THE COOK COUNTY

PROPERTY ASSESSMENT PROCESS

A Primer on Assessment, Classification,

Equalization and Property Tax Exemptions

April 5, 2010

ACKNOWLEDGEMENTS

The Civic Federation would like to thank the following individuals at the Cook County

Assessor’s Office for providing data and answering our questions about property assessment:

Mike Stone, Chief Deputy Assessor, John Horbas, Director of Research, and Sherri Farris,

Senior Policy Analyst.

We are deeply grateful for the substantial legal contributions of Mark Davis, O'Keefe, Lyons &

Hynes, LLC; and for review by Whitney Carlisle, McCracken, Walsh & de laVan, and Timothy

Moran, Schmidt, Salzman and Moran, Ltd.

Copyright © 2010

The Civic Federation

Chicago, Illinois

1

TABLE OF CONTENTS

EXECUTIVE SUMMARY ......................................................................................................................................... 2

OVERVIEW ................................................................................................................................................................ 3

PROPERTY ASSESSMENT ...................................................................................................................................... 3

COOK COUNTY ASSESSMENT DISTRICTS ................................................................................................................... 3

ASSESSMENT METHODS ............................................................................................................................................ 6

CLASSIFICATION ........................................................................................................................................................ 9

ASSESSED VALUE .................................................................................................................................................... 12

CALCULATION OF TAXABLE VALUE .............................................................................................................. 13

EQUALIZATION ........................................................................................................................................................ 13

PROPERTY TAX EXEMPTIONS .................................................................................................................................. 18

Homestead Exemptions ...................................................................................................................................... 18

Charitable, Religious, Educational & Governmental Exemptions ..................................................................... 25

Other Property Tax Assistance Measures .......................................................................................................... 26

TAXABLE VALUE ..................................................................................................................................................... 28

ESTIMATED FULL VALUE OF REAL ESTATE ............................................................................................................. 29

APPENDIX A: NUMBER OF PARCELS BY CLASS 2000-2008 ........................................................................ 30

APPENDIX B: FINAL ASSESSED VALUE 2000-2008 ........................................................................................ 32

APPENDIX C: COOK COUNTY ASSESSED VALUES BY CLASS .................................................................. 33

APPENDIX D: COOK COUNTY MEDIAN LEVELS OF ASSESSMENT ........................................................ 34

APPENDIX E: HOMESTEAD EXEMPTIONS ..................................................................................................... 39

APPENDIX F: HOMESTEAD EXEMPTIONS VS. TAXABLE EAV ................................................................. 41

2

EXECUTIVE SUMMARY

The purpose of this report is to describe how the taxable value of real estate is established in Cook

County, Illinois. The report divides the process into two major parts: the determination of assessed value

and the calculation of taxable value.

Assessed Value Highlights:

Assessment Districts:

Cook County is divided into three districts for the purpose of property

assessment, each of which is assessed every three years. Approximately 47% of the county’s 1.8

million parcels are located within the boundaries of the City of Chicago, 24% of parcels are in the

North triad assessment district and 29% are in the South triad assessment district. Approximately

47% of the assessed value of Cook County property is in the City of Chicago, 33% of value is in the

North triad and 20% is in the South triad.

Assessment Methods:

The primary assessment method used by the Cook County Assessor for the

county’s 1.5 million residential (Class 2) parcels is a comparison to sale prices of other residential

properties using a computer-assisted technique that accounts for factors such as location, square

footage, and construction type. An evaluation of income or construction cost is sometimes used for

other types of property.

Classification:

Cook County is the only county in Illinois that sets different assessment levels for

different types of property. Beginning with assessment year 2009 (for taxes payable 2010), the

assessment level for most residential, vacant, and business incentive properties will be 10% of full

market value, while the level for not-for-profit, commercial, and industrial properties will be 25% of

full market value.

Assessed Value:

The total assessed value of property in Cook County grew 79.6% between 1999 and

2008, from $40.3 billion to $72.5 billion.

Taxable Value Highlights:

Equalization:

Equalization is the application of a factor, or multiplier, to all assessed values such that

the total equalized assessed value of the county equals 33 1/3% of the fair market value. The final

2008 equalization factor for Cook County was 2.9786. Median levels of assessment calculated by the

Illinois Department of Revenue in order to compute the equalization factor fell from 29.5% in 1994 to

a low of 15.7% in 2006 for Class 5a commercial properties, and from 33.5% in 1994 to a low of

18.0% in 2007 for Class 5b industrial properties.

Homestead Exemptions:

Illinois statute currently authorizes ten homestead exemptions available to

different types of homeowners. The total value of homestead exemptions in Cook County has grown

substantially in recent years. In 1999, homestead exemptions removed 5.0% of gross equalized

assessed value (EAV) in Cook County from the final taxable value. In 2008, homestead exemptions

exempted 12.6% of gross EAV from taxation. This increase in the value of homestead exemptions is

due primarily to dramatic growth in the Senior Citizens Assessment Freeze Exemption and expansion

of the General Homestead Exemption through the introduction of the Alternative General Homestead

Exemption. The Senior Citizens Assessment Freeze Exemption had the highest rate of growth,

increasing by 979.6%, or $4.7 billion of EAV between 1999 and 2008.

Total Taxable Value:

Total taxable value of real estate in Cook County increased 104.3% between

1999 and 2008, rising from $85.4 billion to $188.8 billion.

Estimated Full Value:

The full market value of taxable real estate in Cook County is estimated at

$656.5 billion in 2007, the latest year for which data is available from the Illinois Department of

Revenue.

3

OVERVIEW

The purpose of this report is to describe how the taxable value of real estate is established in

Cook County, Illinois. The report divides the process into two major parts: the determination of

assessed value and the calculation of taxable value.

In this report, “assessment” refers to the determination of value for the purpose of taxation.

Assessed value is not the final value used to calculate property tax liability in the State of

Illinois. After the assessed value has been established by the Cook County Assessor and

finalized by the Board of Review,

1

two more steps must occur in order to determine the taxable

value of a parcel: equalization and application of any exemptions.

The first part of this report describes the property assessment process, including Cook County

assessment districts, assessment methods, the classification system, and the finalization of

assessed value. The second part of the report describes the calculation of taxable value,

including equalization and exemptions. It also includes data on the estimated full value of real

estate in Cook County.

PROPERTY ASSESSMENT

The following sections describe the process of determining the assessed value of real estate in

Cook County for the purpose of property taxation.

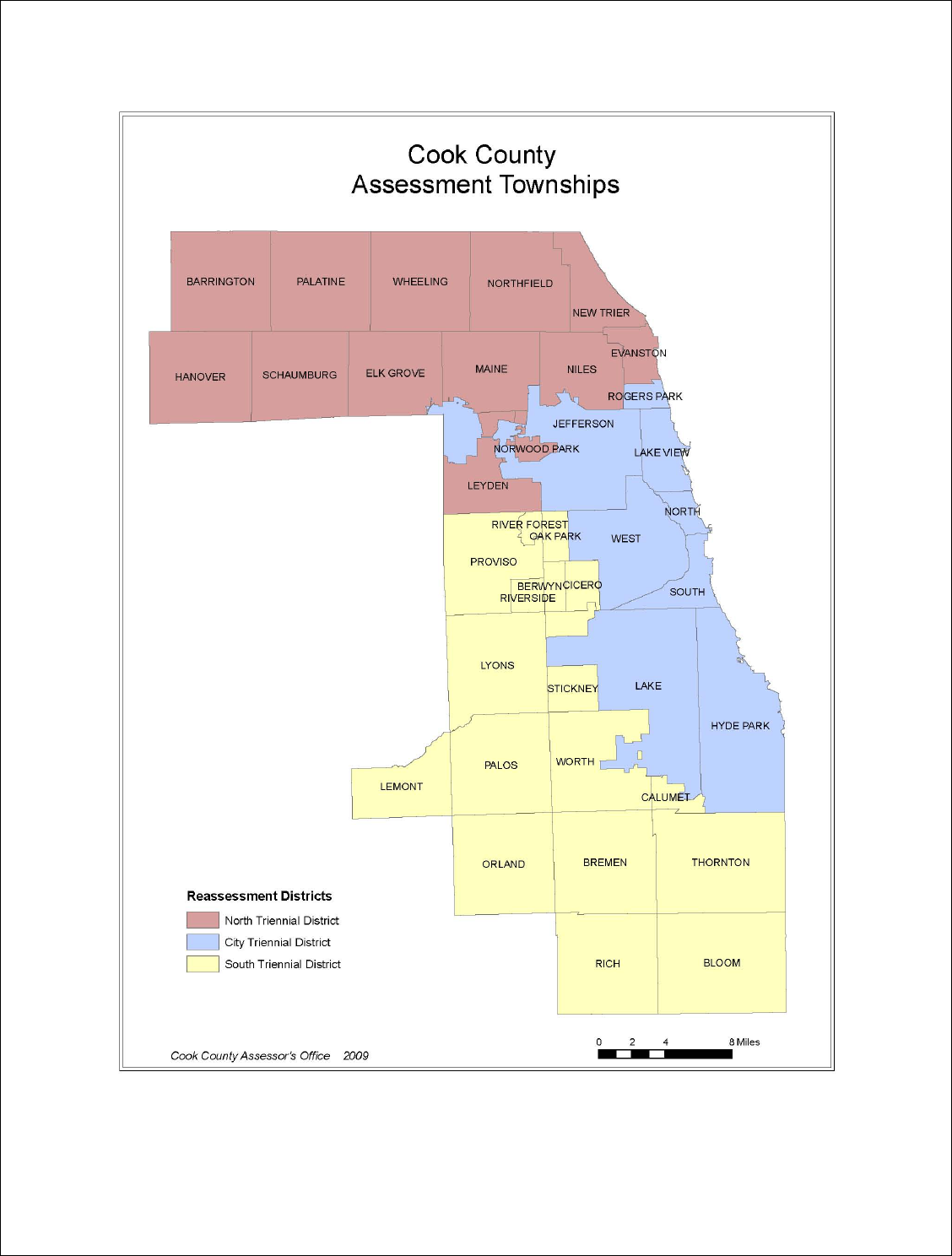

Cook County Assessment Districts

Cook County is divided into three districts for the purpose of property assessment. Each district

is reassessed every three years. All other counties in Illinois must reassess property every four

years.

2

Properties in the City of Chicago were reassessed in 2009. Properties in the north and

northwestern suburbs will be reassessed in 2010, and properties in the south and southwestern

suburbs will be reassessed in 2011. North Avenue serves as the dividing line between the North

and South suburban triads, such that all Cook County properties outside the City of Chicago and

north of North Avenue are in the North triad, and all other suburban Cook County properties are

in the South triad.

3

1

There are some property types that are assessed by the Illinois Department of Revenue rather than the Assessor, as

described beginning on page 5 of this report.

2

Counties are permitted to subdivide into four assessment districts, one of which is reassessed each year on a

rotation. 35 ILCS 200/9-215 and 9-225. All farmland must be reassessed every year. 35 ILCS 200/10-115

3

35 ILCS 200/9-220

4

Approximately 47% of the county’s 1.8 million parcels are located within the boundaries of the

City of Chicago, 24% of parcels are in the North triad assessment district and 29% are in the

South triad assessment district.

4

Approximately 47% of the assessed value of Cook County

property is in the City of Chicago, 33% of value is in the North triad and 20% is in the South

triad, as illustrated below.

City of

Chicago

Triad

855,140

46.7%

North Triad

450,679

24.6%

South Triad

526,799

28.7%

Number of Parcels in Cook County by

Assessment Triad: Tax Year 2008

Source: Cook County Assessor, Final Abstract of Assessment 2008

City of

Chicago

Triad

$34.0

46.9%

North Triad

$23.7

32.7%

South Triad

$14.8

20.4%

Assessed Value of Parcels in Cook County by

Assessment Triad: Tax Year 2008

(in $ billions)

Source:Cook County Assessor, Final Abstract of Assessment 2008

Each triad is subdivided into townships for the purpose of assessment. The townships are listed

below and illustrated in the map on the following page. There are a total of 38 assessment

townships in Cook County: 13 in the North, 17 in the South, and 8 in the City.

5

Triad North South Chicago

Reassessment

Years 2001, 2004, 2007, 2010 2002, 2005, 2008, 2011 2003, 2006, 2009, 2012

Townships

Barrington Berwyn Hyde Park

Elk Grove Bloom Jefferson

Evanston Bremen Lake

Hanover Calumet Lake View

Leyden Cicero North

Maine Lemont Rogers Park

New Trier Lyons South

Niles Oak Park West

Northfield Orland

Norwood Park Palos

Palatine Proviso

Schaumburg Rich

Wheeling River Forest

Riverside

Stickney

Thornton

Worth

Cook CountyTownships by Triad Assessment District

4

Cook County Assessor, Final Abstract of Assessment 2008.

5

Assessment districts, townships, and triennial reassessment years are codified in Cook County Code of Ordinances

Chapter 74 Article II Sections 74-31 and 74-32.

5

All assessment is performed by the Cook County Assessor’s Office, with the exception of the

following types of properties which are assessed by the Illinois Department of Revenue:

pollution control facilities, low sulfur dioxide coal fueled devices, railroad operating property,

6

and regional water treatment facilities.

6

The Department determines the assessed value of these

properties and notifies the Cook County Clerk, who includes them in the tax base.

In most Illinois counties, elected township or multi-township assessors are responsible for

township-level assessments, which are then submitted to a chief county assessment officer, an

appointed supervisor of assessments.

7

In Cook County, however, the elected Cook County

Assessor is responsible for all assessments except those performed by the Illinois Department of

Revenue as described above.

8

A state statute enacted in 1898 created a five-member Board of

Assessors to assess all property in Cook County, and additional legislation in 1932 delegated

assessment responsibility to a single elected assessor.

9

The legislation provided for the retention

of elected township assessors in suburban Cook County as deputy county assessors under the

supervision of the county assessor,

10

and their function is primarily to assist taxpayers in

interpreting and appealing their assessments. Townships within the City of Chicago are simply

geographical boundaries for the purpose of assessment and have no further function.

Assessment Methods

Illinois state statute requires assessment officials to determine the “fair cash value” of each

parcel. This is defined as “the amount for which a property can be sold in the due course of

business and trade, not under duress, between a willing buyer and a willing seller.”

11

It is

important to note that this “fair cash” or “market” value is not necessarily the actual sales price

of a given property, but rather an estimation of what it would sell for on a given valuation date

(January 1 in Cook County). There are states such as California that set the assessed value of a

parcel at its actual sales price and then apply an annual factor to adjust the assessed value over

time. In states such as Illinois that use the market value basis for assessment, adjusting the

assessment of an individual parcel based on its sales price (“sales chasing”) is prohibited when

other properties are not valued the same way.

12

In Illinois and most other states, the “fair cash value” is also expected to represent the

“unencumbered fee simple interest” in the property, meaning the sum total of all ownership

rights to the property regardless of other parties’ less-than-ownership interests such as

leaseholds. For example, if a property is subject to a long-term, below-market rate lease, the

6

35 ILCS 200/11-5 through 11-170.

7

Illinois Department of Revenue, “The Illinois Property Tax System” (PTAX-1004) November 2002, p. 10.

8

St. Clair County also has an elected countywide Assessor. Ibid.

9

Cook County Assessor’s Website, “History of Cook County Assessor’s Office.”

http://www.cookcountyassessor.com/info/history.asp

; “New Conference of Study Choice of Tax Official,” Chicago

Daily Tribune, January 27, 1932.

10

Percy Wood, “Senate Passes Assessing Bill; House Friendly,” Chicago Daily Tribune, January 7, 1932; Cook

County Assessor’s Website, “Township Assessor,”

http://www.cookcountyassessor.com/data/twnships/assessors01.asp

11

35 ILCS 200/1-50; see, also, Cook County Real Property Assessment Classification Ordinance, Cook County

Code of Ordinances § 74-62(b) (“market value” defined in terms of a “fair voluntary sale”).

12

Walsh v. Property Tax Appeal Board, 181 Ill. 2d 228 (1998). In the Walsh case, the Illinois Supreme Court ruled

that the uniformity clause of the Illinois Constitution was violated when some properties in Tazewell County were

assessed based on their recent sales prices while other properties were assessed using the mass appraisal method.

7

diminution of value to the actual owner caused by the lease should be ignored in the assessment

process.

13

A limited exception to the rule that the unencumbered fee simple interest in real estate is the

object of assessment and taxation, as well as an exception to the rule that less-than-fee interests

are not separately taxed, is found in the assessment of leaseholds in certain otherwise exempt

lands. Normally, the leasing of an otherwise exempt property for commercial or other non-

exempt purposes will simply defeat the exempt status, and the fee interest in the property will

become subject to assessment and tax in the normal manner. However, in some cases, such as

property owned by the State of Illinois, or municipalities within their corporate boundaries, the

exemption of the underlying fee is absolute and cannot be affected by a lease.

14

In such cases, the

leasehold interest itself becomes subject to assessment and is taxable to the lessee.

15

Probably

the largest concentrations of taxable leaseholds occur in the major metropolitan airports, which

are municipally owned and lease space to airlines, fixed base operators, and various

concessionaires.

The valuation of such taxable leasehold interests is a somewhat complex subject, largely beyond

the scope of this primer. Generally speaking, the object is to estimate the full “market value” of

the leasehold interest over the remaining life of the lease. This often differs from the valuation

that would be ascribed to the lessee’s interest for other legal purposes, such as condemnation,

and in the case of long-term leases it may closely approximate the value of the entire fee simple

interest.

16

Market value is conceptual and can be represented but not directly observed.

17

Sales prices of

similar properties provide an objective basis for estimating a parcel’s market value, and the sales

comparison approach to valuation is effective when there are sufficient sales to provide a reliable

basis for comparison.

18

Data on the characteristics of parcels, actual prices of parcels that sold,

and other factors affecting sale prices are entered into computer models that can estimate market

values of all parcels. The Cook County Assessor uses such a computer-assisted technique and

three to five years of sales data to value residential properties.

19

There were more than 1.5

million residential properties in Cook County in tax year 2008.

20

13

See Springfield Marine Bank v. Property Tax Appeal Board, 44 Ill.2d 428, 256 N.E.2d 334, 336 (1970)

14

See 35 ILCS 200/15-55 (state property), and 15-60(c) (municipal property).

15

35 ILCS 200/9-195.

16

The modern theory of leasehold valuation for assessment purposes in Illinois is derived from the decision in

People ex rel. Korzen v. American Airlines, 39 Ill.2d 11, 233 N.E.2d 568 (1967), and its progeny. Essentially, the

“American Airlines” methodology requires an estimate of the entire rental value of the leasehold (land and

improvements) in the marketplace to be discounted to a lump sum present value over the remaining term of the

lease. This estimated “market rent” may differ substantially from rent being paid under the actual lease contract.

17

International Association of Assessing Officers, Standard on Ratio Studies, (Kansas City, 2007), 7.

18

International Association of Assessing Officers, Standard on Mass Appraisal of Real Property, (Kansas City,

2002 revised 2008), 8.

19

http://www.cookcountyassessor.com/propertyvaluation.aspx

20

Cook County Assessor, Final Abstract of 2008 Assessment. In this report “residential” means Class 2 properties,

which include single family homes, condominiums, cooperatives, and apartment buildings of up to six units. Larger

apartment buildings (Class 3) are not included.

8

According to the International Association of Assessing Officials, the sales comparison approach

is the most useful mass appraisal approach for valuing single-family residences and

condominiums.

21

Another approach that is useful for revenue-producing properties such as

commercial, industrial, or multifamily residences is the income approach. The income approach

considers data on rental income and expenses, rate of return on investment, vacancy rates, and

other factors unique to income-producing properties.

22

The Cook County Assessor’s Office uses

the income approach for commercial and industrial properties, but also takes sales data into

account. The Assessor notes that values derived from the income approach are often lower than

recorded sales prices because sales prices reflect expectations of higher future income and are

not adjusted for non-realty components of a sale.

23

Therefore, the Assessor’s Office adjusts sales

prices for these factors, then compares the adjusted sales prices to the income market estimates

and reconciles them to produce a property value estimate.

24

Finally, the cost approach to valuation estimates the construction cost of a building minus its

depreciation, and is best suited to newer structures using standard materials and labor.

25

The

Cook County Assessor uses the cost approach for unique manufacturing properties that may not

have reliable income or comparable sales data.

26

Although the income and cost approaches to valuation are useful for certain types of property,

Illinois case law expresses a preference for the sales comparison approach when evidence of

such sales is available. The courts have overturned assessments in some notable cases due to the

failure of assessing officials or valuation experts to use the sales approach because they believed

that other approaches were superior.

27

21

International Association of Assessing Officers, Standard on Mass Appraisal of Real Property, (Kansas City,

2002 revised 2008), 9.

22

International Association of Assessing Officers, Standard on Mass Appraisal of Real Property, (Kansas City,

2002 revised 2008), 9.

23

http://www.cookcountyassessor.com/propertyvaluation.aspx

24

http://www.cookcountyassessor.com/propertyvaluation.aspx

25

International Association of Assessing Officers, Standard on Mass Appraisal of Real Property, (Kansas City,

2002 revised 2008), 8.

26

http://www.cookcountyassessor.com/propertyvaluation.aspx

27

See for example Cook County Board of Review v. Property Tax Appeal Board, 384 Ill.App.3d 472, 894 N.E.2d

400 (1

st

Dist. 2008) and Chrysler Corporation v. Property Tax Appeal Board, 69 Ill.App.3d 207, 387 N.E.2d 351 (2

nd

Dist. 1979)

9

The following table ranks the most useful valuation approaches for different types of property,

according to the International Association of Assessing Officers (“1” being most useful).

Type of Property

Sales

Comparison

Approach

Income

Approach

Cost

Approach

Single-Family Residential

132

Multi-family Residential

1,2 1,2 3

Commercial

213

Industrial

31,21,2

Non-Agricultural Land

12--

Agricultural*

21--

Special-Purpose**

2,3 2,3 1

Rank of Typical Usefulness of the Three Approaches to Value in the

Mass Appraisal of Major Types of Property

*Includes farm, ranch, and forest properties.

**Includes institutional, governmental, resort, and recreation properties.

Source: International Association of Assessing Officers, Standard on Mass Appraisal of Real

Property, (Kansas City, 2002 revised 2008), 9.

Farm home sites are valued as residential properties and are subject to equalization as described

on page 13. However, there are special rules for valuing farmland in Cook County. The Illinois

Constitution states that farmland cannot be assessed at a higher level of assessment than a single

family home.

28

State statute specifies that in Cook County the equalized assessed value per acre

of farmland must be the lesser of two values: 1) the value at the residential assessment level

based on a full market value if the farm were to be sold in a fair, voluntary sale for continued use

as a farm; or 2) 90% of the 1983 average equalized assessed value per acre certified by the

Illinois Department of Revenue.

29

The value of farmland is not subject to equalization.

30

Farmland represented only 0.07% of parcels and 0.01% of assessed value in Cook County for

2008.

31

Classification

Illinois state statute requires that all real property be valued for the purpose of property taxation

at 33 1/3% of its fair cash value in every county except Cook.

32

Cook County is the only county

in the State of Illinois that sets different property tax assessment levels for different types of

property. This differential assessment is called classification and is expressly permitted for

counties with a population greater than 200,000 by the Illinois Constitution Article IX Section 4.

The counties of Cook, DuPage, Kane, Lake, McHenry, Madison, St. Clair, Will, and Winnebago

all currently meet this population threshold but only Cook County has chosen to adopt

classification.

33

The state constitution also requires that the level of assessment or rate of tax for

28

Illinois Constitution Article IX Section 4.

29

35 ILCS 200/10-130

30

35 ILCS 200/10-135

31

Cook County Assessor, Final Abstract of 2008 Assessment

32

Illinois Property Tax Code, 35 ILCS 200/9-145.

33

Population data is the U.S. Census Bureau estimate as of July 1, 2008. See

http://www.census.gov/popest/counties/

.

10

the highest class of property be no more than 2.5 times the level of assessment or rate of tax for

the lowest class of property.

34

The authorization for classification in the 1970 Illinois Constitution first had the effect of

ratifying the existing de facto system of classification maintained by the Cook County Assessor,

which continued unchanged for another four years.

35

Effective January 1, 1974, the General

Assembly provided that future classifications had to be enacted by the County Board in order to

be valid and Cook County passed its first classification ordinance to comply with this law.

36

That ordinance established the following classes and assessment levels (i.e., percentages of the

full value of the property):

Class Description

A

ssessment Level

Class 1 Vacant or Farm Land

22%

Class 2

Residential (single family 6

units or less)

22%

Class 3 Apartments (7 units or more)

33%

Class 4 Not-for-Profit

30%

Class 5

All Other (Commercial,

Industrial)

40%

Cook County Property Classification System: 1974

The theoretical justification for use-based classification of property is usually stated in terms of

the incidence of the resulting tax burden, with the owners of higher-assessment-level properties

being assumed to have the ability to shift the incidence of the tax burden to others. Examples of

such parties are commercial space users who pass the tax on to consumers; manufacturers who

include taxes as a cost of production; and multi-unit apartment owners who recover the tax cost

from their tenants. By contrast, the homeowner absorbs the whole tax cost alone and cannot pass

it on to someone else.

However, the primary justification for classification operative at the time of the 1970 Illinois

Constitutional Convention was arguably the preservation of the de facto classification system

that had evolved in Cook County over many years dating back to at least the 1920s.

37

The

uniformity provisions of the Illinois Constitutions of 1848 and 1870 had been widely interpreted

as prohibiting any form of classified property tax.

38

The likelihood that Cook County’s de facto

classification system would be subject to increasing attack in the courts, and the specter that it

might be struck down, fueled much debate at the 1969-1970 Constitutional Convention.

39

The

34

Illinois Constitution 1970, Article IX, Section 4(b).

35

People ex rel. Kutner v. Cullerton, 58 Ill.2d 270-72, 319 N.E.2d 55, 57-59 (1974).

36

P.A. 78-700, eff. Jan. 1, 1974, now codified at 35 ILCS 200/9-150.

37

See Aldrich v. Harding, 340 Ill.354, 358, 172 N.E. 772, 774 (1930), cited in Richard Wattling, “Taxation of Real

Property in Cook County—The Railroad Cases and the Future of De Facto Classification,” John Marshall Journal

of Practice and Procedure 6 (1968), 212, 213 n. 6.

38

George D. Braden and Rubin G. Cohn, The Illinois Constitution, An Annotated and Comparative Analysis

(Champaign, IL: 1969), 415-416.

39

Joyce D. Fishbane and Glenn W. Fisher, Politics of the Purse: Revenue and Finance in the Sixth Illinois

Constitutional Convention (Champaign, IL: 1974), 70-74; and 7 Record of Proceedings, Sixth Illinois Constitutional

Convention, (1969-1970), 2108-2128.

11

convention delegates generally understood that no new constitution would have passed in 1970 if

it did not “in some way, maybe with some restrictions, make legal the de facto classification in

Cook County.”

40

There are also “incentive” classes, which provide reduced assessment levels for certain periods

of time to encourage specific use or redevelopment. For incentive classifications, the justification

is cast in terms of the social utility of the goal for which the incentive is granted: e.g., industrial

or commercial development of an economically depressed area; or the availability of housing for

economically disadvantaged citizens.

The ultimate goal of classification, which is to produce different effective tax rates for different

types or uses of property, could also be achieved by assigning different tax rates rather than

different assessment classes. The Illinois Constitution of 1970 expressly permits classification by

rate or by class.

41

However, Cook County elected to legalize assessment classification rather than

tax rate classification.

The Cook County Board has changed levels of assessment many times since 1974 and has added

additional classes of property. In every case, the change has been a reduction in the level of

assessment. The most recent major change to the classification ordinance was made in

September 2008 when the Board voted to reduce assessment levels for most classes to either

10% or 25%, effective for tax year 2009.

42

This change was arguably another attempt to bring

the law into alignment with the reality of de facto classification levels.

40

3 Record of Proceedings, Sixth Illinois Constitutional Convention, (1969-1970), 1898; and Hoffman v. Clark, 69

Ill.2d 402, 413-14, 372 N.E.2d 74 (1977).

41

1970 Illinois Constitution, Article IX Section 4: “The level of assessment or rate of tax of the highest class in a

county shall not exceed two and one-half times the level of assessment or rate of tax of the lowest class in that

county.”

42

Cook County ordinance 08-O-51.

12

Class Description New Assessment Level Previous Assessment Level

Class 1 Vacant or Farm Land 22%

Class 2 Residential (single family 6 units or fewer) 16%

Class 3 Apartments (7 units or more)

16% in 2009, 13% in 2010, 10%

in 2011 and subsequent

24% in 2006, 22% in 2007, 20%

in 2008 and subsequent

Class 4 Not-for-Profit 30%

Class 5a Commercial 38%

Class 5b Industrial 36%

Incentive Classes (in effect for limited durations)

Class 6b Industrial Development or Redevelopment

10% for first ten years and any

subsequent renewal periods; if

not renewed, 15% in year 11

and 20% in year 12

16% for first ten years and any

subsequent renewal periods; if

not renewed, 23% in year 11

and 30% in year 12

Class C Brownfields Clean Up and Revelopment

Class 7a

Commercial Development or Redevelopment

With Costs Under $2 Million

Class 7b

Commercial Development or Redevelopment

With Costs Over $2 Million

Class 8

Commercial and Industrial Development in

Areas of Severe Economic Stagnation

10% for first ten years and any

subsequent renewal periods; if

not renewed, 15% in year 11

and 20% in year 12

16% for first ten years and any

subsequent renewal periods; if

not renewed, 23% in year 11

and 30% in year 12

Class 9

Low-Income Multifamily Apartments (7 units or

more)

10% for first ten years;

renewable upon application for

additional ten-year periods

16% for first ten years;

renewable upon application for

additional ten-year periods

Class S

Section 8 Multifamily Apartments (7 units or

more)

10% for the term of the Section

8 contract renewal and for any

additional terms of renewal

16% for the term of the Section

8 contract renewal under the

mark up to market option and

for any additional terms of

renewal

Class L

Landmark Preservation: Commercial,

Industrial, Non-Profit, and Apartment

renewable properties: 10% for

first ten years and subsequent

ten-year renewal periods; if not

renewed, 15% in year 11 and

20% in year 12; commercial

properties: 10% for first ten

years, 15% in year 11 and 20%

in year 12

renewable properties: 16% for

first ten years and subsequent

ten-year renewal periods; if not

renewed, 23% in year 11 and

30% in year 12; commercial

properties: 16% for first ten

years, 23% in year 11 and 30%

in year 12

Cook County Property Classification System

Changes Per 10 & 25 Ordinance 08-O-51 passed September 2008

Note: Class descriptions are summaries. For complete descriptions see Cook County Code of Ordinances Chapter 74 Article II Section 74-63.

10%

25%

10% for first ten years, 15% in

year 11, 20% in year 12

16% for first ten years, 23% in

year 11, 30% in year 12

Assessed Value

Once the Cook County Assessor has estimated the full market value of a property, the class-

specific percentage “level of assessment” is applied to that value to produce the assessed value

(AV). This system whereby assessed value is a percentage of the full market value estimated by

the assessor is sometimes called “fractional assessment”.

43

When the Cook County Assessor’s initial work is completed for a particular township, notices of

assessed value are mailed to the owners of property in that township. Notices are mailed

throughout the year, typically from March through December as township assessments are

43

John L. Mikesell, Fiscal Administration: Analysis and Applications for the Public Sector (Belmont, CA:

Wadsworth/Thompson, 2003), 411-417.

13

completed.

44

The notices advise owners that they may file a complaint within 30 days at the

Assessor’s Office to obtain an internal review of the proposed assessment. The taxpayer may

also appeal the valuation to the Cook County Board of Review, a body charged with the power to

review assessments prior to the determination of final taxable value.

45

The Board of Review typically completes its review process in June and submits its final

valuations to the Illinois Department of Revenue for equalization, which is discussed in the

section below. This is roughly 18 months after the January 1 valuation date of the property.

The following table shows the ten-year change in assessed values for the City of Chicago,

suburban Cook County, and all of Cook County. The City experienced the greatest increase in

assessed values, rising 99.0% from $17.1 billion in 1999 to $34.0 billion in 2008. Total Cook

County assessed value reached $72.5 billion in 2008.

46

1999 2008 $ Change % Change

City of Chicago 17,084,235,762$ 33,995,117,837$ 16,910,882,075$ 99.0%

Suburban Cook County 23,257,055,928$ 38,471,480,450$ 15,214,424,522$ 65.4%

40,341,291,690$ 72,466,598,287$ 32,125,306,597$ 79.6%

Source: Cook County Assessor's Office, Final Assessment Abstracts

Total Cook County

Cook County Assessed Values

1999-2008

CALCULATION OF TAXABLE VALUE

After the assessed value of all properties has been established by the Assessor and finalized by

the Board of Review, two more steps must occur in order to determine the taxable value of a

parcel: equalization and application of any exemptions.

Equalization

Inter-county equalization (sometimes referred to as “state equalization”) is the application of a

factor, or multiplier, to all assessed values such that the aggregate total equalized assessed value

of the county equals 33 1/3% of fair market value. All counties, including Cook, are required to

undergo equalization to ensure that the total value is 33 1/3%. Counties other than Cook also

perform intra-county equalization in order to ensure that townships assessed by different

assessing officials are equalized.

47

Equalization is necessary for the fair implementation of certain state statutes. Assessed valuation

of property is a component in formulas for various education, transportation, and public

assistance grants to local jurisdictions so it is important that assessed values be made equivalent

statewide. State statutes that limit property tax rates and bonded indebtedness of local

44

See http://www.cookcountyassessor.com/appdeadlines/appealdeadlinesform.aspx for dates of notice mailings in

recent years.

45

For more detail on the appeals process see Civic Federation, “Cook County Property Tax Appeals: A Primer on

the Appeals Process with Comparative Data for 2000-2008,” November 17, 2009. http://www.civicfed.org/civic-

federation/publications/cook-county-property-tax-appeals-primer-appeals-process-comparative-da

46

See Appendix C for detailed trend data on Cook County assessed values by class.

47

35 ILCS 200/9-210.

14

governments are also related to assessed value, which must be equalized in order for the statutes

to apply equivalently across the state.

The State of Illinois Department of Revenue is responsible for calculating an equalization factor

for each county.

48

This calculation is made annually using a multi-year comparison of property

assessments and sales prices in each county called the assessment/sales ratio study. The

Department of Revenue uses sales data recorded on Real Estate Transfer Declarations, excluding

sales that are not “arms-length” transactions or are otherwise unrepresentative of market

values.

49

A sample of these sales is compared to the assessed values of the same parcels for the

year prior to the sale. Statistics including median ratio, coefficient of dispersion, and confidence

level are calculated and published in the Department’s annual assessment ratio tables.

50

For

Cook County, the Department calculates these statistics by township for property classes 1, 2, 3,

5a, and 5b when there are at least 25 valid sales in the class.

The Department of Revenue’s assessment/sales ratio studies have long indicated that various

classes of property are valued for assessment purposes at less than the ordinance level

percentages of their fair market value in Cook County. For example, the Department’s studies

show that the median assessment for Cook County residential properties is closer to 10% of full

market value than to the 16% ordinance level (see graph on page 15). Many Cook County

homeowners have noticed this for tax years prior to 2009, when their tax bills showed a fair

market value that is significantly less than what they know their home is worth. The systematic

and historic undervaluing of Cook County property has been widely recognized for many years

and was part of the impetus for Assessor Houlihan’s recent proposal to recalibrate the Cook

County ordinance levels down to 10% for residential and 25% for most other classes of property

(see table on page 12).

The findings of the Department of Revenue’s assessment/sales ratio studies for properties other

than Class 2 residential parcels are more controversial.

51

Controversy arises due to the relatively

small volume of sales for other classes of property because the smaller the sample size, the lesser

the statistical reliability.

52

The uniqueness of some commercial and industrial properties also

makes sales of them difficult to compare to sales of other properties. The Cook County Assessor

has urged the Department of Revenue to use appraisals to supplement the paucity of sales data

for such properties, and to edit sales data to account for sales of personal property and intangible

assets that are often included in the sales price of commercial real estate.

53

The International

Association of Assessing Officers also recognizes the use of appraisal ratios as a technique to

improve sample representativeness where there are few available sales, but it notes that in many

48

35 ILCS 200/17.

49

Illinois Department of Revenue, “PTAX 1007: Findings of the 1998 Assessment/Sales Ratio Study,” January

2003, 7.

50

See http://tax.illinois.gov/AboutIdor/TaxStats/index.htm for statistics and

http://tax.illinois.gov/LocalGovernment/table1-2-3statistics.pdf for an explanation of the statistics.

51

For more detail on this issue see Theodore M. Swain et al., “The Report of The Civic Federation Task Force on

Cook County Classification and Equalization” (Chicago: The Civic Federation, 1999), 8-10.

52

International Association of Assessing Officers, Standard on Ratio Studies, (Kansas City, 2007), 15.

53

Statement of James M. Houlihan, Cook County Assessor, Illinois Department of Revenue Hearing: 2008 State

Equalization Factor for Cook County, July 30, 2009.

15

respects sales ratios are superior to appraisals in terms of lower cost and greater objectivity, and

that appraisals, if possible, should be checked for accuracy against sales.

54

The following graph shows the Cook County median levels of assessment as computed in the

Department of Revenue’s assessment/sales ratio studies from 1994 to 2007, the most recent data

available. Class 2 residential levels fell from roughly 9.5% to 8.5% over this period, reaching

9.0% again in 2007. Class 5a commercial fell from 29.5% to a low of 15.7% in 2006. Class 5b

industrial fell from 33.5% to 17.9%.

55

0%

5%

10%

15%

20%

25%

30%

35%

40%

1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007

Total Cook County Median Levels of Assessment 1994-2007

Note: Median level is computed by comparing a sample of sales to the assessed values of the same parcels for the year prior to the sale.

Source: Illinois Department of Revenue, Table 1 Assessment Ratio Levels, http://www.revenue.state.il.us/AboutIdor/TaxStats/index.htm

1 Vacant

2 Residential

3 Apartment

5b Industrial

5a Commercial

54

Standard on Ratio Studies, §§ 3.2.3.1, 8.2 (IAAO 2007).

55

See Appendix D for more data on assessment/sales ratios by triad.

16

After conducting an assessment/sales ratio study for Cook County, the Department then

calculates the weighted median ratio, which is the countywide ratio of assessed value to full

market value estimated using the median ratios weighted by class. Each weighted median ratio

is also adjusted for any major assessment changes made by the Assessor or the Board of Review

since the original data was collected. The county equalization factor uses the average (mean) of

the adjusted weighted medians of the three years immediately preceding the assessment year and

divides it into 33.33% in order to determine the factor needed to bring the countywide three-year

average ratio to 33.33%.

56

For example, the assessment year 2008 final equalization factor was

calculated by averaging the weighted median levels of assessment for 2005, 2006, and 2007,

each adjusted to account for subsequent assessment changes. The three-year average was then

divided into 33.33% to yield an equalization factor of 2.9786 for tax year 2008, as shown below.

2005 2006 2007

3-Year

Average

Countywide Weighted Median

Level of Assessment 11.92% 10.82% 10.82% 11.19%

Cook County 2008 Final Equalization Factor Calculation

Statutory Level (33.33%) ÷ Prior 3-Year Average Median Level (11.19%) = 2.9786

Source: Illinois Department of Revenue 2008 final Cook County equalization factor press release

http://www.revenue.state.il.us/AboutIdor/PressReleases/PR-08-24-2009.pdf

The state equalization factor for most counties is close to 1.0 because counties other than Cook

do not classify property and they conduct intra-county equalization prior to state equalization.

The equalization factor for Cook County is significantly greater than one and continues to rise as

aggregate assessment levels fall farther below 33.33%.

56

http://tax.illinois.gov/LocalGovernment/table1-2-3statistics.pdf

17

Before publishing a final equalization factor each year, the Department of Revenue calculates a

tentative equalization factor and holds a public hearing on the tentative factor.

57

This tentative

factor is computed before the Board of Review releases its final assessments for a given

assessment year. For assessment year 2008, the Department released a tentative equalization

factor of 2.9058 on July 14, 2009. The final factor of 2.9786 was published on August 24, 2009.

The difference between the tentative and final factors is due to assessment reductions made by

the Board of Review.

58

The following table shows the difference between the tentative and final

equalization factors from 1974 to 2008.

Tax Year Tentative Final Difference

1974 1.4453 1.4453 0.0000

1975 1.4271 1.4483 0.0212

1976 1.3824 1.4153 0.0329

1977 1.4028 1.4153 0.0125

1978 1.4807 1.4966 0.0159

1979 1.5917 1.6016 0.0099

1980 1.7296 1.7432 0.0136

1981 1.8364 1.8548 0.0184

1982 1.9288 1.9288 0.0000

1983 1.9122 1.9122 0.0000

1984 1.8445 1.8445 0.0000

1985 1.8085 1.8085 0.0000

1986 1.8293 1.8486 0.0193

1987 1.8809 1.8916 0.0107

1988 1.9266 1.9266 0.0000

1989 1.9133 1.9133 0.0000

1990 1.9946 1.9946 0.0000

1991 2.0348 2.0523 0.0175

1992 2.0897 2.0897 0.0000

1993 2.1407 2.1407 0.0000

1994 2.1135 2.1135 0.0000

1995 2.1243 2.1243 0.0000

1996 2.1517 2.1517 0.0000

1997 2.1489 2.1489 0.0000

1998 2.1799 2.1799 0.0000

1999 2.2505 2.2505 0.0000

2000 2.1813 2.2235 0.0422

2001 2.2612 2.3098 0.0486

2002 2.4364 2.4689 0.0325

2003 2.3858 2.4598 0.0740

2004 2.5023 2.5757 0.0734

2005 2.6771 2.732 0.0549

2006 2.6244 2.7076 0.0832

2007 2.7500 2.8439 0.0939

2008 2.9058 2.9786 0.0728

Cook County Tentative and Final Equalization Factors:

1974-2008

Source: Illinois Department of Revenue

57

35 ILCS 200/17-20

58

Illinois Department of Revenue 2008 final Cook County equalization factor press release,

http://www.revenue.state.il.us/AboutIdor/PressReleases/PR-08-24-2009.pdf

18

Once the Department of Revenue has certified the final Cook County equalization factor, the

Cook County Clerk applies the factor to the final assessed values determined by the Assessor and

modified by the Board of Review. The new value is called the equalized assessed value (EAV).

This value is the final taxable value of the property unless exemptions are applied, as discussed

in the next section. For example, a Cook County home with a tax year 2008 assessed value of

$32,000 would have an equalized assessed value of $95,315 ($32,000 x 2.9786 equalization

factor) before any exemptions were applied.

The equalization factor is not applied to farmland, coal production property, or wind energy

property.

59

Property Tax Exemptions

The Illinois Constitution specifically permits the General Assembly to grant homestead

exemptions and to completely exempt certain types of property from property taxation.

60

Homestead Exemptions

Illinois statute currently authorizes ten homestead exemptions available to different types of

homeowners. There is a general homestead exemption for all homeowners, as well as special

exemptions targeted at senior citizens, disabled persons, and veterans. Eight of the exemptions

exempt a portion of EAV from taxation, one exempts a portion of AV (Disabled Veterans’

Exemption), and one exempts a portion of cash (market) value (Homestead Improvements

Exemption). All homestead exemptions are designed to reduce the taxable value of

homeowners’ property.

Homestead exemptions are permitted only for a primary residence inhabited by the owner (not a

second home). Application for the exemptions must be made to the county assessor, with the

exception of the Disabled Veterans’ Exemption which is determined by the Illinois Department

of Veterans’ Affairs.

59

35 ILCS 200/10-135, 10-200, and 10-615.

60

Illinois Constitution 1970, Article IX, Section 6.

19

Four of the ten exemptions exempt a flat amount of EAV, and the General Homestead

Exemption effectively exempts a flat amount of EAV because virtually all applicants are eligible

for the maximum amount. The other five exemptions exempt varying amounts of EAV, AV, or

cash value. Four of the ten homestead exemptions were enacted in 2007 and all of the other

exemptions have been modified over the years. The table below lists the exemptions, some of

which are described in greater detail following the table.

61

Statute Name Eligibility Tax Year 2008 Amount

Year

Created

35 ILCS

20/15-165

Disabled Veterans'

Exemption

For disabled veteran homeowners and

their spouses

Property up to an assessed value of $70,000 is

exempted from taxation 1970

35 ILCS

200/15-167

Returning Veterans'

Homestead

Exemption

For veteran homeowners upon the year

of their return from an armed conflict $5,000 of EAV 2007

35 ILCS

200/15-168

Disabled Persons'

Homestead

Exemption

For disabled homeowners unable to

engage in substantial gainful activity by

reason of physical or mental impairment $2,000 of EAV 2007

35 ILCS

200/15-169

Disabled Veterans'

Standard Homestead

Exemption

For disabled veteran homeowners and

their spouses

$2,500 of EAV for 50% to 75% disability, $5,000 of

EAV for at least 75% disability 2007

35 ILCS

200/15-170

Senior Citizens

Homestead

Exemption For homeowners at least 65 years old $4,000 of EAV 1970

35 ILCS

200/15-172

Senior Citizens

Assessment Freeze

Homestead

Exemption

For homeowners at least 65 years old

and with household income under

$55,000 (in tax year 2008 and after),

freezes EAV at time of first application

Varies, equal to difference between current EAV

and base year EAV at time of first application 1994

35 ILCS

200/15-175

General Homestead

Exemption

For all homeowners outside Cook

County on their primary residence

Difference between 1977 EAV and current EAV up

to a maximum of $5,500 of EAV for tax year 2008,

and $6,000 of EAV for tax year 2009 and after 1978

35 ILCS

200/15-176

Alternative General

Homestead

Exemption

For all Cook County homeowners on

their primary residence

Varies, equal to difference between base year EAV

at time of first application and 7% per year growth

in EAV. Depends on assessment triad. 2008

maximum is $26,000 for North Triad, $33,000 of

EAV for South Triad, $20,000 for City Triad and

minimum $5,500 of EAV for all Triads. 2004

35 ILCS

200/15-177

Long-time Occupant

Homestead

Exemption

F

or

C

oo

k

C

oun

t

y

h

omeowners on

th

e

i

r

primary residence. Must have total

household income of $100,000 or less

and have lived in the home for 10

consecutive years, or 5 years if received

government assistance to acquire the

property

Varies, equal to difference between base year EAV

at time of first application and 7% per year growth

in EAV if income is $75,000 or less; 10% per year

EAV increase limit if income is from $75,001 to

$100,000. 2007

35 ILCS

200/15-180

Homestead

Improvements

For all homeowners on their primary

residence

Up to $75,000 fair cash value of improvements

made to homestead property for up to four years 1975

Homestead Exemptions in Illinois Statutes

Prior to the creation of the Alternative General Homestead Exemption (commonly called the

“7% cap”) in 2004, all homeowners across the state were eligible for the General Homestead

Exemption. Cook County had also used the statutory authority granted by 35 ILCS 250/1-99 to

create an additional exemption called the Homeowner Exemption for Long-term Properties

(HELP) in 2001.

62

The stated purpose of this exemption was “to stabilize the effects of soaring

61

See also Appendix E for a more detailed table of these exemptions.

62

Cook County Code of Ordinances Chapter 74 Article II Division 1 Sec. 74-36

20

property taxes for longtime homeowners who otherwise may be displaced from neighborhoods

where gentrification is occurring.”

63

The HELP exemption was for homeowners whose

household incomes did not exceed 115% of the area median, who had lived in their homes for 10

years (or five years if they received certain government assistance to acquire the property),

whose homes were valued at no more than $300,000 in market value and whose assessed value

increase exceeded 150% of the average increase in that assessment district. It provided an EAV

exemption that limited a homeowner’s EAV increase to the prior year EAV multiplied by 150%

of the average assessment increase, with no dollar amount maximum.

HELP first took effect in the City Triad in tax year 2000 and for the North and South triads in

their subsequent reassessment years (2001 and 2002, respectively). It was only in effect for three

years in each triad, however, because Public Act 93-715 amended 35 ILCS 250/20 to limit the

maximum HELP exemption to $20,000 of EAV. This change made the Alternative General

Homestead Exemption the operative homeowner exemption for HELP recipients. In 2002, the

only year when HELP was in effect for all three triads, 1.0% or 14,357 of the county’s 1.4

million Class 2 parcels received the exemption.

64

All counties were permitted by statute to adopt the Alternative General Homestead Exemption

but only Cook County chose to do so.

65

The Alternative General Homestead Exemption created

a range of EAV from $4,500 to $20,000 that could be exempted from taxation and was to expire

after three years. The exemption was implemented during the reassessment year of each triad,

such that it took effect for the City Triad in 2003, the North Triad in 2004, and the South Triad in

2005. It was created in reaction to a rapid increase in housing prices that occurred beginning in

2000 and was intended to prevent increases in taxable value greater than 7% each year, up to a

maximum exemption of $20,000 in EAV.

63

Cook County Code of Ordinances Chapter 74 Article II Division 1 Sec. 74-36(c).

64

Data provided by the Cook County Assessor’s Office, February 26, 2007.

65

The enabling ordinance adopted by the Cook County Board of Commissioners is called the Neighborhood

Preservation Homeowner Exemption, Cook County Code of Ordinances Chapter 74 Article II Division 1 Sec. 74-43.

21

A 2007 amendment to the Alternative General Homestead Exemption extended it for an

additional three years and increased the exemption maximums over the previous $20,000

maximum. As shown in the table below, the increase was introduced in the reassessment year of

each triad. The maximum exemption increased from $20,000 to $40,000 of EAV in the City

Triad for 2006 if the property’s 2006 EAV exceeded the 2002 EAV by 100% or more; the

maximum was $35,000 if the 2006 EAV exceeded the 2002 EAV by 80% or more, and was

$33,000 for all other eligible properties. The other triads had a maximum exemption of $33,000

in their reassessment year. The revised Alternative General Homestead Exemption was designed

to phase down the maximum exemption from $33,000 to $26,000 to $20,000 to $6,000 over four

years. It also increased the minimum exemption from $5,000 to $6,000 of EAV ($6,000 will be

both the minimum and maximum for the City in 2009).

Triad Min. Max.* Min. Max.** Min. Max.** Min. Max.** Min. Max.** Min. Max.**

City*

5,000$

40,000$

5,000$ 26,000$ 5,500$ 20,000$ 6,000$ 6,000$ 6,000$ 6,000$ 6,000$ 6,000$

North

5,000$ 20,000$ 5,000$

33,000$

5,500$ 26,000$ 6,000$ 20,000$ 6,000$ 6,000$ 6,000$ 6,000$

South

5,000$ 20,000$ 5,000$ 20,000$ 5,500$

33,000$

6,000$ 26,000$ 6,000$ 20,000$ 6,000$ 6,000$

*In the City 2006, the maximum exemption is $40,000 if the 2006 EAV exceeds the 2002 EAV by 100% or more; the maximum exemption is $35,000 if the 2006 EAV

exceeds the 2002 EAV by 80% or more; the maximum exemption for all other properties is $33,000.

**Beginning with the implementation of the Long-time Occupant Homestead Exemption in 2007, there is no maximum exemption for taxpayers who have owned the

home for ten years (or five if purchased with certain government assistance), and have a household income of $100,000 or less--the EAV of these homes may increase

no more than 10% per year. Likewise, there is no maximum exemption for taxpayers who have owned the home for ten years (or five if purchased with certain

government assistance), and have a household income of $75,000 or less--the EAV of these homes may increase no more than 7% per year.

Alternative General Homeowner Exemption Minimum and Maximum Amounts: Tax Years 2006-2011

2006 2007 2008 2009 2010 2011

The Long-time Occupant Homeowner Exemption was created at the same time as the extension

of the Alternative General Homestead Exemption. It effectively removes the dollar amount

maximum exemption of the Alternative General Homestead exemption for homeowners who

have lived in their homes for ten years (or five years if purchased with certain government

assistance) and have household income under specified levels. For household income of $75,000

or less, the EAV of the home may increase by no more than 7% each year with no dollar amount

maximum. For household income of $75,001 to $100,000 the EAV of the home may increase by

no more than 10% each year with no maximum.

22

The Cook County Assessor computes the value of homestead exemptions and conveys it to the

Cook County Clerk, who publishes it in an “Agency Exemption Detail Report” for each taxing

agency.

66

For tax year 2008 (the latest available data), the gross Cook County EAV before

exemptions was $215.9 billion and the value of homestead exemptions was $27.1 billion,

creating a net taxable EAV of $188.8 billion.

67

The general homeowner exemptions (Alternative

General Homestead Exemption and Long-time Occupant Homestead Exemption) represent the

vast majority of the value of exemptions, totaling $20.8 billion or 76.8% of total homestead

exemption value in 2008. The next largest exemption value is the Senior Citizens’ Assessment

Freeze Exemption, at $5.2 billion in EAV and 19.2% of total exemption value.

Exemption City of Chicago

Suburban Cook

County Total Cook County

% of Total

Cook

County

Homeowner Exemptions (Alternative

General and Long-time Occupant) $ 7,401,079,882 $ 13,422,348,427

$ 20,823,428,309 76.8%

Senior Citizens Assessment Freeze

Exemption $ 2,375,424,596 $ 2,823,920,420

$ 5,199,345,016 19.2%

Senior Citizens Homestead Exemption $ 398,715,932 $ 688,359,787

$ 1,087,075,719 4.0%

Disabled Persons' Homestead

Exemption $ 3,370,000 $ 7,380,356

$ 10,750,356 0.0%

Disabled Veterans' Exemption* $ 355,052 $ 2,163,661

$ 2,518,713 0.0%

Disabled Veterans' Standard

Homestead Exemption $ 940,889 $ 2,333,793

$ 3,274,682 0.0%

Returning Veterans' Exemption $ 120,000 $ 122,500

$ 242,500 0.0%

TOTAL $ 10,180,006,351 $ 16,946,628,944 $ 27,126,635,295 100.0%

Cook County Equalized Assessed Value of Homestead Exemptions, Tax Year 2008

*This exemption is determined by the Illinois Department of Veterans' Af fairs and certified to the county assessor. Application for all other

exemptions is made to the county assessor and the amounts are certified to the county clerk. The Homestead Improvements exemption is

done by the assessor prior to equalization and is not included here.

Source: Cook County Clerk Tax Year 2008 Agency Exemption Detail Report

66

See http://tax.cookctyclerk.com/ “Taxing Agency Reports”. Before tax year 2007 exemption amounts were

reported in “Equalized Valuations for Split Agencies” reports.

67

The net taxable EAV includes both EAV that is available for taxation by units of local government that levy

property taxes and EAV that is designated for Tax Increment Financing districts. TIF EAV is explained in the Civic

Federation’s Tax Increment Financing Issue Brief (http://www.civicfed.org/civic-federation/publications/tax-

increment-financing-tif-civic-federation-issue-brief) and in a forthcoming Civic Federation issue brief on the

property tax extension process.

23

The total value of homestead exemptions in Cook County has grown substantially in recent

years. The following graph shows that in 1999, homestead exemptions represented 5.0% of

gross EAV in Cook County. In other words, they removed 5.0% of total EAV from the net

taxable EAV. In 2008, homestead exemptions exempted 12.6% of gross EAV from taxation.

$-

$50

$100

$150

$200

$250

1999 2000 2001 2002 2003 2004 2005 2006 2007 2008

Billions of Equalized Assessed Value

Cook County Homestead Exemptions and Taxable EAV

Tax Years 1999-2008

Exemptions Taxab le EAV

Exemptions

= 5.0% of

gross EAV

Exemptions

= 12.6% of

gross EAV

Note: For data points detail see Appendix F

Source: Cook County Clerk Equalized Valuations for Split Agencies reports and Tax Increment Agency Distribution Summarys

This increase in the value of homestead exemptions is due primarily to dramatic growth in the

Senior Citizens Assessment Freeze Exemption and expansion of the General Homestead

Exemption through the introduction of the Alternative General Homestead Exemption.

The Senior Citizens Assessment Freeze Exemption “freezes” an eligible homeowner’s EAV at

the level of the year prior to a homeowner’s first application. In other words, it exempts all EAV

increases over the base amount. The household income eligibility limit was increased from

$35,000 to $40,000 for 1999-2003, from $40,000 to $45,000 for 2004-2005, to $50,000 for

2006-2007 and to $55,000 for tax year 2008. There is no exemption maximum or property value

maximum. Between 1999 and 2008 the Senior Citizens Assessment Freeze Homestead

Exemption value in Cook County increased by 979.6%, or $4.7 billion of EAV, from $481.6

million to $5.2 billion. The Senior Citizens’ Homestead Exemption has also existed for many

years but the total value of the exemption grew by only 69.2%, or $444.7 million from $642.4

million to $1.1 billion between 1999 and 2008. The flat dollar amount of the exemption was

increased from $2,500 to $3,000 for 2004-2005, to $3,500 for 2006-2007, and to $4,000 for tax

year 2008.

24

The “Homeowner Exemptions” category shown in the graph below includes the General

Homestead Exemption for 1998-2002, the Alternative General Homestead Exemption for 2003-

2007, the Homeowner Exemption for Long-term Properties for 2000-2004, the Long-time

Occupant Homestead Exemption for 2007-2008, and the Disabled Veterans' Exemption (1999-

2008).

68

The total value of these general homeowner exemptions in their various forms over the

years grew by $16.5 billion of EAV, or 386.5% between 1999 and 2008, from $4.3 billion to

$20.8 billion. Until tax year 2003, homeowner exemptions in Cook County consisted of the

General Homestead Exemption (a flat $4,500 of EAV) and the Homeowner Exemption for Long-

Term Properties, which did not have a maximum EAV amount but represented less than 0.1% of

total homeowner exemption value. In 2003, the Alternative General Homestead Exemption took

effect in Cook County, allowing a $4,500 minimum and $20,000 maximum homeowner

exemption.

69

The minimum was increased to $5,000 for 2004 and 2005. In 2006, the

Alternative General Homestead Exemption maximum was increased to $40,000 for the City

Triad (see page 20 for detail on this exemption). The Long-time Occupant Homestead

Exemption was added in 2007 with no maximum exemption (see page 21 for description).

$-

$5

$10

$15

$20

$25

1999 2000 2001 2002 2003 2004 2005 2006 2007 2008

Billions of Equalized Assessed Value

Cook County Homeowner and Senior Citizens Assessment Freeze Exemptions:

Tax Years 1999-2008

Homeowner Exemp tions Senior Citizens Assessment Freeze Exemption

Note: See Appendix E for data points detail

Source: Cook County Clerk Equalized Valuations for Split Agencies reports

68

The Disabled Veteran's Exemption is included because it could not be extracted from other homeowner exemption

data prior to 2007.

69

In state statute it is called the Alternative General Homestead Exemption (35 ILCS 200/15-176) but the

corresponding Cook County ordinance is called the Neighborhood Preservation Homeowner Exemption (Cook

County Code of Ordinances Chapter 74 Article II Division 1 Sec. 74-43).

25

By removing some EAV from taxation, exemptions make tax rates higher than they would be

otherwise. The composite tax rate for a typical Chicago property in tax year 2008 (payable in the

fall of 2009) was 4.816%, but if all the exempt EAV had been taxable that year the tax rate

would have been 4.265% or 11.4% lower.

70

Charitable, Religious, Educational & Governmental Exemptions

Article IX Section 6 of the Illinois Constitution authorizes the General Assembly to exempt from

taxation the following types of property: property of the State or local governments, property

used for agricultural and horticultural societies, and property used for school, religious,

cemetery, and charitable purposes.

State statutes currently exempt the following types and uses of property from taxation:

public schools and non-profit private schools and research institutions;

properties used for religious purposes, orphanages, or non-profit religious schools;

cemeteries;

United States federal government properties;

State of Illinois government properties;

local government properties including fire protection properties, public libraries, public

transportation systems, housing authorities, park and conservation districts, municipal

utilities, public water and drainage districts, and airport and port authorities;

properties used for charitable purposes, including non-profit hospitals, nursing homes and

health maintenance organizations;

historical, agricultural, and horticultural societies;

military schools and property of veterans’ organizations; and

parking areas related to any of the above uses.

71

Applications for charitable, religious, educational, and governmental exemptions are filed with

the Cook County Board of Review, which must provide the Assessor’s Office with a copy of the

application.

72

These exemptions may remove the entire value of a property from taxation, or

only a designated part of it, insofar as the property (or part) meets the statutory and constitutional

criteria. The Board of Review makes an initial determination about granting the exemption, but

its decision is not final.

73

Only the Illinois Department of Revenue can make a final

determination on granting or denying the exemption in the first instance, which determination is

then subject to review in the courts.

74

Owners of most types of exempt properties must submit

an annual affidavit stating whether or not there have been any changes to the ownership or use of

the property.

75

70

“Exempt EAV” here refers to homestead exemptions, not charitable, religious, and governmental property

exemptions described in the next section.

71

35 ILCS 200/15-35 to 15-60.

72

35 ILCS 200/15-5 et seq.

73

35 ILCS 200/16-130

74

35 ILCS 200/16-130. For detail on appealing these exemptions see the Civic Federation’s Cook County Property

Tax Appeals: A Primer with Comparative Data for 2000-2008, November 17, 2009, available at

http://civicfed.org/sites/default/files/091117_CookCountyAppealsReport.pdf

75

35 ILCS 200/15-10.

26

The number of exempt parcels in Cook County increased by 16.8% between tax years 1999 and

2008, from 79,260 to 92,548.

76

The total number of parcels for all classes in Cook County

increased 13.1% during the same time period, and exempt parcels remained steady at

approximately 5% of the total.

The value of exempt parcels is unknown because they are not assessed. There is one recent

example of an attempt to quantify the value of these property exemptions. At the request of the

Cook County Board of Commissioners, the Cook County Assessor estimated the full market

value of 54 tax-exempt hospitals in the county at $4.3 to $4.5 billion as of January 2006. This

represented approximately 0.72% to 0.75% of full market value countywide.

77

There is also a statute that permits but does not require taxing districts and owners of exempt

properties to enter into agreements whereby the owners make payments in lieu of taxes to

compensate the districts for the cost of services provided by the districts.

78

Other Property Tax Assistance Measures

State statutes make three additional property tax relief measures available to individuals: the

Senior Citizens Real Estate Tax Deferral, the Circuit Breaker, and the 5% income tax credit, all

described below.

The Senior Citizens Real Estate Tax Deferral Act first took effect in 1983 and allows persons

over 65 years of age or older with household incomes of $50,000 or less to defer payment of all

or part of their property taxes.

79

The State of Illinois will pay the property taxes owed by the

applicant and place a lien on the property equal to the deferred tax payment plus six percent

annual interest. The maximum amount of property tax that can be deferred is 80% of the

taxpayer’s equity in the property. The full amount must be repaid to the State within one year of

the applicant’s death or 90 days of the transfer of the property. Application is made to the Cook

County Treasurer.

The Senior Citizens and Disabled Persons Property Tax Relief and Pharmaceutical Assistance

Act—commonly known as the “Circuit Breaker”—provides property tax or rent assistance to

persons with disabilities and persons 65 years of age or older with a household income under

$22,218 for a single person ($36,740 for a household with three or more persons).

80

This

program is provided through grants by the State of Illinois Department of Aging. Grant amounts

range from $5 to $700 per a sliding scale based on income and tax or rent paid.

81

In FY2008 the

76

Cook County Assessor, Final Abstracts of Assessment 1999-2008. See Appendix A.

77

Cook County Assessor’s Office, “Exempt Hospitals: Valuation Estimates and Appraisal Methodology,”

November 6, 2007. Available at http://www.cookcountyassessor.com/LatestNews/LateNews.aspx?ID=171

78

35 ILCS 200/15-30

79

320 ILCS 30/1 et seq.

80

320 ILCS 25/1.

81

Illinois Department of Aging, “How to Estimate Your Circuit Breaker Property Tax Grant,”

http://www.cbrx.il.gov/aging/1rx/cbrx/estimate-tax.pdf

27

State appropriated $52.3 million for the Circuit Breaker Program (including pharmaceutical

assistance).

82

An individual income tax credit equal to 5% of residential property taxes paid was enacted

by the State of Illinois beginning with property tax year 1991 (payable during income tax year

1992).

83

The value of this income tax credit was $478.4 million in State fiscal year 2007, an

increase of 7.8% from $443.7 million the previous year.

84

The City of Chicago’s Homeowner Assistance Program provides 3% simple interest loans to

homeowners who need assistance paying their property taxes. Eligible properties are those

whose assessed value increased more than 1.25 times the median increase in the city’s most

recent reassessment, or any homeowner whom the Executive Director of the Chicago Tax

Assistance Center determines is in imminent danger of losing their home due to foreclosure or

tax sale. The homeowner may not have household income over 80% of the Chicago area median

family income and may not also be eligible for the Cook County Homeowner Exemption for

Long Term Properties. The loan is for the amount of tax increase attributable to the increase in

assessed value of the property. It can be no less than $500 and no more than $4,000.

85

As part of the City’s 2010 budget, the City Council approved a temporary Property Tax Relief

Program for qualified homeowners in the City of Chicago.

86

The program provides grants

between $25 and $200 depending on household income ($200,000 maximum) and the size of the

assessment increase for tax year 2008, payable fall of 2009.

82

State of Illinois FY2010 Budget, 7-2.

83

35 ILCS 5/208.

84

Illinois Comptroller, Illinois Fiscal Year 2007 Tax Expenditure Report, B-1. Available at

http://www.apps.ioc.state.il.us/ioc-pdf/TaxExpRptFY2007Web.pdf

.

85

City of Chicago Municipal Code 2-32-625.

86

See http://webapps.cityofchicago.org/PropertyTaxReliefWeb and

http://www.chicityclerk.com/journals/2009/Nov25th_2009/financeoptimize.pdf

. Last visited January 21, 2010.

28

Taxable Value