The Earned Income Tax Credit:

Program Outcomes, Payment Timing,

and Next Steps for Research

OPRE Report #2021-34

February 2021

The Earned Income Tax Credit: Program Outcomes, Payment

Timing, and Next Steps for Research

OPRE Report 2021-34

February 2021

Elaine Maag, William J. Congdon, and Eunice Yau

Author affiliations: Elaine Maag and William J. Congdon, Urban Institute; Eunice Yau, MEF Associates

Submitted to:

Lisa Zingman, Project Officer

Office of Planning, Research, and Evaluation

Administration for Children and Families

U.S. Department of Health and Human Services

www.acf.hhs.gov/opre

Contract Number: HHSP233201500077I

Project Director: Sam Elkin

MEF Associates

1330 Braddock Pl, Suite 220

Alexandria, VA 22314

www.mefassociates.com

This report is in the public domain. Permission to reproduce is not necessary. This report and other reports

sponsored by the Office of Planning, Research, and Evaluation (OPRE) are available at

http://www.acf.hhs.gov/opre.

Suggested citation: Maag, Elaine, William J. Congdon, and Eunice Yau (2021). The Earned Income Tax

Credit: Program Outcomes, Payment Timing, and Next Steps for Research, OPRE Report #2021-34,

Washington, DC: Office of Planning, Research, and Evaluation, Administration for Children and Families,

U.S. Department of Health and Human Services.

Disclaimer: The views expressed in this publication are those of the authors and do not necessarily reflect

the views or policies of OPRE, the Administration for Children and Families, or the U.S. Department of

Health and Human Services. They should not be attributed to the Urban Institute, its trustees, or its funders.

Funders do not determine research findings or the insights and recommendations of Urban experts. Further

information on the Urban Institute’s funding principles is available at urban.org/fundingprinciples.

Acknowledgements: The authors thank Sam Elkin at MEF Associates; Signe-Mary McKernan and Mark

Mazur at the Urban Institute; Steve Holt of HoltSolutions; Tiffany McCormack at the United States Agency

for International Development; and Lisa Zingman, Peter Germanis, and Naomi Goldstein at the U.S.

Department of Health and Human Services for helpful comments and conversations that shaped the

development of this brief. Any remaining errors are our own.

Sign-up for OPRE News

Follow OPRE

on Twitter

@OPRE_ACF

Like OPRE’s

page on

Facebook

OPRE.ACF

Follow OPRE

on Instagram

@oper_acf

Connect on

LinkedIn

company/opreacf

The Earned Income Tax Credit: Program Outcomes, Payment Timing, and Next Steps for Research | ii

Table of Contents

Overview .....................................................................................................................................

.................................................................................................................................

.................................................................................................................

..........................................................................................................................

................................................................................................................................

............................................................................................................................

..................................................................................................................................

.................................................................................................................................................

...............................................................................................................................................

..............................................................................................................................................

...............................................................................................................................

.......................................................................................................................

................................................................................................

............................................................................................................................

................

.....................................................................................

...............................................................................................................

..................................................................................................

...............................................................................................................

..................................................................................................................

...........................................................................................................................

...........................................................................................................................................

.............................................................................................................................

......................................................................................................................

..................................................................................................

....................................................................................

................................................................................................................................

1

Introduction 4

Description of the EITC 5

Benefit Administration 8

Defining Eligibility 9

Credit Participation 10

Credit Payment 10

How the EITC Affects Work, Wages, Poverty, Financial Stability and Other Non-Financial Benefits 11

Work 11

Wages 12

Poverty 12

Financial Stability 13

Non-Financial Benefits 13

Health benefits of the EITC 13

Education benefits 14

Rethinking EITC Payment: Proposals to Change How the EITC is Paid and What That Would Mean

for Recipients and Credit Administration 14

Proposals to Change Timing 14

Alternative Payment Demonstrations 15

Timing and Use of the Credit 15

Timing and Credit Impacts 16

Work and Earnings 16

Poverty 17

Financial Stability 17

Non-Financial Benefits 17

Administrative and Transition Issues 17

Conclusions and Directions for Research 18

References 20

The Earned Income Tax Credit: Program Outcomes, Payment Timing, and Next Steps for Research | iii

Overview

Introduction

The Earned Income Tax Credit (EITC) provides substantial support for working families with low and

moderate incomes, including those who may participate in traditional safety net programs, such as TANF.

Based on incomes in 2019, the Tax Policy Center estimates that more than 27 million households qualified

for almost $67 billion in reduced taxes and payments. The Center on Budget and Policy Priorities estimates

that annually, the EITC lifts 5 to 6 million people out of poverty and reduces the depth of poverty for many

more. The structure and timing of EITC payments is an important feature of the credit, and they potentially

mediate its benefits and effects for recipients. In particular, the annual, lump-sum nature of the credit

payment creates potential challenges for recipients and has been the subject of attention from researchers

and policymakers.

This brief reviews the design of the EITC and summarizes evidence on the relationship between the EITC

and work, wages, poverty, financial stability, and other nonfinancial benefits for credit recipients. The

authors conclude that research shows the EITC provides substantial support for working families with low

and moderate incomes.

This brief also considers how the EITC’s effects may be sensitive to how the credit is paid. Several EITC

proposals reflect a view that paying the credit periodically may be appropriate, and recent evidence from a

small number of experiments also suggests that recipients of periodic payments found them useful. The

brief concludes by identifying promising directions for future research.

Research Questions

1. What are the financial and nonfinancial effects of the EITC on recipient outcomes, and how do

those effects relate to the EITC’s design and payment structure?

2. What are the potential implications of changing how the EITC is paid for its administration and its

recipients?

3. What are the research gaps in these areas and options for future research and evaluation to

address these gaps?

Purpose

This brief reviews the design and administration of the EITC and summarizes the literature on the EITC’s

effects on work, wages, poverty, financial stability, and other nonfinancial benefits, giving special attention

to the way program outcomes might depend on or relate to payment timing. The authors discuss how

changing the EITC’s payment structures may affect recipients and how the Internal Revenue Service (IRS)

carries out the EITC to highlight important considerations and possible trade-offs. The brief identifies areas

where additional research is needed to better understand these relationships and trade-offs related to

payment timing.

The Earned Income Tax Credit: Program Outcomes, Payment Timing, and Next Steps for Research | 1

Key Findings and Highlights

• The EITC provides substantial benefits that extend to many people who are both working and

participating in traditional safety net programs, such as TANF. This includes both near-term

benefits, such as encouraging people to work and reducing poverty, and longer-term benefits

related to improvements in health and educational attainment for children who live in households

that receive the EITC.

• The form and timing of EITC payments creates potential challenges for recipients. If people prefer

to use the EITC mainly to purchase large items or as a form of forced savings, a lump-sum

payment may be the most appropriate delivery mechanism. However, to the extent that people

prefer to use their EITC to pay down debt or meet basic needs, a more regular payment might be

appropriate. Limited studies of refund use show that people do both.

• Changes to the timing of EITC payments might have implications for carrying out the credit in

general and create particular challenges in the transition from a lump sum to periodic payment. The

government’s administrative costs of periodic payment are likely to be somewhat higher than for

lump-sum payments.

• Some impacts of the credit on outcomes such as work and earnings, poverty, financial stability,

and some nonfinancial outcomes might be sensitive to the payment timing. Early findings from a

few small-scale demonstration projects that tried to test a different form of credit payment suggest

that recipients of periodic payments found them useful.

Methods

This brief reviews the literature on several aspects of the EITC’s design and credit administration, such as

payment timing, size of payments, and credit participation. The brief also summarizes evidence on the

relationship between the EITC and work, wages, poverty, financial stability, and other nonfinancial benefits

for credit recipients. In summarizing the empirical literature, the brief focuses on journal articles and articles

from think tank websites that were published in the past 5 years. The evidence cited includes a small

number of demonstration projects, quasi-experimental research, and econometric analyses.

The brief then discusses how the EITC’s effects may be sensitive to how the credit is paid, drawing on a

range of published and unpublished literature and reports, including proposals for changing how the EITC

is paid and evidence from a small number of recent experiments. The brief analyzes these sources in

combination with the literature on the relationship between the EITC and recipients’ financial and

nonfinancial outcomes to discuss considerations in changing the EITC’s payment structure and possible

trade-offs.

Recommendations

Several promising paths exist for further research:

• Additional research on how the EITC and other income support programs interact for both family

well-being and work incentives would inform policymakers and program administrators on how

families with low incomes tend to think about potential trade-offs.

• Additional research on the opportunities and challenges created by interactions between the EITC

and other safety net programs related to program administration and participation would also be

valuable for understanding why some people are less likely to claim and receive the EITC than

The Earned Income Tax Credit: Program Outcomes, Payment Timing, and Next Steps for Research | 2

others. Researchers could study whether there are opportunities to encourage and increase

participation in the EITC through administering traditional transfer programs.

• Research to better understand how the timing of EITC payments affects program impacts is of

particular interest and importance. Currently, early findings from a few small-scale demonstration

projects that tried to understand how periodic payments might alter the EITC’s benefits suggest

that recipients of periodic payments found them useful.

• Additional research could more precisely and rigorously analyze what groups of people are most

likely to benefit from the proposed alternative payment options and how they do so. Randomized

controlled trials would be most useful for testing the effects on credit recipients’ financial and

nonfinancial outcomes.

• Research to study more closely how the EITC’s size affects how people perceive and respond to

the credit could build on prior work to better understand the benefits and drawbacks of monthly and

quarterly payments. Analysts could also combine work on taxes and more traditional spending

programs to understand how important an annual payment is in achieving longer-term goals and

better understand whether some share of the EITC should continue to be paid as a lump-sum

benefit, even if periodic payments are introduced.

Citation

Maag, Elaine, William J. Congdon, and Eunice Yau (2021). “The Earned Income Tax Credit: Program

Outcomes, Payment Timing, and Next Steps for Research,” OPRE Report #2021-34, Washington, DC:

Office of Planning, Research, and Evaluation, Administration for Children and Families, U.S. Department of

Health and Human Services.

Glossary

Earned Income Tax Credit (EITC): The EITC is a refundable tax credit that workers with low to moderate

incomes and qualifying children may be eligible to claim when they file their tax returns.

The Earned Income Tax Credit: Program Outcomes, Payment Timing, and Next Steps for Research | 3

Introduction

The earned income tax credit (EITC) is a refundable tax credit that provides substantial support for working

families with low and moderate incomes. Based on incomes in 2019, the Tax Policy Center estimates that

over 27 million households qualified for almost $67 billion in reduced taxes and payments. Over 97 percent

of all benefits from the credit go to families with children. Benefits are highly concentrated among those with

income in the bottom 40 percent of the income distribution.

1

1

Tax Policy Center, Table T20-0090 “Earned Income Tax Credit; Baseline; Current Law; Distribution of Federal Tax Change by Expanded

Cash Income Percentile, 2019.” https://www.taxpolicycenter.org/model-estimates/2019-child-and-work-credit-proposals/t20-0090-earned-

income-tax-credit-baseline

The vast majority of benefits were delivered as

tax refunds in 2020 after 2019 taxes were filed.

2

2

In a typical year, the deadline for filing federal tax returns is April 15. In 2020, the date was extended to July 15 because of the coronavirus

pandemic. Most returns claiming an EITC are filed early in the filing season.

This brief explores the design of the EITC and its benefits. We summarize evidence on the relationship

between the EITC and work, wages, poverty, financial stability and other non-financial benefits, areas of

interest among policy makers designing policies for families with low-incomes and practitioners serving

these same families.

This brief considers how the EITC’s effects may be sensitive to how the credit is paid. A handful of federal

policymakers have proposed increasing the credit and, at the same time, altering how it is paid. These

changes could provide more support to very low-income families and change how recipients respond to the

benefit. We review proposals for changing how the credit is paid, drawing on evidence that includes a small

number of recent experiments that show how changes to credit administration can affect recipients. We

discuss what these potential changes may mean both in terms of how individuals may respond to the credit

and how the credit would be carried out.

Key findings reviewed in this brief include:

▪ The EITC supports low-income working families.

▪ Annually, the EITC lifts 5 to 6 million people out of poverty and reduces the depth of

poverty for many more.

▪ The credit also encourages people to work, particularly single mothers, further reducing

poverty.

▪ Longer-term benefits of the credit include improvements to health and educational

attainment for children who live in households that receive the EITC.

▪ About four-fifths of people eligible for EITC benefits receive them (similar to the

Supplemental Nutrition Assistance Program (SNAP), formerly known as the Food Stamp

Program, but higher than other transfer programs).

▪ Proposals to increase the EITC recognize that not all people with low and moderate incomes can

benefit from the credit.

▪ By design, the credit goes mostly to workers with low and moderate incomes and

children at home. Workers without children at home, sometimes called “childless” for tax

purposes, can receive a small credit over a relatively small income range.

▪ Administering the EITC through the tax code lowers administrative costs but makes it less

responsive to changing living situations and monthly incomes.

The Earned Income Tax Credit: Program Outcomes, Payment Timing, and Next Steps for Research | 4

▪ The EITC has relatively low administrative costs for the government and application for

benefits is generally easier than for traditional support programs such as SNAP.

▪ EITC benefits are based on a tax unit, which is defined based on legal relationships

among household members, and support tests that are applied once to establish

eligibility and benefits for the entire year. Traditional transfer programs such as SNAP

and Temporary Assistance for Needy Families (TANF) can include other household

members (for example, a couple that lives together but is not married) and benefits or

eligibility can change throughout the year.

▪ Tax credits are delivered annually.

▪ People claim the credit annually on tax returns as part of the regular tax-filing process,

with eligibility calculated in the filing process. In contrast, traditional transfer programs

calculate eligibility based on a family’s monthly income and needs.

▪ The annual nature of the credit, paid in one lump sum, can help people save larger

amounts of money or make larger purchases, but increases income volatility and may

lead workers to take on costly debt.

In this brief, we consider how changing the payment frequency may affect recipients and how the Internal

Revenue Service (IRS) carries out the EITC. For example, a more frequent payment may help people meet

ongoing needs such as rent, utilities, and childcare—similar to traditional transfer programs. Increasing

payment frequency would likely increase administrative burden both for the IRS—to deliver multiple

payments and verify eligibility—and for individuals who would likely need to claim benefits differently.

Depending on the payment frequency adopted and reporting requirements, individuals might be more

aware of how changes in earnings relate to changes in the EITC.

Description of the EITC

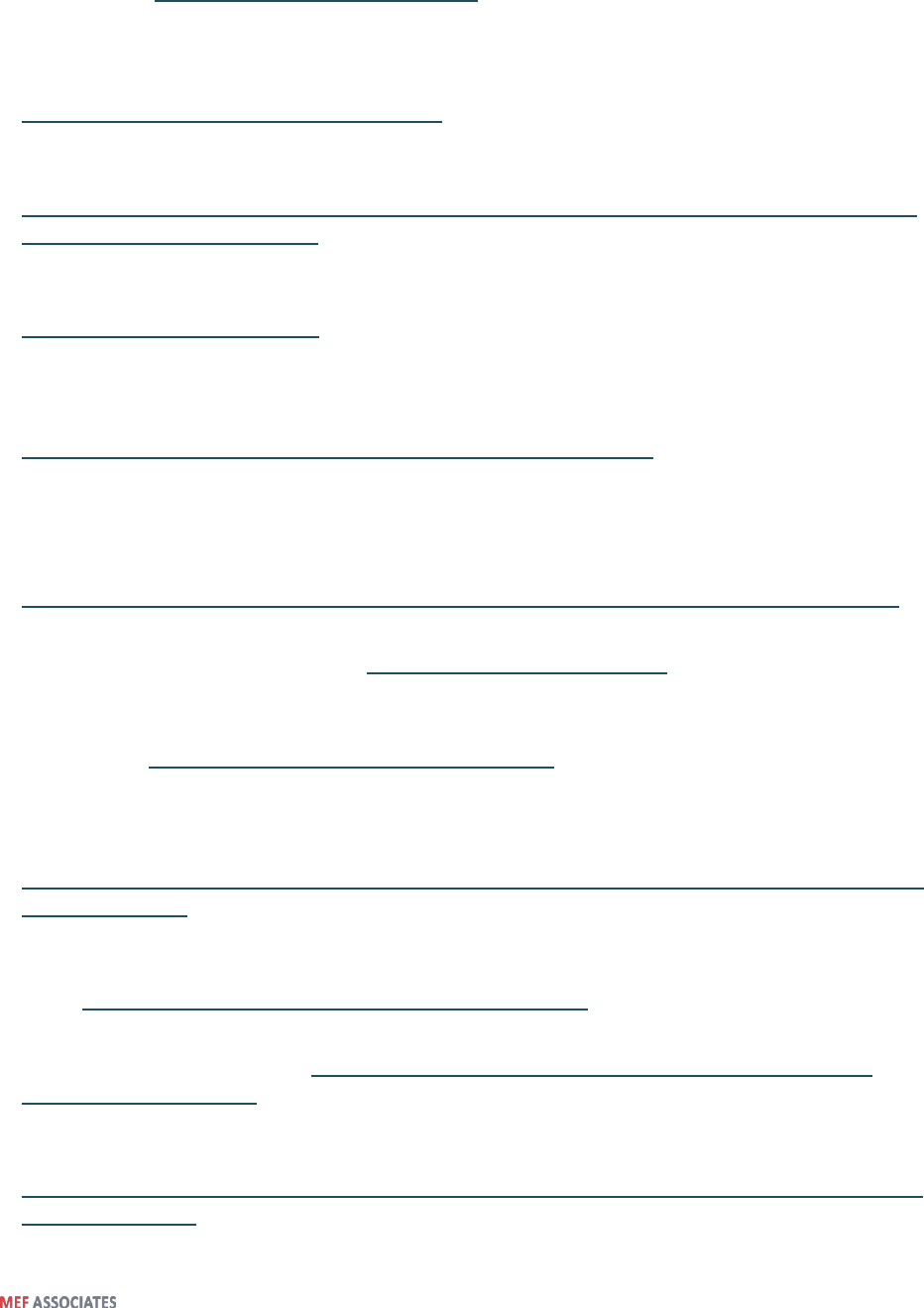

The EITC supplements wages of workers with low and moderate incomes. Only families with at least

one worker can qualify for the credit. Workers receive a credit equal to a percentage of their earnings up to

a maximum amount. Both the credit rate and the maximum credit vary by how many children are in the

family,

3

3

For readability, we use the term “family” rather than tax unit. Tax units form the basis for calculating taxes. They are based on legal

relationships, residency, and support. They are typically headed by a single adult or a married couple. Common examples of cases where a

family might be composed of more than one tax unit include multigenerational households and cohabiting couples. Typically, a child can be

claimed by only one tax unit, even though people in multiple tax units might support the child (Maag, Peters, and Edelstein 2016).

with larger credits available to families with more children. After the credit reaches its maximum, it

remains flat until earnings reach the phase-out point. Thereafter, the credit declines with each additional

dollar of income until no credit is available (figure 1).

The EITC is a refundable credit, meaning that if a family qualifies for a credit greater than the federal

income tax they owe, then they receive the difference as a tax refund. This feature of the credit is

important for families with low incomes who may not earn enough to owe income taxes. In 2020, a single

parent can earn up to $18,650 before owing federal income taxes.

Nearly all (about 96 percent) of the credit’s benefits accrue to workers with low and moderate incomes and

children at home.

4

4

Tax Policy Center, Table T20-0090 “Earned Income Tax Credit; Baseline: Current Law; Distribution of Federal Tax Change by Expanded

Cash Income Percentile, 2019.” https://www.taxpolicycenter.org/model-estimates/2019-child-and-work-credit-proposals/t20-0090-earned-

income-tax-credit-baseline

Two features of the EITC cause this: a much higher maximum benefit and larger eligible

income range for workers with children at home than for childless workers. The EITC goes to relatively few

The Earned Income Tax Credit: Program Outcomes, Payment Timing, and Next Steps for Research | 5

older adults (ages 65 and older). Not only are older adults less likely to work and have children at home,

but benefits for childless people are only available to taxpayers at least age 25 and under age 65. There

are no age limits for workers with children at home.

0

1,000

2,000

3,000

4,000

5,000

6,000

7,000

0 10,000 20,000 30,000 40,000 50,000 60,000

No children One child Two children Three or more children

Income ($)

Source:

Tax Policy Center.

Note:

Assumes all income comes from earnings. The credit for married couples begins to phase out at income $5,890 higher than shownonchart.

FIGURE 1. EARNED INCOME TAX CREDIT BENEFITS DEPEND ON FAMILY SIZE

AND INCOME

Earned Income Tax Credit, 2020

Credit ($)

Label: Figure 1. Earned Income Tax Credit Benefits Depend on Family Size and Income Text description: Figure 1, Earned Income Tax Credit Benefits Depend on Family Size and Income, is a line chart that shows how the amount of earned income tax credit that a

family receives varies by their income and the number of children in their family – no children, one child, two children, or three or more children. The Y-axis shows the amount of credit (in 2020) in dollars, and the X-axis shows the family’s income in dollars. In this chart,

we assume all income comes from earnings.

The first line, for families with no children, starts at $0 of credit and $0 of income and reaches a peak at the maximum credit amount of $538 at income levels above $7,030. The line remains flat until the credit starts to phase-out at income levels above $8,790, then

slopes downwards until no credit is available at income levels above $15,820.

The second line, for families with one child, starts at $0 of credit and $0 of income and reaches a peak at the maximum credit amount of $3,584 at income levels above $10,540. The line remains flat until the credit starts to phase-out at income levels above $19,330, then

slopes downwards until no credit is available at income levels above $41,576.

The third line, for families with two children, starts at $0 of credit and $0 of income and reaches a peak at the maximum credit amount of $5,920 at income levels above $14,800. The line remains flat until the credit starts to phase-out at income levels above $19,330, then

slopes downwards until no credit is available at income levels above $47,440.

The fourth line, for families with three or more children, starts at $0 of credit and $0 of income and reaches a peak at the maximum credit amount of $6,660 at income levels above $14,800. The line remains flat until the credit starts to phase-out at income levels above

$19,330, then slopes downwards until no credit is available at income levels above $50,954. The credit for married couples begins to phase out at incomes $5,890 higher than is shown on the chart.

Source: Tax Policy Center.

The EITC’s structure has been consistent since its inception, but the credit amount has increased

many times throughout its history. The first credit payments were made in 1975. Families with children

could receive a credit worth 10 percent of earnings of up to $4,000 for a maximum credit worth up to $400 a

year. Families stopped receiving the credit once their income reached $8,000. The maximum credit

increased to $500 in 1979, to $550 in 1985, and to $851 in 1987 – at which point the credit was indexed for

inflation. The largest expansions happened in 1990 and 1993 (effective in 1991 and 1994). During this time,

families with at least two children became eligible for a higher credit, the maximum credit was increased by

over $1,000 and the credit for workers without children was implemented (figure 2) (Urban Institute 2015).

As part of the Tax Cuts and Jobs Act of 2017, the measure of inflation used for indexation was changed

from the Consumer Price Index-Urban consumers (CPI-U) to the chained CPI-U (C-CPI-U), a measure that

is designed to be a closer approximation to a cost-of-living index and tends to grow slightly slower.

The Earned Income Tax Credit: Program Outcomes, Payment Timing, and Next Steps for Research | 6

$0

$1,000

$2,000

$3,000

$4,000

$5,000

$6,000

$7,000

$8,000

$9,000

$10,000

1975 1979 1983 1987 1991 1995 1999 2003 2007 2011 2015 2019

No children One child Two children Three or more children

FIGURE 2. MAXIMUM EARNED INCOME TAX CREDIT, BY NUMBER OF

CHILDREN

1975–2020

Sources:

1975-2003: Joint Committee on Taxation; Ways and Means Committee, 2004 Green Book. 2004-2009: Internal Revenue Service, Form 1040

Instructions. 2010-2013: Internal Revenue Service, Revenue Procedures from various years. 2014: Internal Revenue Service, Revenue

Procedure 2013-35 downloaded January 23, 2014 from irs.gov/pub/irs-drop/rp-13-35.pdf. 2015: Internal Revenue Service, Revenue Procedure

2014-61 downloaded November 11, 2014 from irs.gov/pub/irs-drop/rp-14-61.pdf.2016: Internal Revenue Service, Revenue Procedure 2015-53

downloaded January 5, 2016 from irs.gov/pub/irs-drop/rp-15-53.pdf. 2017: Internal Revenue Service, Revenue Procedure 2016-55

downloaded February 8, 2017 from irs.gov/pub/irs-drop/rp-16-55.pdf. 2018: Internal Revenue Service, Revenue Procedure 2018-18

downloaded July 24, 2018 from irs.gov/irb/2018-10_IRB#RP-2018-18. 2019: Internal Revenue Service, Revenue Procedure 2018-57

downloaded August 5, 2019 from irs.gov/pub/irs-drop/rp-18-57.pdf 2020: Internal Revenue Service, Revenue Procedure 2019-44 downloaded

November 20, 2019 from irs.gov/pub/irs-drop/rp-19-44.pdf compiled in Tax Policy Center, 2019, "Earned Income Tax Credit Parameters, 1975–

2020." taxpolicycenter.org/statistics/eitc-parameters

Note: Prior to 1991, all families with children were eligible for the same maximum credit; prior to 2008, families with threeormore children

were eligible for the same maximum credit as families with two children.

Calendar year

Credit ($)

Figure 2. Maximum Earned Income Tax Credit, By Number of Children Text description: Figure 2, Maximum Earned Income Tax Credit, By Number of Children, is a line chart that shows how the maximum amount of the earned income tax credit has increased over time. There are four lines on the chart which show the maximum earned income tax credit for families with no children, one child, two children, or three or more children. The Y-axis shows the maximum amount of credit in dollars, and the X-axis shows the calendar years from 1975 to 2020.

The first line, for families with one child, starts at calendar year 1975 when the first credit payments were made. Families with children could receive a credit worth 10 percent of earnings of up to $4,000 for a maximum credit worth up to $400 a year. The maximum credit increased to $500 in 1979, to $550 in 1985, and to $851 in 1987—at which point the credit was indexed for inflation and the line showing the maximum credit amount increases accordingly. The largest expansions happened in 1990 and 1993 (effective in 1991 and 1994). In 2020, the maximum credit amount for families with one child is $3,584.

The second line, for families with at least two children, begins in calendar year 1991 at a maximum credit amount of $1,235 when families with at least two children became eligible for a higher credit. The largest expansion happened in 1993 (effective in 1994) when the maximum credit was increased by over $1,000, from $1,5111 to $2,528. In 2020, the maximum credit amount for families with at least two children is $5,920.

The third line, for families with no children, begins in 1994 when the credit for workers without children was implemented. The maximum credit amount in 1994 was $306. In 2020, the maximum credit amount for workers without children is $538. The fourth line, for families with three or more children, begins in 2009 when families with at least three children became eligible for a higher credit. The maximum credit amount in 2009 was $5,657. In 2020, the maximum credit amount for families with three or more children is $6,728.

Note that prior to 1991, all families with children were eligible for the same maximum credit; prior to 2008, families with three or more children were eligible for the same maximum credit as families with two children. Sources: 1975-2003: Joint Committee Taxation; Ways and Means Committee 2004 Green Book. 2004-2009: Internal Revenue Service, Form 1040 Instructions. 2010-2013: Internal Revenue Service, Revenue Procedures from various years. 2014: Internal Revenue Service, Revenue Procedure 2013-35 downloaded January 23, from irs.gov/pub/irs-drop/rp-14-61.pdf. 2015: Internal Revenue Service, Revenue Procedure 2014-61 downloaded November 11, 2014 from irs.gov/pub/irs-drop/rp-14-61.pdf. 2016: Internal Revenue Service, Revenue Procedure 2015-53 downloaded January

5, 2016 from irs.gov/pub/irs-drop/rp-14-61pdf. 2017: Internal Revenue Service, Revenue Procedure 2016-55 downloaded July 24, 2018 from irs.gov/irb/2018-10_IRB#RP-2018-18. 2019: Internal Revenue Service, Revenue Procedure 2018-57 downloaded August 5, 2019 from irs.gov/pub/irs-drop/rp-19-44.pdf compiled in Tax Policy Center, 2019, “Earned Income Tax Credit Parameters, 1975-2020.” Taxpolicycenter.org/statistics/eitc-parameters.

Little research exists on the overlap of people receiving the EITC and other traditional transfer

programs. A somewhat unique feature of the EITC is that you must work for pay to benefit. People who

are working and receiving other benefits are likely to receive the EITC if they have children. Research

focusing on the 24 million households with children with income less than 200 percent of the poverty level

found that the most common combination of benefits was SNAP, the child tax credit, the EITC, and

Medicaid, true for about 3 million households (Chien and Macartney 2019). The same study found that

about 0.3 million people received those programs plus TANF. A separate analysis of SNAP and EITC

recipients in Florida showed that about half of people who receive SNAP also receive the EITC and about

half of EITC recipients receive SNAP. SNAP families that do not tend to receive the EITC are those with no

earnings or those with people over age 65. In contrast, EITC recipients who do not also receive SNAP tend

to have earnings too high to qualify for SNAP (Maag et. al 2015).

States can also have their own EITCs, which build on the federal EITC. Twenty-nine states and the

District of Columbia have implemented an EITC, generally calculated as a percentage of the federal credit.

5

5

Washington state also has an EITC but it has not yet been implemented. http://www.taxcreditsforworkersandfamilies.org/state-tax-credits/

The Earned Income Tax Credit: Program Outcomes, Payment Timing, and Next Steps for Research | 7

For states that set their EITC as a percentage of the federal credit, a change in the value of the federal

credit will also lead to a change in the value of the state credit. In some cases, state rules diverge from

those of the federal EITC. For example, in California, families with children under 6 are eligible for a larger

credit than families with older children; Maine calculates its state credit as a higher percentage of the

federal credit for workers without children at home than for workers with children at home.

Benefit Administration

The EITC is carried out as part of the tax code. Families claim the credit by providing the appropriate

information on their federal income tax return. Because claiming the EITC is part of the annual tax-filing

process and relies on self-reported information, the government’s associated administrative costs

are low. As a percent of total benefits paid out, the IRS estimates the cost of program administration to be

about 1 percent (Taxpayer Advocate Service Special Report to Congress 2019). Comparable

administrative fees for SNAP and Supplemental Security Income (SSI) are 9 percent and 10 percent,

respectively (figure 3).

1%

9%

8%

E I T C S N A P S S I

Sources:

EITC (data for FY2018): Payment Accuracy.gov, https://paymentaccuracy.gov/ (last visited June 24, 2020); IRS SOI Table 2.5: Returns with Earned Income Credit;

Cost of administering EITC program ratio to claims paid: House Committee on Ways and Means, Subcommittee on Oversight, Hearing on Improper Payments in

the Administration of Refundable Credits, May 25, 2011.

SNAP (data from FY2019): Payment Accuracy.gov, https://paymentaccuracy.gov/ (last visited June 24, 2020); USDA Supplemental Nutrition Assistance Program

Participation and Costs (March, 2020).

SSI (data for FY2019): Payment Accuracy.gov, https://paymentaccuracy.gov/ (last visited June 24, 2020); Social Security Administration 2019 Annual Report of the

Supplemental Security Income Program Table IV.EI - Selected SSI Costs, Social Security Administration 2019 Annual Report of the Supplemental Security Income

Program Table IV.C2 - SSI Federal Payments in Current Dollars

FIGURE 3. EITC HAS LOW OVERHEAD COSTS COMPARED TO OTHER MEANS-

TESTED PROGRAMS

EITC Overhead Costs Compared to Other Means-Tested Programs

Label: Figure 3. EITC Has Low Overhead Costs Compared to Other Means-Tested Programs, is a bar graph showing the overhead costs of the following means-tested programs: The Earned Income Tax Credit (EITC), Supplemental Nutrition Assistance Program (SNAP), and Supplemental Security Income

(SSI). The graph shows the following overhead costs:

EITC: 1%

SNAP: 9%

SSI: 8%

Sources:

EITC (data for FY2019): Payment Accuracy.gov, https://paymentaccuracy.gov/ (last visited June 24, 2020); IRS SOI Table 2.5: Returns with Earned Income Credit; Cost of administering EITC program ratio to claims paid: House Committee on Ways and Means, Subcommittee on Oversight, Hearing on Improper Payments in the Administration of Refundable Credits, May 25, 2011.

SNAP (data from FY2019): Payment Accuracy.gov, https://paymentaccuracy.gov/ (last visited June 24, 2020); USDA Supplemental Nutrition Assistance Program Participation and Costs (March 2020).

SSI (data for FY2019): Payment Accuracy.gov, https://paymentaccuracy.gov/ (last visited June 24, 2020); Social Security Administration 2019 Annual Report of the Supplemental Security Income Program, Table IV.EI – “Selected SSI Costs, Social Security Administration 2019 Annual Report of the Supplemental Security Income Program”, Table IV.C2 – “SSI Federal Payments in Current Dollars”.

Claiming the credit is convenient for families who would otherwise need to file a tax return (for

example, to either meet their filing obligation or claim a refund of taxes that had been withheld throughout

the year but were not owed), compared with traditional transfer programs. Families fill out a tax return,

typically sometime between mid-February and mid-April. No offices must be visited or caseworkers met

with before determining eligibility. Typically. employers provide earnings information key to determining

benefits, which is reported to both the individual filing taxes and the Social Security Administration (which

then shares it with the IRS). Self-employed workers must compute their own earnings independently. If a

family moves throughout the year, they do not need to reapply for benefits with the agency in a new state.

The Earned Income Tax Credit: Program Outcomes, Payment Timing, and Next Steps for Research | 8

Though not required, many families with low incomes likely eligible for benefits from the EITC use paid tax

preparation services, which can reduce how much of their tax refunds they get to keep, essentially shifting

administrative costs onto the people claiming the credit (Government Accountability Office 2019). Although

free preparation services are available to families with low incomes through Volunteer Income Tax

Assistance clinics, a very small portion of families with low incomes use them (table 1). Most families use

paid tax preparers, which may ultimately benefit EITC recipients. An earlier study showed that people with

low incomes who know about the EITC are more likely to receive it if they use a paid preparer than if they

file their return themselves (Maag 2005). In some cases, tax preparers can create problems for EITC

claimants by erroneously claiming the EITC (something that the taxpayer will be liable for if audited, not the

preparer). Unenrolled tax preparers—someone that prepares a return that is not an attorney, CPA, or an

enrolled agent licensed by the IRS—have the highest overclaim rate of all paid preparer types. More EITC

claimants use this type of paid preparer than other types of paid preparers (IRS 2014).

Label: Table 1. Tax Preparation Method

Text description: Table 1. Tax Preparation Method, is a table that describes tax preparation methods by adjusted gross income (AGI) in 2010. The headers for the columns, from left to right, are: AGI (thousands of dollars), tax returns (millions), and tax preparation method. The sub-headers under tax preparation method are tax returns (millions), no identified preparer, paid preparer, IRS prepared, volunteer income tax assistance, and tax counseling for the elderly.

The first row of the table reads: Under 30, 65.7, 41.8%, 54.5%, 0.2%, 1.7%, 1.7%

The second row of the table reads: 30-50, 25.6, 42.3%, 55.7%, 0.1%, 0.9%, 1.0%

The third row of the table reads: 50-100, 30.7, 40.9%, 58.2%, 0.0%, 0.4%, 0.5%

The fourth row of the table reads: Over 100, 18.2, 36.6%, 63.2%, 0.0%, 0.1%, 0.1%

The last row of the table reads: Total, 142.8, 40.9%, 56.8%, 0.1%, 1.0%, 1.1%

The source of this table is the Tax Policy Center’s tabulations of 2010 Statistics of Income Public Use File.

Claiming the EITC is often simpler for families than claiming other types of transfer benefits. For

example, SNAP applicants typically need to either visit a local SNAP office in-person or submit an online

application to a state agency.

6

6

“SNAP Eligibility,” USDA Food and Nutrition Service, updated August 14, 2019, https://www.fns.usda.gov/snap/recipient/eligibility.

After submitting the SNAP application, that person must complete an

eligibility interview and provide various supporting documents to verify the information provided in their

application. A face-to-face eligibility interview is required unless that individual meets the conditions for a

waiver.

7

7

Waivers of the face-to-face interview are determined on a case-by-case basis depending on the household’s circumstances that include but

are not limited to illness, prolonged severe weather, transportation difficulties, or work hours during normal agency office hours.

Applicants typically must wait to receive a written notice informing them of whether they are eligible

to receive SNAP benefits, a process that can take up to 30 days. If a person moves to a different state, they

will need to reapply for benefits. In contrast, eligible families claim their EITC on their tax return during the

annual tax filing process.

Defining Eligibility

Most transfer benefits calculate eligibility for benefits based on a group of people sharing resources, which

can change throughout the year. The EITC is calculated based on a tax unit that is defined once each

The Earned Income Tax Credit: Program Outcomes, Payment Timing, and Next Steps for Research | 9

calendar year. This is a consequence of delivering the EITC through the income tax system, which defines

who is eligible for programs based on legal relationships (typically defined on December 31

st

) and place of

residence (defined throughout the year). As a result, distributing benefits through this system can miss

changing needs.

A tax unit for claiming the EITC and a family claiming transfer benefits can be the same (for example, a

married couple that lives all year with only biological children), but they can also differ. As the American

family has changed to include divorced couples and couples who live together without being married

(cohabit; Carlson and Meyer 2013)—as well as children who may move regularly between households,

including living with relatives other than parents (Vandivere et. al 2012, Kalil and Ryan 2010)—the tax unit

has become less reflective of how people live their lives. The point is particularly true for multigenerational

families that live together, unmarried and younger mothers, and more economically disadvantaged families

(Raley et. al 2019). A child usually is allowed to be claimed in only one tax unit, even if multiple tax units

provide support for the child (Maag, Peters, and Edelstein 2017). For example, if a child lives part of the

year with one parent and the rest of the year with the other parent, only one parent will receive the EITC.

Credit Participation

Not all people who are eligible for the credit receive it. The IRS and Census Bureau estimate that almost

80 percent of workers eligible for the EITC claim it. Because people eligible for higher credits are more

likely to claim the credit than those eligible for lower credits, about 85 percent of potential benefits are

claimed each year (IRS 2019). IRS researchers have found that EITC non-participants are more likely to be

people who are living in rural areas, self-employed, receiving disability income or have children with

disabilities, not proficient in English, grandparents raising grandchildren, eligible for the credit for workers

without children, or recently changed marital or employment status (IRS 2020).

Some research has investigated factors that might influence claiming among eligible families, as well as

interventions that promote participation. The existence of a state EITC may encourage participation in the

federal EITC (Neumark and Williams 2016). Mailed notices have some positive short-term effects on EITC

take-up, and can be effective in particular among people who have filed a tax return who appear to be

eligible for the credit but fail to claim it (Bhargava and Manoli 2015; Manoli and Turner 2014). Other studies

have found some positive short-term effects of sending notices to individuals who have not filed a tax return

but who may be eligible for the EITC (Guyton et al. 2017). A recent experiment in California, which

attempted to inform people of their potential eligibility for the California EITC, demonstrated limited

effectiveness of outreach efforts. Though a few more people viewed online resources related to California’s

EITC, the letters and texts did not result in more people filing a tax return, using a free tax preparation

service, or claiming a federal or state EITC (Linos et. al 2020).

Credit Payment

Traditional transfer programs such as SNAP and TANF typically pay benefits monthly. In contrast, most

benefits of the EITC are paid annually, after an income tax return is filed. The IRS estimates that less

than 20 percent of EITC benefits offset income taxes owed and the rest are in excess of income taxes

owed (IRS 2018). When a credit offsets taxes owed, it is theoretically possible for a person to receive that

credit throughout the year in the form of reduced withholding from each paycheck (individuals can adjust

their withholding to pay less in income taxes with each paycheck, essentially receiving the EITC throughout

the year). It is not possible to reduce withholding below $0, so any EITC that exceeds income taxes owed

must be paid as a one-time payment after taxes are filed. Between 1979 and 2010, some families were

eligible to receive a portion of their anticipated EITC in advance of tax filing. Very few families utilized this

The Earned Income Tax Credit: Program Outcomes, Payment Timing, and Next Steps for Research | 10

option for various reasons, such as both employers and employees being unaware of the option and fear of

becoming ineligible and having to repay all or a portion of the credit at tax time (GAO 2007; Holt, 2008).

The lump-sum nature of the EITC increases income volatility (defined as an increase or decrease of 25

percent over an average month) for those who receive a credit (Maag, Peters, et al. 2018; USFD 2017),

because they can receive a relatively large sum of money when they file taxes. For single parents in the

bottom one-fifth of the income distribution who have earnings, the EITC contributes on average more than

16 percent of total annual income. For 10 percent of parents in this income group, the EITC represents at

least 25 percent of their annual income.

8

8

Authors’ calculations using the Tax Policy Center microsimulation model, version 0319-2.

In many cases, it is the largest single payment of income over the

course of the year.

In some families, their tax credits (both the EITC and child tax credit) amounted to more than double their

average monthly income, according to data analysis from a small sample of individuals with low incomes

through the U.S. Financial Diaries project. Among the lowest-income households in the study, tax credits

were three times their average monthly income (Siwicki 2015). Although the EITC increases income

volatility among recipients, it is typically helpful since it is an increase in income instead of a decrease.

When the credit is delivered as an annual lump sum, it may benefit families by resembling a savings

program.

How the EITC Affects Work, Wages, Poverty, Financial

Stability and Other Non-Financial Benefits

Effects of the EITC have been well studied and include both near-term effects, such as encouraging people

to work and reducing poverty, and longer-term effects related to improvements in education and health.

Both types of effects are important to understanding the full impact of the EITC.

Work

Most research suggests the EITC encourages people to work, particularly single mothers

(summarized in Hoynes 2019). More recent analysis suggests the EITC encourages single women with low

incomes to work more months, reducing the frequency with which they enter and exit work (Wilson 2020).

The large majority of credit recipients are single parents, representing just over 80 percent of all claimants

in 2019.

9

9

Tax Policy Center, Table T20-0090 “Earned Income Tax Credit; Baseline; Current Law; Distribution of Federal Tax Change by Expanded

Cash Income Percentile, 2019.” https://www.taxpolicycenter.org/model-estimates/2019-child-and-work-credit-proposals/t20-0090-earned-

income-tax-credit-baseline

Married couples, by contrast, have different incentives from the EITC. While the EITC might encourage one

person in the couple to work, a second earner can put the couple’s joint earnings in the phase-out range of

the credit. As a result, secondary earners may work less than they otherwise would since the married

couple would receive a smaller credit for each additional dollar of income. Overall, the pull of the EITC into

the labor force for single people outweighs the small incentive for some married couples to reduce work

(Eissa and Hoynes 2006).

Though most research into the employment effects of the EITC has focused on families with children, some

evidence shows that the EITC also increases employment among childless workers, as demonstrated by

an expansion to the credit in New York City. Nichols, Sorensen, and Lippold (2012) found that a New York

The Earned Income Tax Credit: Program Outcomes, Payment Timing, and Next Steps for Research | 11

EITC policy targeted at noncustodial parents who pay child support increased employment among those

with relatively small-dollar child support orders (who are likely people with low incomes). A recent EITC

demonstration project in New York City, the Paycheck Plus demonstration, found that an expanded credit

for childless workers modestly increased employment rates (Miller et al. 2018).

Some analysis suggests that claims of the EITC increasing work are overstated. One recent paper argues

that the positive effects of the EITC on work apply only to a particularly large expansion of the credit

enacted in 1993, contending that work increases among single women since then have been driven more

by reductions in welfare benefits and overall economic conditions (Kleven 2019). That analysis was based

on a weekly measure of work, rather than an annual measure of employment and it does not account for

business cycle effects. Measuring work on an annual basis and including controls for the unemployment

rate suggests that the EITC does, indeed, encourage work (Schanzenbach and Strain 2020). Additional

analysis using matched data from the Current Population Survey’s Annual Social and Economic

Supplement and tax data from the IRS concludes that recent expansions of the EITC increased work and

reduced reliance on other transfer programs (Bastian and Jones 2019).

Wages

Both workers and their employers may benefit from the EITC, but workers benefit more. By

supplementing workers’ wages and encouraging work, the EITC potentially allows some employers to

reduce how much they pay employees. The EITC increases how much people benefit from working, which

can draw more workers into the labor force. Firms may be able to attract workers even while offering lower

wages than they would in the absence of the EITC. If employers are able to reduce wages, they effectively

capture some of the benefits of the EITC. Early studies showed that employees received almost three-

quarters of every dollar paid out in the EITC (Rothstein 2020). Overall, the limited research on this aspect

of the EITC suggests that employees are better off with the credit than without it, and coupled with a strong

minimum wage policy, employers have limited opportunity to reduce wages in response to their employees

receiving the credit (Rothstein and Zipperer 2020).

Poverty

The EITC reduces poverty through two channels. First, the EITC directly increases incomes for

people who receive the credit. The Supplemental Poverty Measure (SPM) is a poverty measure designed

to, among other things, account for the effects of tax programs on a person’s well-being. Since 2011, the

Census Bureau has published the SPM in addition to the official poverty measure, which does not account

for the effect of items such as the EITC. In 2018 (the most recent estimates available), the Census Bureau

estimates, using the SPM, that the EITC along with the refundable portion of the child tax credit reduced

poverty for 8.9 million people (Fox 2019). The Center on Budget and Policy Priorities (CBPP) estimates that

the EITC alone lifted 5.6 million people out of poverty, including about 3 million children. Further, CBPP

estimates that the EITC reduced poverty for an additional 16.5 million people, including 6.1 million children

(Center on Budget and Policy Priorities 2019). These estimates are calculated by estimating the number of

people in poverty without including the value of the EITC and then adding in the value of the credit. The

difference between the two is the effect of the EITC on poverty. The credit is particularly effective for young

parents, who often have lower wages than older parents (Carson 2020).

The second way the EITC reduces poverty is through increasing work, discussed above. Research

suggests that when this indirect effect of the EITC is fully accounted for, the total effect of the EITC in

reducing poverty is nearly 50 percent larger than the direct effects of the credit alone (Hoynes and Patel

2016).

The Earned Income Tax Credit: Program Outcomes, Payment Timing, and Next Steps for Research | 12

Financial Stability

The EITC can improve household financial stability. Income tax refunds can provide an important

pathway for households with low incomes to save and build assets (Grinstein-Weiss et al., 2015). Studies

show that the EITC improves financial stability by increasing the likelihood that single mothers with some

college will save, and balances saved are larger now than before the EITC was expanded in the early

1990s. Among less-educated single mothers (those with a high school diploma or less), the EITC

expansion was correlated with recipients being less likely to hold unsecured debt such as payday loans, in

part because people are working more in response to the EITC (Jones and Michelmore 2018).

EITC receipt at tax time presents an opportunity for low- and moderate-income taxpayers to save money

and begin to build wealth (Consumer Financial Protection Bureau 2019). Some demonstration projects

have built on that opportunity and encouraged EITC recipients to save a portion of their refunds and

matched those savings. Tax filers with low and moderate incomes participating in the $aveNYC program

through Volunteer Income Tax Assistance (VITA) sites were encouraged to deposit and maintain a portion

of their refund in a savings account for a one-year period to receive a 50 percent match added to their

account. Most of these filers (70 percent) kept these refund portions saved for the entire year, with 72

percent continuing to save after the program ended (Tucker, Key, & Grinstein-Weiss, 2014). Those savings

can act as a buffer for future hardships. Compared with a group of tax filers not offered the program, savers

in the $aveNYC study were less likely to have experienced financial hardship during the one-year period

following the intervention (Key, Tucker, Grinstein-Weiss, & Comer, 2015).

The EITC can help stabilize households during a recession. In theory, a person could lose their EITC if they

are out of work for an entire year, however it is more likely a person will experience reduced earnings

during a recession year, working fewer hours or at reduced wages. In many cases, individuals will receive a

larger EITC as they move inward from being outside the income eligibility range or in the phase-out range

for the credit as their earnings are reduced. In these cases, the larger EITC can offset some of their wage

losses (Maag and Marron 2020). Following the Great Recession, the EITC appeared to be a stabilizer

overall (Nichols and Rothstein 2016; Bitler, Hoynes, and Kuka 2017).

Non-Financial Benefits

Beyond the direct financial benefits of the credit, research has also identified how the EITC translates into

improved outcomes for individuals and families along numerous dimensions including health and

education. In some cases, these benefits last into the future, not only when people receive the credit.

Health benefits of the EITC

Research consistently finds the EITC is associated with improvements in health for children.

Employing quasi-experimental designs that look at outcomes prior to and following expansions to the

federal EITC and to the New York State and New York City EITCs, analysts have found that the EITC

reduces rates of low birthweight in infants, and raises average birthweights (Hoynes, Miller, and Simon

2015; Wicks-Lim and Arno 2017). The same has been found using variation in state-level EITCs comparing

states with a state-level EITC to those without a state-level EITC (Wagenaar et al. 2019). Benefits for

children in their early years can last into later years, providing a lifetime of benefits (Shonkoff and Phillips

2000). During school-age years, parents who received more generous state EITC benefits report health

improvements for their children (Baughman and Duchovny 2016). Even after EITC receipt, children in

families who received the EITC report improved health outcomes including lowered body mass index and

improved self-reported health as young adults. Likely, these health effects are in part a result of increased

The Earned Income Tax Credit: Program Outcomes, Payment Timing, and Next Steps for Research | 13

The Earned Income Tax Credit: Program Outcomes, Payment Timing, and Next Steps for Research | 14

health insurance coverage during childhood stemming from either a parent gaining employer provided

health insurance from increased work or simply additional resources from the credit that can be used to

purchase insurance (Braga, Blavin, and Gangopadhyaya 2020).

For adults, the EITC is associated with general health improvements such as reduced mortality

rates and a higher quality of life, based on estimates using variation in state-level EITCs (Muennig et al.

2016). Assessing state and federal EITC expansions, analysts find that mothers who received the EITC

report improved mental health, a result the authors attribute to their higher incomes and, among unmarried

mothers, increases in employment (Gangopadhyaya, Blavin, Braga, and Gates 2020).

Education benefits

The EITC is linked with higher test scores, higher graduation rates, and increases in college

enrollment. Increases to the EITC have been linked with higher test scores among young students and,

later in these students’ lives, an increased likelihood of graduating from high school and completing at least

one year of college (Maxfield 2015). The timing of the EITC helps boost college enrollment. An analysis of

tax data showed that high school seniors in families that received the maximum EITC in the spring were

more likely to enroll in college the following fall than those who did not receive the maximum EITC (Manoli

and Turner 2018).

Rethinking EITC Payment: Proposals to Change How the EITC

is Paid and What That Would Mean for Recipients and Credit

Administration

The National Academy of Sciences recently convened a panel focusing on child poverty. The panel’s report

documents that millions of children remain in poverty – even after accounting for safety net programs

including the EITC. It documents the many harms throughout children’s lifetimes associated with living in

poverty during childhood (National Academy of Sciences 2019).

Using the supplemental poverty measure (SPM), analysts find that the EITC coupled with the child tax

credit reduces poverty by more than any other government program outside of Social Security (Fox 2019).

Policy makers continue to consider whether it could be changed to make it even more effective. One aspect

of the EITC that sticks out is the lump sum payment schedule, which is very different from the monthly

benefits provided by most safety net programs.

This form and timing of payments creates potential challenges for recipients. A number of policy proposals

under consideration would change how the EITC is paid. Below, we briefly discuss these proposals, and

review the research on how recipients use the EITC and how the impact of the EITC is related to the timing

of payments, including results from some recent experiments with different EITC payment schedules.

Proposals to Change Timing

Several large-scale EITC proposals would change the EITC from an annual payment following eligibility

verification to a series of payments throughout the year. These include the Cost-of-Living Refund Act, the

LIFT (Livable Incomes for Families Today) the Middle Class Act, and the Working Families Tax Relief Act

(Maag and Airi 2020; table 2). Proposals range from allowing recipients to get a small share of the credit

prior to filing their income tax returns to providing a substantial monthly advance. All of these proposals

reflect a view that paying the credit periodically may be beneficial, particularly if the credit is increased to

become an even more important income source.

Label: Table 2. Advanced Payment Options

Text description: Table 2. Advanced Payment Options, is a table that describes the advanced payment options of several large-scale EITC proposals. The header for the second column reads ‘Advanced payment option’.

The first row describes the current law for the earned income tax credit. There is no advanced payment option. A majority of the credit is delivered as a tax refund in the calendar year following the year of eligibility.

The second row describes the Cost-of-Living Refund Act. The advanced payment option is the option to receive up to $500 of credit before tax filing.

The third row describes the LIFT (Livable Incomes for Families Today) the Middle Class Act. The advanced payment option is an option for monthly advanced payments.

The fourth row describes the Working Families Tax Relief Act. The advanced payment option is to receive up to $500 of credit before tax filing.

Sources: Internal Revenue Service, Revenue Procedure 2018-57, downloaded August 5, 2019; H.R. 1431, “The Cost-of-Living Refund Act,” 116th Cong. (2019); S.4, “LIFT (Livable Incomes for Families Today) the Middle Class Act,” 116th Cong. (2019); S. 1138, 116th Cong. (2019).

Alternative Payment Demonstrations

Two small-scale experiments have tried to test whether paying the credit differently could increase its

effectiveness. The first demonstration, in 2013 and 2014, asked a small group of EITC recipients in

Colorado to consider how they might use periodic payments of the credit differently than a lump sum

payment. Participants in the exercise noted that if they had access to their credit on a more regular basis,

they could use it to pay past-due bills they were juggling and deal with surprise expenses such as a

healthcare need or car repair (Holt 2015). In the second demonstration, in tax year 2014, a group of

taxpayers in Chicago were given the opportunity to receive half of their expected EITC payment in four

quarterly payments. Researchers compared outcomes and experiences of individuals who did and did not

participate in the demonstration to gauge some of the effects of periodic payments. They found that 90

percent of those who received quarterly payments wished to continue receiving quarterly payments and

these periodic payments had improved their financial stability (Bellisle and Marzahl 2015). We review

issues related to timing of the EITC below.

Timing and Use of the Credit

If people prefer to use the EITC mainly to purchase large items or as a form of forced savings, a

lump-sum payment may be the most appropriate delivery mechanism. However, to the extent that

people prefer to use their EITC to pay down debt or meet basic needs, a more regular payment

might be appropriate. Limited studies of refund use show people do both. A small study of 115 EITC

recipients asked individuals how they spent their refunds. On average, the families interviewed spent 25

percent of their refunds paying debts or bills, and 11 percent of the refund went to discretionary

expenditures— “treats” for the family, which brought the EITC recipients social-psychological rewards. On

average, these EITC recipients saved about 17 percent of their refund and the rest was used to try and

build assets and pay for education (Sykes et. al 2020). A more frequent payment could help prevent costly

debt, but individuals in the study indicated that their refund represented a chance to save, purchase used

The Earned Income Tax Credit: Program Outcomes, Payment Timing, and Next Steps for Research | 15

cars and durable goods such as appliances or furniture, invest in education, and make home

improvements. The annual payment was a key part in encouraging savings.

The Refund to Savings initiative was a large-scale randomized experiment intended to better understand

the role of various interventions on savings at tax time (Washington University in Saint Louis n.d.). EITC

recipients indicated they used the money to catch up on short-term debt, typically related to prior

consumption as opposed to secured debt like equity in a house. Almost four-fifths of people used some of

their refund for purchasing basic necessities like food and housing, and two-thirds spent some of their

refund on other needs such as clothing, shoes, and school supplies. About one-third of recipients reported

spending part of their refund on big-ticket items like furniture (Despard et. al 2015). Receiving the credit

throughout the year could have helped avoid the debt in the first place, but receiving the payment as a lump

sum was critical to those who used it as savings to purchase a larger item.

Paying the credit periodically may leave recipients better or worse off depending on not only how

they prefer to use the credit, but whether they are able to realize their preferences. Standard

economic theory suggests that periodic payments should leave people at least as well off as an annual

payment. This is because people who preferred the lump-sum payment could, at least in theory, imitate that

annual payment by saving their periodic payments. In reality, turning an annual payment into a periodic

payment is complicated by human nature and how people think about and take actions related to savings

and debt (Thaler 1999; Prelec and Loewenstein 1998). If individuals find it difficult to commit to saving or

avoiding debt, a lump sum EITC held by the government until released at tax time, and that is truly

inaccessible until then, might leave these individuals better off.

Timing and Credit Impacts

Some impacts of the credit, as reviewed above, on outcomes such as work and earnings, poverty, financial

stability, and some non-financial outcomes, might also be sensitive in some ways to the timing of payment.

Work and Earnings

For a periodically paid EITC to have the same effect of changing people’s behavior as the lump-sum

payment, such as taking work or working additional months, the relationship between the credit

and working would need to remain at least as clear to workers as under the current system of

payments. Evidence on how many people know about the EITC is mixed. Early research suggested that

about 58 percent of people with incomes under twice the poverty level knew about the EITC, and

knowledge was much higher among white or Black people than among Hispanic people (Maag 2005). More

recent analysis has shown that, at least among people who are self-employed, knowledge of the EITC is

high enough to affect EITC use (Chetty and Saez 2013; Saez 2010; and Mortenson and Whitten 2019).

How large the EITC is may also affect how much people will notice and react to the payment. If the

payment is too small, people may not notice it and will be unlikely to react to it. Some evidence from earlier

payment efforts by the federal government suggests that smaller payments may not be as noticeable as

larger payments. In 2020, many households received an Economic Impact Payment of $1,200 per adult

and $500 per dependent child in response to the COVID-19 pandemic. This was similar to 2008 when

households received economic stimulus payments that averaged $950. Analysis of the 2008 payments

suggested that a majority of people could identify when the payment came, and even people who could not

remember when the payments came remembered receiving it (Broda and Parker 2008). Another

government benefit, the Making Work Pay tax credit (about $400 per adult) was provided in 2009 and 2010.

This credit went largely unnoticed. It was delivered in relatively small amounts through reduced tax

The Earned Income Tax Credit: Program Outcomes, Payment Timing, and Next Steps for Research | 16

The Earned Income Tax Credit: Program Outcomes, Payment Timing, and Next Steps for Research | 17

withholding in people’s regular paychecks. A poll from the New York Times showed only 10 percent of

people noticed the credit (Gleckman 2010).

Depending on which advance payment option is adopted, the salience of the payments—or how noticeable

they are to recipients—could be reduced substantially. Alternatively, if the credit was sufficiently large and

received as a separate check (rather than simply increasing someone’s regular paycheck), it could be more

salient. If the program was designed so that payments adjusted automatically with changes in earnings,

something that has not been proposed to date, the link between earnings and the EITC could be made

more apparent to recipients.

Poverty

In the current system of annual payments, people receive the EITC after the year in which they had

qualifying income, creating a separation between the identified need and credit receipt. Periodic payments

of the credit could better align payments and needs, and to that extent potentially be more effective

at alleviating poverty. A change to periodic payments would also improve the ability of policymakers and

researchers to measure and understand the true effects of the EITC on poverty. Currently, when measuring

the credit’s effect on poverty, analysts typically include the EITC in the year it was earned, not in the year it

was received. As a result, the credit’s effect on poverty will be overstated in cases where a person’s income

increases in the year the credit is received.

Financial Stability

The two recent demonstrations described above in Colorado and Chicago provide direct tests of how

recipient financial behaviors and outcomes might differ under periodic payments. A third initiative, the

Refund to Savings experiment, tries to encourage EITC recipients to save all or part of their tax refund.

Participants in the Colorado demonstration and participants in the Refund to Savings initiative said the most

frequent use of their refund was to catch up on bills (Holt 2015). When given the opportunity to receive

part of their EITC on a quarterly basis, people in Chicago missed fewer bills, paid fewer late fees,

and decreased borrowing from formal and informal sources, relative to a comparison group that

received the EITC as a traditional lump-sum payment (Bellisle and Marzahl 2015). Almost all people in

this demonstration reported wanting to continue periodic payments.

Non-Financial Benefits

Finally, some of the non-financial benefits associated with the EITC may be sensitive to when people

receive their benefits. Researchers have found that delivering the EITC when students are making

decisions about college may be influencing more people to enroll (Manoli and Turner 2018). In Chicago,

recipients received one of their payments in August, which they reported using to help with back-to-school

clothing and school fees (Holt 2015). Other research suggests if people have money on hand at the start of

school, it could encourage spending on children’s school (Manoli and Turner 2018).

Administrative and Transition Issues

Changes to the timing of EITC payments might also have implications both for carrying out the credit in

general and create particular challenges in the transition from a lump-sum to periodic payment.

The government’s administrative costs of periodic payment are likely to be somewhat higher than

for lump-sum payments. As noted above, the additional administrative costs the IRS incurs because of

the EITC are currently relatively low in part because the credit is delivered through the existing tax system.

Eligibility determinations are made as part of the tax-filing process, and payments are delivered as part of

the tax refund process. A periodic payment that preserves using tax-year income and family status to

determine credit eligibility and amounts would require some additional administrative mechanisms to

determine and deliver periodic payments to families. Alternatively, a periodic payment that establishes

eligibility and benefit amounts in some other way would require another means of making these

determinations besides a tax return.

Periodic payment administration may be complicated because it would reduce the tax refund payment

eligible families receive at tax time (Barr and Dokko 2006). If too much EITC is delivered in advance,

people who had received these payments would likely need to pay them back when they file their annual

income tax return. Individuals may reject advance payments to avoid this possibility (Kahneman and

Tversky 1979; Jones 2010). One specific lesson from the Advance EITC, noted above, suggests that

making periodic payment an available option will succeed only to the extent that the option is effectively

communicated to potential recipients (Government Accountability Office 1992). It would be possible to

design a periodic payment that allowed only part of the anticipated EITC to be delivered throughout the

year, reducing the risk of owing money at tax time and also improving the odds that some lump-sum

amount would still be available at tax time.

Transitioning from an annual payment to a periodic payment could create problems for recipients. For

example, for recipient families who are used to or count on receiving large refunds, the loss of an

anticipated lump-sum payment may create money management challenges. Under such a change, more

communication might be required with likely EITC recipients about the change in a timely, clear, and salient

manner, or recipients may need assistance with planning or managing the transition. Note that these

challenges may be different depending on whether families have received the EITC many times or only

once or twice (Dowd 2005).

Conclusions and Directions for Research

The EITC provides substantial benefits, particularly to families with children. The credit is not only an

important source of income at tax time, when benefits are received, but also has a host of positive effects