, are summarized in the Figure below.

2

Short term rentals were conditional uses in the C-2, MU-1, MC, MS, LS, CBD-1, CBD-2, CBD-3, and CBD-4

Districts, prior to the adoption of the current regulations.

Page 18 of 152

City Council Adopted Regulations

On May 5, 2016, the City Council passed a motion directing the City Planning Commission to consider a

text amendment to the Comprehensive Zoning Ordinance to implement the recommendations in the Short

Term Rental Study. This request was considered by the City Planning Commission at their August 9, 2016

meeting, and went back to City Council for final consideration. At their December 1, 2016 meeting, City

Council adopted multiple ordinances to enact the short term rental regulations in the Comprehensive Zoning

Ordinance and City Code.

City Council made a number of modifications to what was initially recommended by the City Planning

Commission. While the City Council maintained the prohibition on the Principal Residential Short Term

Rental type, they expanded the use of the Temporary Short Term Rental type. The limit on the number of

days per year was increased from 30 days to 90 days, and perhaps more significantly, the Temporary Short

Term Rental was no longer required to be someone’s occupied dwelling unit, which allowed every dwelling

unit to potentially become a short term rental without any limits on occupancy or density. In addition, City

Council voted to eliminate the recommendation that short term rentals be allowed in the French Quarter

(except for the VCE District along Bourbon Street), among other changes.

City Council also adopted an ordinance that established the permit and license requirements, fees, penalties,

and platform data sharing requirements in City Code.

3

These City Code changes set up the licensing

3

Ordinance No. 27,204 MCS

Figure 1: City Planning Commission’s Original STR Recommendation

Page 19 of 152

requirements for the Short Term Rental types that were established in the CZO. These requirements allowed

the applicant to attest to complying with then licensing requirements, which helped facilitate the “pass-

through” registration process that was established with Airbnb where applicants could initiate the license

application on Airbnb’s website. Finally, City Council adopted an ordinance that established a $1 per night

fee for the Neighborhood Housing Improvement Fund for affordable housing,

4

and authorizing the Mayor

to enter into a Cooperative Endeavor Agreement with Airbnb for the remittance of taxes.

5

The Short Term

Rental regulations went into effect on April 1, 2017.

Modifications Since Short Term Rental Regulations were Adopted

Since the regulations went into effect on April 1, 2017, there have been a few relatively minor permanent

modifications and a significant temporary change. When modifications to the Riverfront Design Overlay

District were adopted on March 6, 2018, Commercial Short Term Rentals were prohibited in the Marigny

and Bywater portions of the Riverfront Overlay District.

6

Another modification was adopted on April 11,

2018 which placed a “soft cap” on Commercial Short Term Rentals in the HU-B1 and HU-MU Districts,

where only the first two Commercial Short Term Rentals per property are a permitted use and any more

than two require a conditional use.

7

In addition to the changes above, right after City Council adopted this new Short Term Rental Study motion,

City Council adopted Motion M-18-145 which created the Short Term Rental Interim Zoning District

(IZD). This IZD prohibits the following uses in the Historic Core Districts, Historic Urban Districts, Central

Business Districts, the MU-1 District, and the MU-2 District:

Any issuance or renewal of a Temporary Short Term Rental permit or license.

Any issuance of a Commercial Short Term Rental permit or license for STR-use on the first floor of a

multi-story building that can or may contain residential uses on subsequent floors.

This IZD went into effect when the motion was adopted. The City Planning Commission considered this

request at it July 10, 2018 meeting and recommended modified approval of the IZD.

8

The City Council

voted to approve the City Planning Commission’s recommendation at their September 6, 2018 meeting.

Current Short Term Rental Regulations

Comprehensive Zoning Ordinance Regulations

As amended by recent text amendments and the Short Term Rental Interim Zoning District, here are the

current short term rental definitions, use standards, off-street parking requirements, permitted and

conditional use permissions, and temporary provisions in the Comprehensive Zoning Ordinance:

Definitions (Article 26)

Here are the definitions for short term rentals and the three specific types of short term rentals from the

Comprehensive Zoning Ordinance:

4

Ordinance No. 27,210 MCS

5

Ordinance No. 27,218 MCS

6

Ordinance No. 27,674 MCS

7

Ordinance No. 27,726 MCS

8

The City Planning Commission recommended some minor changes to clarify the applicability of the IZD for certain

Commercial Short Term Rentals (Zoning Docket 086/18).

Page 20 of 152

Short Term Rental. Rental of all or any portion thereof of a residential dwelling unit for dwelling, lodging

or sleeping purposes to one party with duration of occupancy of less than thirty (30) consecutive days.

Hotels, motels, bed and breakfasts, and other land uses explicitly defined and regulated in this ordinance

separately from short term rentals are not considered to be short term rentals. Common bathroom facilities

may be provided rather than private baths for each room. A short term rental is further defined as follows:

A. Short Term Rental, Accessory. Either (i) an owner occupied dwelling with a principal use as

a permanent dwelling unit and which rents no more than three (3) guest rooms and six (6) total

guests for overnight paid occupancy as an accessory use, or (ii) an owner-occupied two-family

dwelling in which one unit of the two-family dwelling is occupied by the owner with a principal

use as the owner's permanent residential dwelling unit and which the other unit of the two-family

dwelling is rented with no more than three (3) guest rooms and six (6) total guests as an accessory

use. Only one accessory short term rental shall be permitted in any two-family dwelling. For either

type of accessory short term rental, the owner shall occupy the unit and be present during the guest's

stay.

B. Short Term Rental, Temporary. A residential dwelling which rents the entire unit with no

more than five (5) guest rooms for overnight paid occupancy as a temporary use not to exceed

ninety (90) days per year, except in the Vieux Carré, the area generally bounded by: Iberville St.,

N. Rampart St., Esplanade Ave., and the Mississippi River, where Temporary Short Term Rentals

shall be prohibited. No owner or resident is required to be present during the guest's stay.

C. Short Term Rental, Commercial. An entire dwelling unit in a non-residential district that

rents no more than five (5) guest rooms for overnight paid occupancy.

Use Standards (Article 20)

The use standards for Commercial Short Term Rentals are found in Article 20 and listed below. The use

standards for Accessory Short Term Rentals are in found in Article 21, Section 21.6 Accessory Structures

and Uses and the use standards for Temporary Short Term Rentals are found in in Article 21, Section 21.8

Temporary Uses, both of which are in Article 21. The Commercial Short Term Rental use standards are

listed below:

20.3.LLL SHORT TERM RENTALS

20.3.LLL.1 SHORT TERM RENTALS GENERAL STANDARDS

a. In addition to the regulations below, all short term rentals shall comply with the

regulations of the Department of Safety and Permits and the Department of Finance,

Bureau of Revenue.

b. All short term rentals shall require a license. The license shall be prominently

displayed on the front facade of the property in a location clearly visible from the street

during all period of occupancy and contain the license number, the contact information

for the owner or in-town property manager, the license type (Temporary, Accessory,

or Commercial) and the bedroom and occupancy limit.

c. Short term rentals shall not be operated outdoors, in an accessory structure, or in a

recreational vehicle.

d. Only one party of guests shall be permitted per short term rental unit.

Page 21 of 152

e. There shall be an in-town property manager if the owner or operator is out of town

during the time of the rental.

f. Short term rentals shall be considered dwelling units for density purposes and subject

to the minimum lot area per dwelling unit requirement of the applicable zoning district.

20.3.LLL.2 SHORT TERM RENTAL, COMMERCIAL STANDARDS

a. A short term rental license shall be secured prior to operation; and short term rental

operators shall comply with all applicable license requirements provided in the Code

of the City of New Orleans.

b. The license shall be prominently displayed on the front facade of the property in a

location clearly visible from the street during all period of occupancy and contain the

license number, the contact information for the owner or in-town property manager,

the license type (Temporary, Accessory, or Commercial) and the bedroom and

occupancy limit.

c. Up to five (5) bedrooms may be rented to guests and occupancy shall be limited to two

(2) guests per bedroom with a maximum ten (10) guests.

d. No signs are allowed for a Commercial Short Term Rental.

Accessory and Temporary Use Standards (Article 21)

The use standards for Accessory Short Term Rentals are in found in Article 21, Section 21.6 Accessory

Structures and Uses and the use standards for Temporary Short Term Rentals are found in in Article 21,

Section 21.8 Temporary Uses

21.6.II ACCESSORY SHORT TERM RENTALS

21.6.II.1 SHORT TERM RENTALS GENERAL STANDARDS

a. In addition to the use standards below, all short term rentals shall comply with the

regulations of the Department of Safety and Permits and the Department of Finance,

Bureau of Revenue.

b. All short term rentals shall require a license. The license shall be prominently

displayed on the front facade of the property in a location clearly visible from the street

during all period of occupancy and contain the license number, the contact information

for the owner or in-town property manager, the license type (Temporary, Accessory,

or Commercial) and the bedroom and occupancy limit. But in no event shall any

Accessory Short Term Rental license be issued in the Vieux Carré, the area generally

bounded by: Iberville St., N. Rampart St., Esplanade Ave., and the Mississippi River.

c. Short term rentals shall not be operated outdoors, in an accessory structure, or in a

recreational vehicle.

d. Only one party of guests shall be permitted per short term rental unit.

e. The short term rental shall appear outwardly to be a residential dwelling.

f. Use of the short term rentals for commercial or social events shall be prohibited.

g. The short term rental shall not adversely affect the residential character of the

neighborhood.

h. The short term rental shall not generate noise, vibration, glare, odors, or other effects

that unreasonably interfere with any person's enjoyment of his or her residence.

i. Proof of ownership shall be required via a valid homestead exemption.

Page 22 of 152

21.6.II.2 SHORT TERM RENTAL, ACCESSORY STANDARDS

a. A short term rental license shall be secured prior to operation; and short term rental

operators shall comply with all applicable license requirements provided in the Code of the

City of New Orleans.

b. For partial unit accessory short term rentals, only a portion of the dwelling shall be rented,

which shall be limited to three (3) guest bedrooms, and occupancy shall be limited to two

(2) guests per bedroom or six (6) guests total. There shall be at least one bedroom for the

fulltime owner-occupant.

c. For partial unit accessory short term rentals, the owner shall occupy the unit and be present

during the party's stay.

d. For all Accessory Short Term Rentals, proof of owner occupancy shall be required with a

homestead exemption.

e. Where the accessory short term rental occupies one unit of a two-family dwelling,

occupancy shall be limited to two (2) guests per bedroom for a total of up to six (6) guests.

f. No signs are allowed for an Accessory Short Term Rental.

[…]

21.8.C PERMITTED TEMPORARY USES

Table 21-3: Permitted Temporary Uses

Permitted

Temporary

Use

District

Timeframe

Hours of

Operation

Temporary

Use

Standards

[…]

Short Term

Rental,

Temporary

Any Zoning

District where

dwelling units

are permitted*

Rentals shall be limited to a maximum

of ninety (90) days per year, except in

the Vieux Carré, the area generally

bounded by: Iberville Street, N.

Rampart Street, Esplanade Avenue,

and the Mississippi River, where

Temporary Short Term rentals shall be

prohibited.

Section

21.8.C.14

[…]

* In accordance with City Council Motion M-18-195, any issuance or renewal of a Temporary Short Term

Rental permit or license is prohibited in the Historic Core Districts, Historic Urban Districts, Central

Business Districts, the MU-1 District, and the MU-2 District.

[…]

21.8.C.14 SHORT TERM RENTAL, TEMPORARY*

21.8.C.14.a SHORT TERM RENTAL GENERAL STANDARDS

1. In addition to the use standards below, all short term rentals shall comply with the

regulations of the Department of Safety and Permits and the Department of Finance,

Bureau of Revenue.

2. All short term rentals shall require a license.

3. The license shall be prominently displayed on the front facade of the property in a

location clearly visible from the street during all periods of occupancy and contain the

Page 23 of 152

license number, the contact information for the owner or in-town property manager,

the license type (Temporary, Accessory, or Commercial) and the bedroom and

occupancy limit.

4. Short term rentals shall not be operated outdoors, in an accessory structure, or in a

recreational vehicle.

5. Only one party of guests shall be permitted per short term rental unit.

6. The short term rental shall appear outwardly to be a residential dwelling.

7. For temporary short term rentals, there shall be an in-town property manager available

at all times if the owner or operator is out of town during the time of the rental.

8. Use of the short term rentals for commercial or social events shall be prohibited.

9. The short term rental shall not adversely affect the residential character of the

neighborhood.

10. The short term rental shall not generate noise, vibration, glare, odors, or other effects

that unreasonably interfere with any person's enjoyment of his or her residence.

11. If renter occupied and operated, proof of the property owner's consent and signature

on the license application shall be required.

12. If renter occupied, the operator shall provide a current rental lease.

21.8.C.14.b SHORT TERM RENTAL, TEMPORARY STANDARDS*

1. A short term rental license shall be secured prior to operation; and short term rental

operators shall comply with all applicable license requirements provided in the Code

of the City of New Orleans.

2. Rentals shall be limited to a maximum of ninety (90) days per year, except in the Vieux

Carré, the area generally bounded by: Iberville Street, N. Rampart Street, Esplanade

Avenue, and the Mississippi River, where Temporary Short Term rentals shall be

prohibited.*

3. Up to five (5) bedrooms may be rented to guests.

4. Occupancy shall be limited to two (2) guests per bedroom or ten (10) guests, whichever

is less.

5. The entire dwelling can be rented and the permanent resident is not required to be

present during the party's stay.

6. No signs are allowed for a Temporary Short Term Rental.

Off-Street Parking and Loading (Article 22)

The parking requirements for short term rentals depend on the type. As a temporary use, Temporary Short

Term Rentals do not have any parking requirements. Accessory Short Term Rentals are required to have

the same number of parking spaces as the dwelling unit. Commercial Short Term Rentals are required to

have one parking space per 2 guest rooms, which is equivalent to the parking requirement for a bed and

breakfast. In districts where parking is not required for any use, no off-street parking is required for the

short term rental.

22.4 Required Off-Street Vehicle Parking Spaces

22.4.A General Requirements

[…]

Page 24 of 152

Table 22-1: Off-Street Vehicle and Bicycle Parking Requirements

Use

Minimum Required

Vehicle Spaces

Minimum Required Bicycle Spaces

Required Short-Term

Bicycle Spaces

Percentage of Long-

Term Bicycle Spaces

[…]

Short Term Rental,

Accessory

see applicable dwelling

type

Short Term Rental,

Commercial

1 space per 2

guestrooms

1 per 5 rooms

25%

[…]

Permitted and Conditional Uses (Articles 7 to 17)

Below are the use tables that show the zoning districts where Commercial Short Term Rentals are permitted

(“P”), conditional (“C”), and prohibited uses (blank space). Accessory and Temporary Short Term Rentals

do not appear in these use tables below because these short term rental types are permitted in a dwelling

unit in any zoning district, subject to the definition and use standards for each type. Commercial short term

rentals are not currently permitted in Open Space Districts (Article 7), Historic Core Neighborhoods

Residential Districts (Article 9), Historic Urban Neighborhoods Residential Districts (Article 11), and

Suburban Neighborhoods Residential Districts (Article 13), and thus the use tables for these districts are

not shown below.