10 - 1

MODULE 10: YEAR END CLOSING PROCESSES

Module Overview

Completing the year-end closing process in Microsoft Dynamics NAV

2013 involves three steps.

1. Closing the fiscal year by using the Close Year function on the

Accounting Periods page.

2. Generating a year-end closing entry by using the Close Income

Statement batch job.

3. Posting the year-end closing entry together with the offsetting equity

account entries.

Closing a year is not required by Microsoft Dynamics NAV 2013. However,

completing the closing process makes sure that balances are displayed only for

open year(s). For example, on the Chart of Accounts page.

Objectives

The objectives are:

• Close the accounting periods for the fiscal year.

• Explain and run the Close Income Statement batch job process.

• Complete the closing process by posting the general journal.

Microsoft Official Training Materials for Microsoft Dynamics ®

Your use of this content is subject to your current services agreement

Finance Essentials in Microsoft Dynamics

®

NAV 2013

10 - 2

Closing a Fiscal Year

The first step in the year-end closing process is to close the fiscal year. This

process manages the periods and dates for fiscal years.

Note: A fiscal year cannot be closed before a new one is created.

Close the Fiscal Year

To close the accounting periods, follow these steps.

1. In the Search box, enter Accounting Periods, and click the related

link.

2. On the Home tab, click Close Year. You will receive a message about

the year to be closed. This year is suggested based on the earliest

open year, and the corresponding check marks in the New Fiscal

Year field.

FIGURE 10.1: ACCOUNTING PERIODS – CLOSE YEAR FUNCTION

3. Click Yes to close the year.

Note: To close a nonstandard year, add a check mark in the New Fiscal Year

check box of the last period to be included in the year to be closed.

Microsoft Official Training Materials for Microsoft Dynamics ®

Your use of this content is subject to your current services agreement

Module 10: Year End Closing Processes

10 - 3

After you run the fiscal year closing process, the following will apply.

• The Closed and Date Locked fields for all periods in that fiscal year

are selected and they cannot be cleared any longer.

• The Date Locked field for the first period of the next fiscal year is

selected and it cannot be cleared any longer.

• The period lengths for the closed periods cannot be changed.

Note: To prevent users from posting entries in a closed fiscal year, set a date

range in the Allow Posting From and Allow Posting To fields on the General

Ledger Setup page.

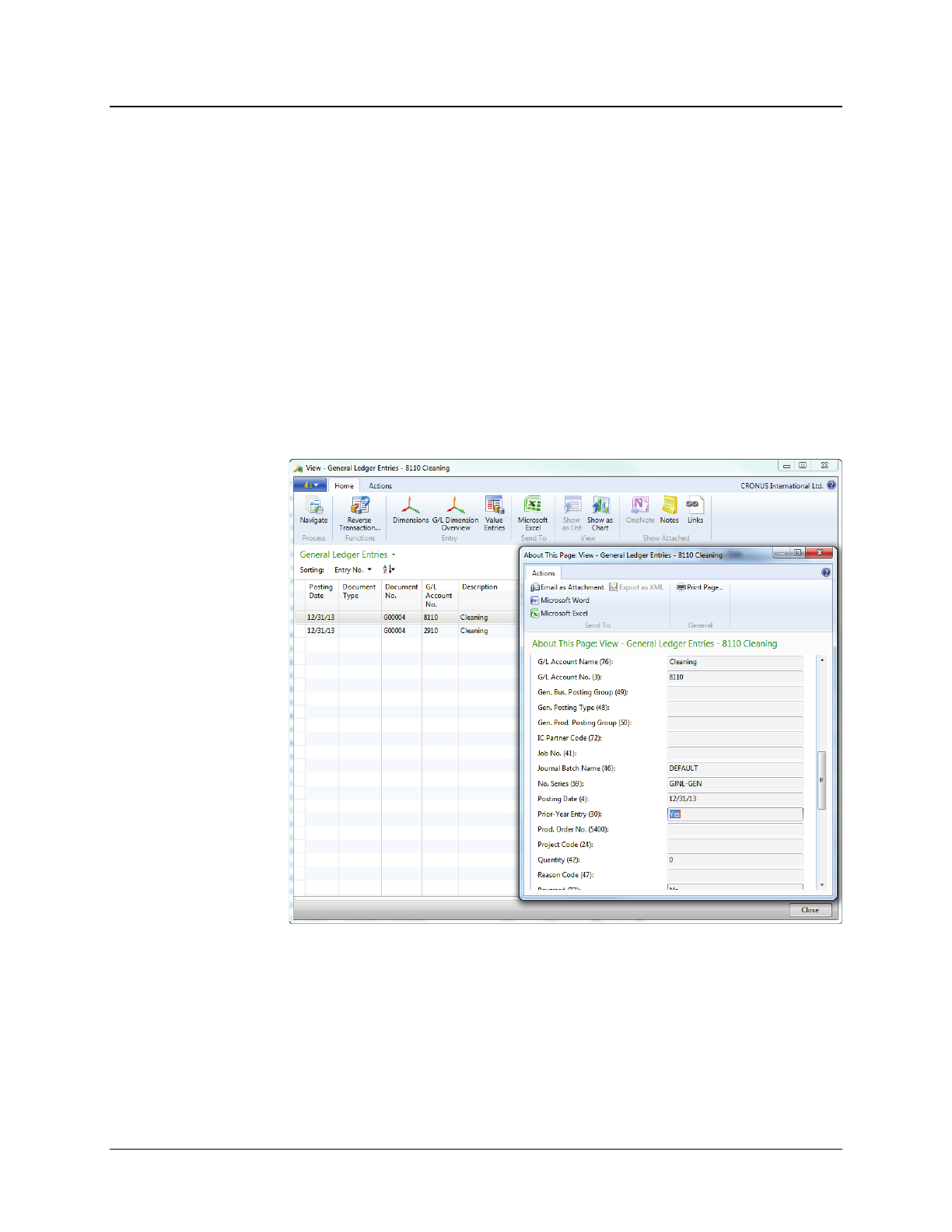

Demonstration: Prior-Year Entry Confirmation

Scenario: After the 2013 fiscal year is closed, Phyllis, the Accounting Manager at

CRONUS International Ltd., realizes that she must post a December 2013 cleaning

expense for 80.00 local currency (LCY).

After Phyllis posts the expense, she reviews the entry to verify that the Prior-Year

Entry check box is selected to indicate that it is a prior-year entry.

Note: To complete this demonstration, make sure that the 2013 fiscal year is

closed. If a different year is closed, post into that year in step 6 of this

demonstration.

Demonstration Steps

1. Post the 2013 cleaning expense and review the posted entries.

a. In the Search box, enter General Journals, and click the related

link.

b. In the Batch Name field, click the drop-down list and then select

the DEFAULT journal batch.

c. Click OK.

d. Delete any existing journal lines in the batch.

e. In the Posting Date field, enter 12/31/13.

f. Make sure that the Account Type field is set to G/L Account.

g. In the Account No. field, enter 8110.

h. In the Amount field, enter 80.00.

i. Make sure that the Bal. Account Type field is set to G/L Account.

j. In the Bal. Account No. field, enter 2910.

k. On the Actions tab, click Post.

l. Click Yes to post the journal lines.

Microsoft Official Training Materials for Microsoft Dynamics ®

Your use of this content is subject to your current services agreement

Finance Essentials in Microsoft Dynamics

®

NAV 2013

10 - 4

m. Click OK.

n. Click OK to close the General Journal page.

To review the posted entries, follow these steps:

a. In the Search box, enter G/L Registers, and click the related link.

b. Press CTRL+END to move to the last entry and select this entry.

c. On the Navigate tab, click General Ledger to review the posted

entries.

d. Click the About This Page function.

e. Expand the Table Fields FastTab.

f. Locate the Prior-Year Entry field and verify that the value is set

to Yes. This means that this entry is considered a closing entry

and it will be included when the Close Income Statement batch

job is run.

FIGURE 10.2: GENERAL LEDGER ENTRIES - ABOUT THIS PAGE

g. Close the About This Page page.

h. Click Close to close the View – General Ledger Entries page.

Microsoft Official Training Materials for Microsoft Dynamics ®

Your use of this content is subject to your current services agreement

Module 10: Year End Closing Processes

10 - 5

Transferring Income Statement Account Balances

The Close Income Statement batch job transfers the income statement account

balances to an account in the balance sheet and it closes the income statement

accounts. The Close Income Statement batch job also creates lines in a journal

that are posted manually.

You can use the Close Income Statement batch job multiple times to transfer the

income statement account balances. For example, you might have to do this when

the next entries are posted into a closed year.

Close Income Statement Batch Job

To open the Close Income Statement batch job, follow these steps.

1. In the Search box, enter Close Income Statement, and click the

related link.

FIGURE 10.3: CLOSE INCOME STATEMENT WINDOW

Microsoft Official Training Materials for Microsoft Dynamics ®

Your use of this content is subject to your current services agreement

Finance Essentials in Microsoft Dynamics

®

NAV 2013

10 - 6

The following fields appear on the batch job.

• Fiscal Year Ending Date – Automatically populated with the last date

in the latest closed fiscal year. This date is used to determine the

posting date for the journal.

• Gen. Journal Template – Identifies the name of the general journal

template that the entries are added in.

• Gen. Journal Batch – Identifies the name of the general journal

batch that the entries will be added in.

• Document No. – Automatically populated with the next available

number from the number series for the selected Gen. Journal Batch.

• Retained Earnings Acc. – Identifies the account that the retained

earnings entries are added in.

• Posting Description – Specifies the text to accompany the entries.

The default text is Close Income Statement.

• Close by – Provides the available accounting options in Microsoft

Dynamics NAV2013 to classify into multiple entries. The options are

as follows:

o Business Unit Code: If this field is selected, and the company is a

consolidated company, separate entries are created for each

business unit.

o Dimensions: For any dimensions selected, one entry is posted for

each dimension value combination used in a G/L account.

If neither option is used, a single entry is created for each

account.

• Inventory Period Close – Indicates that the inventory period(s) with

ending dates equal to or greater than the last date of the accounting

period is closed.

After you close a fiscal year, you can still post general ledger entries to the closed

year. When you post in a closed year, entries are marked as prior-year entries.

When the next entries are posted to a closed fiscal year, you must follow these

steps.

1. Run the Close Income Statement batch job to transfer the balances

to the retained earnings (equity) account.

2. Post the transferred entries.

Microsoft Official Training Materials for Microsoft Dynamics ®

Your use of this content is subject to your current services agreement

Module 10: Year End Closing Processes

10 - 7

Demonstration: Run the Close Income Statement Batch

Job

Scenario: After the 2013 fiscal year is closed, Phyllis, the Account Manager, must

run the Close Income Statement batch job to transfer the income statement

accounts to account 3120, the retained earnings account, as part of the fiscal year

processing.

The default general journal is used and the posting description includes the fiscal

year number.

You must keep the Area, Business Group, and Customer Group dimension

information that is posted on the income account entries.

Demonstration Steps

1. Run the Close Income Statement batch job.

a. In the Search box, enter Close Income Statement, and click the

related link.

b. Make sure that the Fiscal Year Ending Date is 12/31/13.

c. In the Gen. Journal Template field, click the drop-down list and

select GENERAL.

d. In the Gen. Journal Batch field, click the drop-down list and

select DEFAULT.

e. Click OK.

f. In the Retained Earnings Acc. field, enter 3120.

g. In the Posting Description field, add 2013 to the end of the text.

h. In the Dimensions field, click the AssistEdit (…) button.

i. Select the Selected check box for the AREA, BUSINESS GROUP,

and CUSTOMER GROUP dimension codes.

j. Click OK to close the Dimension Selection page.

k. Click OK to run the Close Income Statement batch job.

l. Click OK to the message that the journal lines are now created.

Microsoft Official Training Materials for Microsoft Dynamics ®

Your use of this content is subject to your current services agreement

Finance Essentials in Microsoft Dynamics

®

NAV 2013

10 - 8

Posting the Journal

The Close Income Statement batch job transfers the closing entries to the

specified journal batch. The batch job does not post the entries automatically.

If an account is not specified in the Retained Earnings Acc. field in the Close

Income Statement batch job, one or more lines must be inserted into the journal

with the retained earnings account, and the amount that will be posted to the

account.

When the journal is posted, one or more entries are posted to each income

statement account so that its balance becomes zero. Also, the retained earnings

account is updated for the gain or loss.

Note: When an additional reporting currency is set up in the General Ledger

Setup page, Microsoft Dynamics NAV2013 posts the journal automatically. This

guarantees the correct posting of rounding differences.

Demonstration: Review Entries and Post the General

Journal

In this demonstration, a general ledger account that has 2013 entries is reviewed

before and after the journal is posted, to obtain a comparison. The steps for

reviewing these entries are not part of the closing process.

Scenario: To complete the year-end closing process, Phyllis posts the entries

transferred to the DEFAULT general journal batch.

Because a retained earnings account is already specified in the Close Income

Statement batch job, a separate balancing line is not required.

Demonstration Steps

1. Review G/L account 9110 before posting.

a. In the Search box, enter Chart of Accounts, and click the related

link.

b. Select account 9110.

c. Notice the amount in the Net Change field.

d. On the Navigate tab, click Ledger Entries.

e. Review the posted entries.

f. Click Close to close the General Ledger Entries page.

Microsoft Official Training Materials for Microsoft Dynamics ®

Your use of this content is subject to your current services agreement

Module 10: Year End Closing Processes

10 - 9

2. Post the general journal.

a. In the Search box, enter General Journals, and click the related

link.

b. Make sure that the DEFAULT batch is selected.

c. Do not change the Posting Date.

d. Scroll down to the last entry for account 3120, the Retained

Earnings account. Notice the amount.

Notice that the Total Balance field at the bottom of the window

contains a zero balance. Therefore, the journal can be posted.

e. On the Actions tab, click Post.

f. Click Yes to post the journal.

g. Click OK.

h. Click OK to close the General Journal page.

3. Review G/L account 9110 after posting.

As soon as the journal lines are posted, an entry is posted to each

income statement account so that its balance becomes zero and the

year's result is transferred to the Retained Earnings account in the

balance sheet.

To review the posted G/L accounts, follow these steps.

a. In the Search box, enter Chart of Accounts, and click the related

link

b. Select account 9110.

Notice that the Net Change field contains a zero balance.

c. On the Navigate tab, click Ledger Entries.

Notice that an offsetting line appears for the amount noted when you

reviewed the account before posting the journal.

d. Click Close to close the General Ledger Entries page.

e. Select account 3120.

f. On the Navigate tab, click Ledger Entries.

Notice that the amount for the Close Income Statement 2013 line

matches the amount for this account from the general journal.

g. Click Close to close the General Ledger Entries page.

Microsoft Official Training Materials for Microsoft Dynamics ®

Your use of this content is subject to your current services agreement

Finance Essentials in Microsoft Dynamics

®

NAV 2013

10 - 10

Lab: Post an Entry into a Closed Fiscal Year

Scenario

In this lesson, the 2013 fiscal year is already closed and it uses the three step

process. It is now audit time and the auditors have found an additional vacation

compensation expense for 7,844.74 LCY that must be posted in 2009.

As the accounting manager, it is your responsibility to post the accrual. The debit

is to the Vacation Compensation expense (account 8740), and the credit is to the

Vacation Compensation Payable account (5840). Use 12/31/13 as the posting date

for the entry.

After the entry is made, transfer and post the expense to include it in the closing

process. Use the following criteria to complete the closing process.

• Use the DEFAULT general journal as the transfer to journal.

• Post to the retained earnings account, 3120.

• Add 2013 Audit to the end of the posting description.

• Do not close by dimensions because dimensions are not used to post

this expense.

You do not have to review any entries.

Exercise 1: Post an Entry into a Closed Fiscal Year

Task 1: Post an Entry into a Closed Fiscal Year

High Level Steps

1. Post the accrual according to the scenario.

2. Run the Close Income Statement batch job according to the scenario.

3. Post the general journal.

Detailed Steps

1. Post the accrual according to the scenario.

a. On the Navigation Pane, click Departments.

b. Click Financial Management > General Ledger > General

Journals.

c. In the Batch Name field, click the drop-down list and select the

DEFAULT journal batch.

d. Click OK.

e. Delete any existing journal lines in the batch.

f. In the Posting Date field, enter 12/31/13.

g. Make sure that the Account Type field is set to G/L Account.

Microsoft Official Training Materials for Microsoft Dynamics ®

Your use of this content is subject to your current services agreement

Module 10: Year End Closing Processes

10 - 11

h. In the Account No. field, enter 8740.

i. In the Amount field, enter 7,844.74.

j. Make sure that the Bal. Account Type field is set to G/L Account.

k. In the Bal. Account No. field, enter 5740.

l. On the Home tab, click Post.

m. Click Yes to post the journal lines.

n. Click OK.

o. Click OK to close the General Journal page.

2. Run the Close Income Statement batch job according to the scenario.

a. On the Navigation Pane, click Departments.

b. Click Financial Management > Periodic Activities > Fiscal

Year > Close Income Statement.

c. Make sure that the Fiscal Year Ending Date is 12/31/13.

d. In the Gen. Journal Template field, click the drop-down list and

select GENERAL.

e. In the Gen. Journal Batch field, click the drop-down list and

select DEFAULT.

f. Click OK.

g. In the Retained Earnings Acc. field, enter 3120.

h. In the Posting Description field, add 2013 to the end of the text.

i. In the Dimensions field, click the AssistEdit (…) button.

j. Clear the Selected check box for the AREA, BUSINESS GROUP,

and CUSTOMER GROUP dimension codes.

k. Click OK to close the Dimension Selection page.

l. Click OK to run the Close Income Statement batch job.

m. Click OK to the message that the journal lines are now created.

3. Post the general journal.

a. On the Navigation Pane, click Departments.

b. Click Financial Management > General Ledger > General

Journals.

c. Make sure that the DEFAULT batch is selected.

d. On the Home tab, click Post.

e. Click Yes to post the journal.

f. Click OK.

g. Click OK to close the General Journal page.

Microsoft Official Training Materials for Microsoft Dynamics ®

Your use of this content is subject to your current services agreement

Finance Essentials in Microsoft Dynamics

®

NAV 2013

10 - 12

Module Review

Module Review and Takeaways

The year-end closing processes in Microsoft Dynamics NAV 2013 are the final step

in the fiscal year. A company must close all the income and expense accounts to

obtain a final statement and balance for the year.

The year-end closing processes close all entries in Microsoft Dynamics NAV 2013

and the Close Income Statement batch job transfers all general ledger accounts

to the balance so that the company is ready for the next period.

Completing the year-end closing processes will make data segregation and

analysis easier, and will also simplify the review of the posted entries in the Chart

of Accounts, because the balances only reflect the current year activity.

Test Your Knowledge

Test your knowledge with the following questions.

1. What does not occur after the Close Year process is run?

( ) The next entries posted in the closed year are marked as prior-year

entries.

( ) The Closed and Date Locked check boxes in the Accounting Periods

window are selected.

( ) A new fiscal year is created.

( ) Period lengths of closed periods cannot be changed.

2. What steps must be performed after an entry is posted into a closed fiscal

year?

( ) Move on to the postings in the next fiscal year.

( ) The Close Income Statement batch job must be run and then the

transferred entries must be posted.

( ) The next fiscal year must be created.

Microsoft Official Training Materials for Microsoft Dynamics ®

Your use of this content is subject to your current services agreement

Module 10: Year End Closing Processes

10 - 13

3. Which of the following statements is false for the Close Income Statement

batch job?

( ) Reconciles all G/L entries.

( ) Transfers the income statement account balances to an account in the

balance sheet.

( ) Creates lines in a journal.

( ) Closes the income statement accounts.

4. What type of account are closing entries transferred to?

( ) Accrued Earnings

( ) Retained Earnings

( ) Accrual Entries

( ) Retained Accruals

5. What occurs when you post a journal that contains the closing entries?

( ) An entry is posted to each balance sheet account so that its balance

becomes zero.

( ) An entry is posted to each income statement account so that its

balance becomes zero.

( ) The income statement accounts are updated for the gain or loss.

( ) The retained earnings accounts are updated so that their balances

become zero.

6. In the closing process, what occurs when an additional reporting currency is

set up in the General Ledger Setup window?

( ) This setup does not affect the closing process.

( ) Additional currencies are added to the journal.

( ) Two journals are created when the Close Income Statement batch job

is run.

( ) The journal is automatically posted when the Close Income Statement

batch job is run.

Microsoft Official Training Materials for Microsoft Dynamics ®

Your use of this content is subject to your current services agreement

Finance Essentials in Microsoft Dynamics

®

NAV 2013

10 - 14

7. What is used to transfer the income statement account balances to a balance

sheet account?

( ) Transfer Fiscal Year Balance batch job

( ) Close Income Statement batch job

( ) Transfer Income Balance batch job

( ) Close Fiscal Year batch job

8. Which of the following is not a step in completing the year-end closing

process?

( ) Post the general journal.

( ) Open the new fiscal year.

( ) Transfer the Income Statement account balances.

( ) Close the fiscal year.

9. What must occur to prevent users from posting in a closed period?

( ) Open a new fiscal year.

( ) Run the Close Year process.

( ) Set a date range in the General Ledger Setup window.

( ) Close the Income Statement.

Microsoft Official Training Materials for Microsoft Dynamics ®

Your use of this content is subject to your current services agreement

Module 10: Year End Closing Processes

10 - 15

Test Your Knowledge Solutions

Module Review and Takeaways

1. What does not occur after the Close Year process is run?

( ) The next entries posted in the closed year are marked as prior-year

entries.

( ) The Closed and Date Locked check boxes in the Accounting Periods

window are selected.

(√) A new fiscal year is created.

( ) Period lengths of closed periods cannot be changed.

2. What steps must be performed after an entry is posted into a closed fiscal

year?

( ) Move on to the postings in the next fiscal year.

(√) The Close Income Statement batch job must be run and then the

transferred entries must be posted.

( ) The next fiscal year must be created.

3. Which of the following statements is false for the Close Income Statement

batch job?

(√) Reconciles all G/L entries.

( ) Transfers the income statement account balances to an account in the

balance sheet.

( ) Creates lines in a journal.

( ) Closes the income statement accounts.

4. What type of account are closing entries transferred to?

( ) Accrued Earnings

(√) Retained Earnings

( ) Accrual Entries

( ) Retained Accruals

Microsoft Official Training Materials for Microsoft Dynamics ®

Your use of this content is subject to your current services agreement

Finance Essentials in Microsoft Dynamics

®

NAV 2013

10 - 16

5. What occurs when you post a journal that contains the closing entries?

( ) An entry is posted to each balance sheet account so that its balance

becomes zero.

(√) An entry is posted to each income statement account so that its

balance becomes zero.

( ) The income statement accounts are updated for the gain or loss.

( ) The retained earnings accounts are updated so that their balances

become zero.

6. In the closing process, what occurs when an additional reporting currency is

set up in the General Ledger Setup window?

( ) This setup does not affect the closing process.

( ) Additional currencies are added to the journal.

( ) Two journals are created when the Close Income Statement batch job

is run.

(√) The journal is automatically posted when the Close Income Statement

batch job is run.

7. What is used to transfer the income statement account balances to a balance

sheet account?

( ) Transfer Fiscal Year Balance batch job

(√) Close Income Statement batch job

( ) Transfer Income Balance batch job

( ) Close Fiscal Year batch job

8. Which of the following is not a step in completing the year-end closing

process?

( ) Post the general journal.

(√) Open the new fiscal year.

( ) Transfer the Income Statement account balances.

( ) Close the fiscal year.

Microsoft Official Training Materials for Microsoft Dynamics ®

Your use of this content is subject to your current services agreement

Module 10: Year End Closing Processes

10 - 17

9. What must occur to prevent users from posting in a closed period?

( ) Open a new fiscal year.

( ) Run the Close Year process.

(√) Set a date range in the General Ledger Setup window.

( ) Close the Income Statement.

Microsoft Official Training Materials for Microsoft Dynamics ®

Your use of this content is subject to your current services agreement

Finance Essentials in Microsoft Dynamics

®

NAV 2013

10 - 18

Microsoft Official Training Materials for Microsoft Dynamics ®

Your use of this content is subject to your current services agreement