Tax and Duty Manual Vehicle Registration Tax Manual Section 1 - Part A

The information in this document is provided as a guide only

and is not professional advice, including legal advice. It should

not be assumed that the guidance is comprehensive or that it

provides a definitive answer in every case.

1

Vehicle Registration Tax

Manual Section 1A

Vehicle Classification and Tax Categories

Document last reviewed June 2024

Tax and Duty Manual Vehicle Registration Tax Manual Section 1 - Part A

2

Table of Contents

1 Executive Summary ...........................................................................................4

2 Legislation .........................................................................................................4

3 Classification of Vehicles ...................................................................................5

4 Vehicle Categories.............................................................................................6

4.1 Bodywork Codes and Body Types...................................................................7

4.2 VRT Categories, EU Categories and Tax..........................................................7

4.3 Non-standard Vehicles .................................................................................12

4.3.1 Buses..........................................................................................................12

4.3.2 Motor Caravans/Motor Homes .................................................................12

4.3.3 Hearses ......................................................................................................13

4.3.4 Quadricycles ..............................................................................................13

4.3.5 Ambulances ...............................................................................................13

4.3.6 Re-built Passenger Vehicles.......................................................................15

4.3.7 Kit Cars.......................................................................................................15

4.3.8 "Q" Registered Vehicles.............................................................................16

5 Basis of VRT Charge.........................................................................................17

5.1 VRT Categories A and B ................................................................................17

5.2 Other VRT Category Vehicles........................................................................17

6 Declaration and Payment of VAT for New and Used Vehicles ........................18

6.1 Payment of VAT............................................................................................18

6.2 VAT-registered persons ................................................................................18

6.3 Purchase Invoices .........................................................................................19

6.4 Value for VAT Purposes ................................................................................19

6.5 Vehicles not regarded as means of transport for VAT purposes..................19

6.6 Vehicles that are "not new" for VAT purposes.............................................19

6.7 Vehicles from outside the EU .......................................................................20

7 Type-Approval .................................................................................................21

7.1 Type-Approval and CO2................................................................................21

7.2 Nitrogen Oxide (NOx) Emissions...................................................................22

7.3 Certificate of Conformity..............................................................................22

7.4 Procedure at Registration.............................................................................22

7.4.1 Declaration by an Authorised Person ........................................................22

Tax and Duty Manual Vehicle Registration Tax Manual Section 1 - Part A

3

7.4.2 Declaration by a Private Individual/Dealer at the NCTS Centre ................22

7.4.3 "Export" Vehicles from the UK ..................................................................23

7.4.4 Exempt/End-of-Series Vehicles..................................................................23

8 EU Classification of Vehicles............................................................................25

9 Process for vehicles presented as N1 from 31 July 2018 ................................28

Tax and Duty Manual Vehicle Registration Tax Manual Section 1 - Part A

4

1 Executive Summary

As part of the process of registering and taxing vehicles Revenue classifies vehicles

into specific categories to ensure that the correct tax is collected. These categories

are generally mapped to the vehicle categories as outlined in European Union type

approval legislation. In this section customers can learn more about how vehicles

are categorised for VRT purposes.

2 Legislation

The legislative provisions that apply to this section are:

Part II, Chapter IV, Finance Act, 1992 (as amended)

Vehicle Registration and Taxation Regulations, 1992, (S.I. 318/1992)

Vehicle Registration and Taxation (No. 2) Regulations, 1992, (S.I. 437/1992)

Vehicle Registration and Taxation Regulations, 1993, (S.I. 252/1993)

Vehicle Registration and Taxation (Amendment) Regulations, 1999, (S.I.

432/1999)

Vehicle Registration and Taxation (Amendment) Regulation, 2010 (S.I. 400/2010)

Vehicle Registration and Taxation (Amendment) Regulations 2012 (S.I. 542/2012)

Vehicle Registration (Identification Marks) Regulations 2013 (S.I. 452/2013)

Vehicle Registration and Taxation (Amendment) Regulations 2016 (S.I. 402/2016)

Vehicle Registration and Taxation (Amendment) Regulations 2022 (S.I. 10/2022)

In addition, the Regulation on type-approval, Regulation (EU) 2018/858, is a key

piece of legislation that defines the EU Categories of vehicle that are used in

determining VRT Categories of vehicle.

Tax and Duty Manual Vehicle Registration Tax Manual Section 1 - Part A

5

3 Classification of Vehicles

From 1 January 2011, the classification of vehicles for VRT purposes reflects the

categories used for the EU classification of vehicles as set out in a number of EU

regulations and directives. In addition, certain vehicles (e.g. buses and ambulances)

that had been specifically defined in VRT legislation now use EU vehicle definitions.

Before classifying a vehicle, it is first of all necessary to determine whether it falls

within the definition of a motor vehicle for VRT purposes. A mechanically propelled

vehicle for VRT purposes is defined in section 130, Finance Act 1992, as amended:

“mechanically propelled vehicle' means a vehicle that-

(a) has been designed and constructed for road use,

(b) is, at the time of declaration for registration, in compliance with any

measures taken to give effect in the State to any act of the European

Communities relating to the approximation of the laws of Member States in

respect of type-approval for the type of vehicle concerned,

(c) is intended or adapted for propulsion by a mechanical means, or by an

electrical means or by a partly mechanical and a partly electrical means,

and

(d) is capable of achieving vehicle propulsion at the time of registration or

at the time of examination by a competent person under section

135D(1)(d), to the satisfaction of the Commissioners,

including a motor-cycle but not including a powered personal transporter, a

tramcar or other vehicle running on permanent rails or a vehicle including a cycle

with an attachment for propelling it by mechanical power not exceeding 400

kilograms in weight unladen adapted and used for invalids.”

Once a vehicle falls within the definition of a mechanically propelled vehicle, it must

be classified in its correct EU category and be allocated a unique Statistical Code.

This code identifies the characteristics attaching to the make and model of the

vehicle in question.

The classification of vehicles and the allocation of statistical codes are the

responsibility of the National VRT Service (NVRTS) in Wexford.

Tax and Duty Manual Vehicle Registration Tax Manual Section 1 - Part A

6

4 Vehicle Categories

The classification of vehicles for VRT purposes reflects the categories used for the EU

classification of vehicles as set out in a number of EU directives and regulations,

particularly those relating to the type-approval of passenger vehicles (Regulation

(EU) 2018/858), two and three wheeled motor vehicles (Regulation 168/2013), and

agricultural or forestry tractors (Regulation 167/2013).

When a new or used vehicle is being registered in the State it must have an EU

Category (e.g. M1, N1). For new vehicles, this EU Category is normally found on the

Certificate of Conformity and in the case of used vehicles it is normally found on the

registration documentation issued by the previous Registration Authority. If, for

whatever reason, the EU Category cannot be confirmed to the satisfaction of the

Revenue Commissioners at the time of registration, for VRT purposes the vehicle is

deemed to be an EU Category M1, i.e. a passenger vehicle (Section 132(3)(g),

Finance Act, 1992).

From a VRT point of view, the EU Category is normally equivalent to the VRT

Category. So, for example, EU Category M1 is normally equivalent to VRT Category A

(passenger vehicles). The following table maps EU Categories against VRT

Categories:

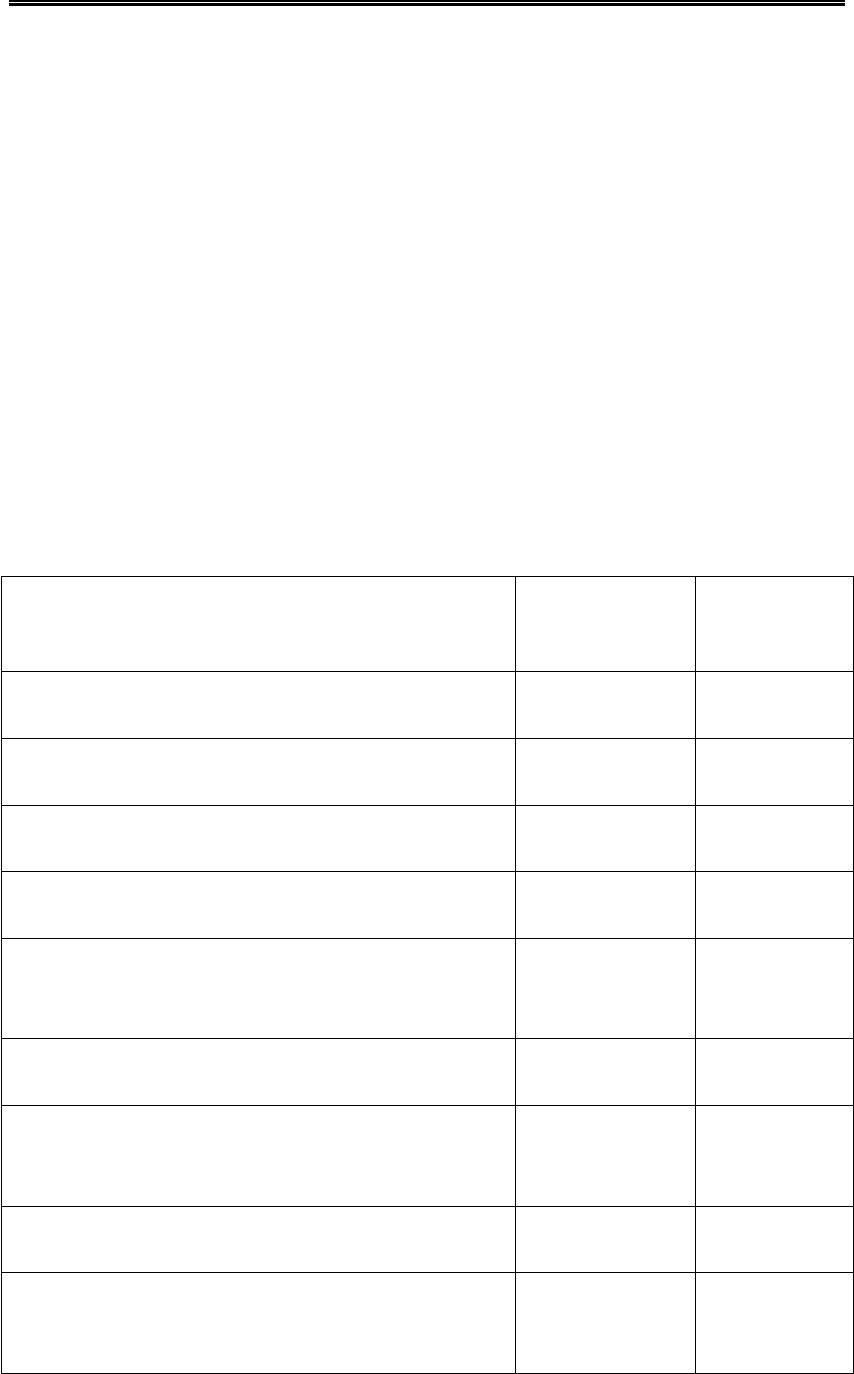

EU Category

VRT Category

M1 - passenger vehicles comprising not

more than 8 seating positions in addition

to the driver’s seating position and with

no space for standing passengers

Category A – generally passenger cars

M2 - passenger vehicles comprising more

than 8 seating positions in addition to the

driver’s seating position, may have space

for standing passengers and not

exceeding 5 tonnes

Category C – i.e. a mini bus

M3 - passenger vehicles comprising more

than 8 seating positions in addition to the

driver’s seating position, may have space

for standing passengers and exceeding 5

tonnes

Category C – i.e. a large bus

Motor Caravans can be Category M1, M2

or M3

Category B

N1 - commercial vehicles, designed and

constructed for the carriage of goods and

not exceeding 3.5 tonnes

Category A, Category B or

Vehicles that at all stages of manufacture

are classified as category N1 vehicles

Tax and Duty Manual Vehicle Registration Tax Manual Section 1 - Part A

7

with less than 4 seats, and have, at any

stage of manufacture, a technically

permissible maximum laden mass that is

greater than 130 per cent of the mass in

service of the vehicle with bodywork in

running order are charged at the rate of

€200.

N2 - commercial vehicles designed for

the carriage of goods having a maximum

mass exceeding 3.5 tonnes but not

exceeding 12 tonnes

Category C

N3 - commercial vehicles designed for

the carriage of goods having a maximum

mass exceeding 12 tonnes

Category C

L1 to L7 - motor cycles and certain three-

wheel vehicles

Category M (motor-cycle*)

T1 to T5 - agricultural tractors/vehicles

Category C

*Motor-cycles are commonly referred to as “Category M” because of their IT

designation – the phrase used in the legislation is “motor-cycle”.

4.1 Bodywork Codes and Body Types

Each EU Category has an associated 2-character EU bodywork code that designates

the vehicle’s type of body (e.g. Category M1 AA = saloon, Category N1 BE = pick-up

truck).

However, EU bodywork codes are very general and limited in number. In order to

provide continuity between the more extensive Revenue body types system and the

EU bodywork codes, the Revenue body types are mapped to the EU bodywork codes.

This means, for example, that EU bodywork code AC (station wagon) is further

divided into Revenue body types “station wagon” (Revenue body type 2), “liftback”

(78), “military vehicle” (84) and so on.

This information is used for a range of other purposes including statistics, motor

taxation purposes and insurance. Please refer to section 8 EU Classification of

Vehicles for a list of EU Categories and bodywork codes.

4.2 VRT Categories, EU Categories and Tax

The following paragraphs provide more detail of the VRT Categories, the EU

Categories and the tax applicable in each case.

VRT Category A (EU Category M1 and certain EU Category N1*)

Passenger vehicles (e.g. saloon, estate, hatchback, convertible, coupé, MPV, jeep

etc.), designed and constructed for the carriage of passengers and comprising of a

Tax and Duty Manual Vehicle Registration Tax Manual Section 1 - Part A

8

maximum of 9 seats including the driver’s seat are classified as EU Category M1. M1

vehicles are classified as Category A for VRT purposes. The rate of VRT applicable is

determined by the level of CO

2

emissions of the vehicle at the time of manufacture,

and the rates are applied to the Open Market Selling Price (OMSP) to calculate the

VRT. The table below sets out the rates of VRT at the time of manufacture.

*EU Category N1:

Also included in the Category A rate, from 31 July 2018, are those N1 vehicles that

have 4 or more seats and in which the passenger and cargo/functional

compartments are contained in a single unit. A single unit is considered as:

An area of a vehicle that is covered by a generally continuous roof or that has a

generally continuous floor.

These vehicles will be charged the CO

2

element of VRT in the same manner as M1

vehicles i.e. the charge will be levied by reference to their CO

2

emissions in

accordance with table below. Therefore, it is essential that the CO

2

of the vehicle is

available when presenting the vehicle for registration to ensure the correct charge to

tax.

CO

2

Emissions (CO

2

g/km)

VRT Rates

Minimum

VRT

0g/km up to and including 50g/km

7% of OMSP

€140

More than 50g/km up to and including 80g/km

9% of OMSP

€180

More than 80g/km up to and including 85g/km

9.75% of OMSP

€195

More than 85g/km up to and including 90g/km

10.5% of OMSP

€210

More than 90g/km up to and including 95g/km

11.25% of

OMSP

€225

More than 95g/km up to and including 100g/km

12% of OMSP

€240

More than 100g/km up to and including 105g/km

12.75% of

OMSP

€255

More than 105g/km up to and including 110g/km

13.5% of OMSP

€270

More than 110g/km up to and including 115g/km

15.25% of

OMSP

€305

Tax and Duty Manual Vehicle Registration Tax Manual Section 1 - Part A

9

More than 115g/km up to and including 120g/km

16% of OMSP

€320

More than 120g/km up to and including 125g/km

16.75% of

OMSP

€335

More than 125g/km up to and including 130g/km

17.5% of OMSP

€350

More than 130g/km up to and including 135g/km

19.25% of

OMSP

€385

More than 135g/km up to and including 140g/km

20% of OMSP

€400

More than 140g/km up to and including 145g/km

21.5% of OMSP

€430

More than 145g/km up to and including 150g/km

25% of OMSP

€500

More than 150g/km up to and including 155g/km

27.5% of OMSP

€550

More than 155g/km up to and including 170g/km

30% of OMSP

€600

More than 170g/km up to and including 190g/km

35% of OMSP

€700

More than 190g/km

41% of OMSP

€820

Furthermore, as these vehicles are Category A, they will also be liable to the

Nitrogen Oxide (NOx) charge, as outlined below.

VRT Category A – Diesel Propelled Vehicles

From 1 January 2019 an increase of 1% applied to all vehicles, subject to the

Category A rate, which were propelled by diesel fuel. This surcharge was removed

by the Finance Bill 2019 and ceased effect from 31 December 2019.

VRT Category A – Nitrogen Oxide Emissions

A Nitrogen Oxide emissions charge is applied to all Category A vehicles registered on

or after 1 January 2020. The NOx emissions charge forms a component part of the

VRT payable as illustrated below:

Carbon Dioxide Rate + NOx charge = VRT Payable

The NOx charge is calculated on a milligram per kilometre basis with the charge per

mg/km increasing as the emissions increase. The table below displays the

applicable rates:

Tax and Duty Manual Vehicle Registration Tax Manual Section 1 - Part A

10

NO

x

emissions (NO

x

mg/km or

mg/kWh)

Amount payable per mg/km or

mg/kWh

The first 0-40 mg/km or mg/kWh,

as the case may be

€5

The next 40 mg/km or mg/kWh,

or part thereof, as the case may

be, up to 80 mg/km or mg/kWh,

as the case may be

€15

The remainder above 80 mg/km

or mg/kWh, as the case may be

€25

NOx charges are subject to a maximum of €600 for petrol vehicles and €4,850 for all

other fuel types.

The charge as outlined above applies cumulatively to the NOx emissions: for

example a diesel vehicle with 120mg/km emissions would be charged as follows:

40mg/km x €5 = 200

40 mg/km x €15 = 600

40 mg/km x €25 = 1000

€1800 NOx charge payable

As a component part of VRT NOx is charged on all vehicles classed as Category A.

This includes conventional hybrids and plug-in hybrid’s but excludes electrics.

VRT Category B (EU Category N1)

Vehicles classified as EU Category N1 (light commercial vehicle) are generally VRT

Category B vehicles and liable to VRT at 13.3% based on the OMSP with a minimum

charge of €125.00.

These vehicles are distinct to those referenced above in that they a) have 3 seats or

less or b) have more than 3 seats but have the passenger and cargo/functional

compartments in completely separate units. Examples of vehicles which would fall

into this category are: pick-ups, tippers, recovery vehicles and similarly designed

vehicles.

It should be noted that partitioning a single unit, so that the seating and

cargo/functional areas are in separate compartments, will not satisfy Revenue that

the seating and cargo/functional areas are fully distinct. Such vehicles will not be in

a position to avail of the Category B rate.

Tax and Duty Manual Vehicle Registration Tax Manual Section 1 - Part A

11

However, certain vehicles, that at all stages of manufacture are classified as EU

Category N1 vehicles with less than 4 seats, and have, at any stage of manufacture, a

technically permissible maximum laden mass weight that is greater than 130% of the

mass in service of the vehicles with bodywork in good running order, and are

designed and constructed for the carriage of goods with a maximum mass not

exceeding 3.5 tonnes, are charged VRT of €200, subject to the correct

documentation accompanying the vehicle e.g. Certificate of Conformity/NSSTA/IVA.

VRT Category C (EU Categories M2, M3, N2, N3, T1 to T5)

A VRT Category C vehicle is a bus with a minimum of 10 seats including the driver’s

seat, a commercial vehicle over 3.5 tonnes, an agricultural tractor or a listed vehicle.

Please refer to section 8 EU Classification of Vehicles for more detail. Vehicles

classified as EU Categories M2, M3, N2, N3, T1 to T5 are charged VRT at €200.

VRT Category D (EU Categories M and N)

A VRT Category D vehicle is a special purpose vehicle such as an ambulance, a fire

engine or a vehicle used in the transportation of road construction machinery. VRT

Category D vehicles are not associated with a specific EU Category and are charged

at the rate of nil per cent of the value of the vehicle.

VRT Category motor-cycle (EU Category L)

An EU Category L vehicle is a motor-cycle, a moped, a tricycle or certain all-terrain

vehicles. Please refer to section 8 EU Classification of Vehicles for further

description. Motor-cycles are charged by reference to the cubic capacity (cc) of the

engine as shown in the following table:

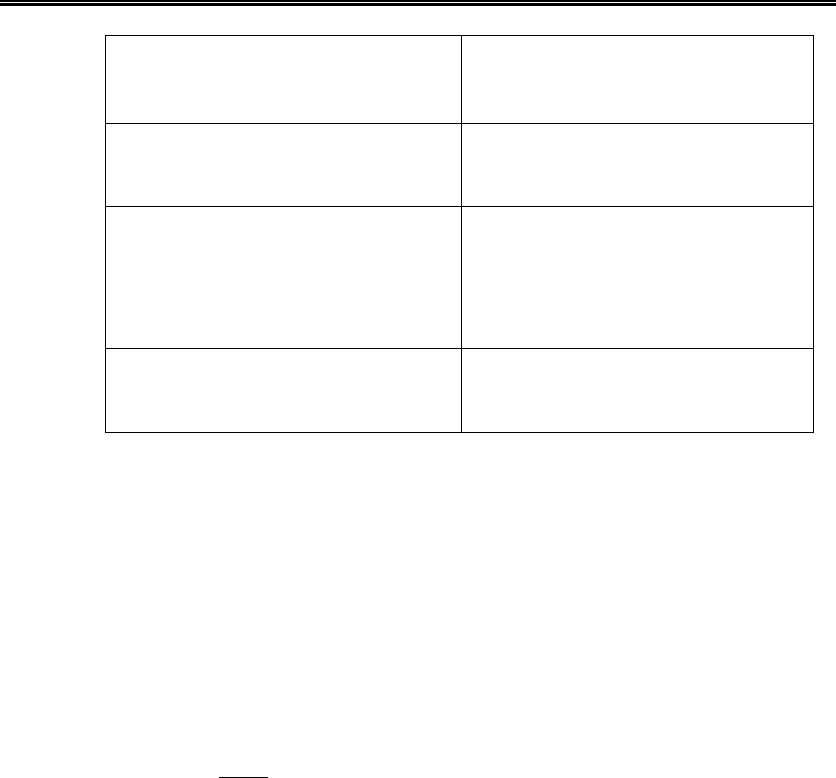

Engine capacity

Rate of VRT

Up to 350 cc

€2 per cc

350 cc and above

€2 per cc up to 350 cc + €1 per cc

thereafter

In the case of used motor-cycles, the VRT payable is depreciated in accordance with

the following table (a motor-cycle declared as used must be accompanied by

evidence of previous registration abroad, e.g. registration certificate/log-book etc.):

Age of Motor-Cycle

Rate of VRT

Over 3 months but not more than 1 year

10%

Tax and Duty Manual Vehicle Registration Tax Manual Section 1 - Part A

12

Over 1 year but not more than 2 years

20%

Over 2 years but not more than 3 years

40%

Over 3 years but not more than 4 years

50%

Over 4 years but not more than 5 years

60%

Over 5 years but not more than 7 years

70%

Over 7 years but not more than 10 years

80%

Over 10 years but not more than 30

years

90%

Over 30 years

100%

There is no VRT payable on an electric motorcycle.

4.3 Non-standard Vehicles

4.3.1 Buses

EU Category M2 vehicles designed and constructed for the carriage of passengers

with more than eight seating positions in addition to the driver's seating position and

having a maximum mass not exceeding 5 tonnes, i.e. a mini bus.

EU Category M3 vehicles designed and constructed for the carriage of passengers

with more than eight seating positions in addition to the driver's seating position and

having a maximum mass exceeding 5 tonnes, i.e. a large bus.

4.3.2 Motor Caravans/Motor Homes

A motor caravan is a vehicle with an EU Category of M and an EU bodywork code of

“SA” (Regulation (EU) 2018/858) and is constructed to include living accommodation

which contains at least the following equipment:

seats and table,

sleeping accommodation which may be converted from the seats,

cooking facilities, and

storage facilities.

The equipment must be rigidly fixed to the living compartment; however, the table

may be designed to be easily removable.

Motor Caravans or Motor Homes are charged VRT at 13.3% (VRT Category B) of the

open market selling price of the vehicle at the time of registration.

Tax and Duty Manual Vehicle Registration Tax Manual Section 1 - Part A

13

4.3.3 Hearses

A hearse is a "listed vehicle" as defined in Section 130, Finance Act, 1992, as

amended, is classified as an EU Category M vehicle and is chargeable at the Category

C rate for VRT purposes. Hearses, “intended for the transport of deceased persons

and having special equipment for such purpose” (Regulation (EU) 2018/858) are

usually derived from EU Category M1 vehicles and may retain features characteristic

of that category.

As a result, in some instances, classification may not be straightforward. This is

particularly so in the case of “first-call hearses” (vehicles used for informal transport

of coffins/remains) that may only have minimal modifications when compared with

the original vehicle.

In order for a vehicle to be classified as a hearse, the EU bodywork code must be

“SD” on the vehicle’s most recent type approval documentation.

Where type approval documentation is not available, consideration should be given

to the following:

1. Does the vehicle have the appearance of a hearse?

2. Does the vehicle have a coffin deck?

3. Is the coffin deck permanently fitted in the vehicle?

4. Does the coffin deck have rollers and stays fitted?

5. Number of permanent seats in the vehicle?

6. Is the registered owner in the undertaking business?

4.3.4 Quadricycles

Quadricycles or quads are used for both work (primarily agricultural) and leisure

purposes.

EU Category L6e is a light quadricycle and EU Category L7e is a heavy quadricycle.

New L6e and L7e vehicles should only be registered if they have a Certificate of

Conformity. It should be noted that quadricycles other than L6e and L7e vehicles

should not be registered.

4.3.5 Ambulances

Ambulance (EU bodywork "SC"): is defined in Regulation (EU) 2018/858, as follows:

“A vehicle of category M intended for the transport of sick or injured persons and

having special equipment for such purpose.” and “The patient compartment of

ambulances shall comply with the requirements of EN 1789:2020 on Medical

vehicles and their equipment – Road ambulances with the exception of Section 6.5,

list of equipment. Proof of compliance shall be provided with a test report of the

technical service and may be based on an assessment carried out by

subcontractors or subsidiaries of the technical service in accordance with the

provisions of Article 71. If a wheelchair space is foreseen, the requirements for

wheelchair accessible vehicles (code SH) relating to the wheelchair tiedown and

occupant restraint systems shall also apply.”

Tax and Duty Manual Vehicle Registration Tax Manual Section 1 - Part A

14

EN 1789:2020 is the European Standard for ambulances. This specifies the design,

testing, performance and equipping of road ambulances. This standard is applicable

to vehicles capable of transporting at least one person on a stretcher.

There are four types of Road Ambulances as follows:

Type A: Patient Transport Ambulance: Road Ambulance designed and

equipped for the transport of patients who are not expected to become

emergency patients. Type A is sub-divided into:

o Type A1: suitable for the transport of single patient

o Type A2: suitable for the transport of one or more patient(s) (on

stretcher(s) and/or seat(s)).

Type B: Emergency Ambulance: Road Ambulance designed and equipped for

the transport, basic treatment and monitoring of patients.

Type C: Mobile Intensive Care Unit: Road Ambulance designed and equipped

for the transport, advanced treatment and monitoring of patients.

Some of the requirements to obtain Ambulance classification are as follows:

EU bodywork of “SC” on the Certificate of Conformity, Individual Vehicle

Approval or NSAI Approved Test Centre (ATC) certification. The ATC

Certification should also include a separate statement that the vehicle meets

the requirements of EN 1789:2020.

Permanent Bulkhead/Partition Wall separating the driver’s compartment

from the passenger compartment, with 1/2 windows. Door may be fitted,

but where it is, it must not be possible to drive the vehicle with the door in

the open position.

The minimum number of 12V connections in passenger compartment is in

the following table:

Type of road ambulance

A1

A2

B

C

Minimum number

of connections

1

1

1

1

3

1

3

1

Minimum capacity

in Ampere

10

15

10

15

10

15

10

15

Communication equipment (e.g. radio installation) shall comply with national

and/or European regulations.

Exterior Body Colour - White or Yellow. If white is the base colour, additional

florescent yellow or red should be used on external surface of the vehicle.

Tax and Duty Manual Vehicle Registration Tax Manual Section 1 - Part A

15

Ceiling, side walls and doors of patient’s compartment must be lined in a

non-permeable material, resistant to continuous cleaning.

Floor coverings must provide adequate grip and be durable and easy to clean.

Visual and Audible Warning System.

These are only some of the requirements for a vehicle to be classified as an

ambulance at the time of registration in the State or upon declaration of a post-

registration conversion. There are many other criteria set down in EN 1789:2020.

Revenue must be satisfied that the criteria have been fulfilled even if the vehicle has

been previously registered as an ambulance in another State. Revenue reserves the

right to refuse registration as an ambulance if it is considered that the vehicle

presented does not meet the required criteria (for example, it is unlikely that an

estate car or MPV will have the potential to qualify as an ambulance).

Further queries about the exact requirements and dimensions required for a vehicle

to be classified as an ambulance should be directed to the National Standards

Association of Ireland (NSAI) regarding: Irish Standard I.S. EN 1789:2020: medical

vehicles and their equipment - Road Ambulances.

The following types of non-standard vehicles are not manufactured or built in the

conventional manner, i.e. they are not mass-produced using all new parts or

assembled on large-scale production lines. Consequently, they are not covered by

the “normal” procedures for classification. The following paragraphs provide

guidelines on the treatment of these vehicles for VRT purposes.

4.3.6 Re-built Passenger Vehicles

A re-built passenger vehicle, which is interpreted as being an unregistered vehicle

under Section 130, Finance Act, 1992, as amended, requires an Individual Type-

Approval (IVA) from the National Standards Authority of Ireland (NSAI).

Where Revenue determines that the chassis has been obtained from a registered

vehicle and the rebuild does not amount to a conversion (as defined in Section 130,

Finance Act, 1992, as amended) registration is not required.

The owner should be directed to notify the Department of Transport in Shannon of

the changes in the registered particulars. Where Revenue determines that a

conversion has been affected, the owner should be directed to make a declaration of

conversion, supported by a certificate from a Suitably Qualified Individual.

It is the owner’s responsibility to notify the Department of Transport in Shannon of

the scrapping of a vehicle, i.e. of the irrevocable destruction of the chassis,

monocoque, or assembly serving an equivalent purpose.

4.3.7 Kit Cars

A kit-car vehicle, which is interpreted as being an unregistered vehicle under Section

130, Finance Act, 1992, as amended, requires an Individual Type-Approval (IVA) from

the National Standards Authority of Ireland (NSAI).

Tax and Duty Manual Vehicle Registration Tax Manual Section 1 - Part A

16

A kit-car, which is usually an EU Category M1, is constructed from an amalgam of

parts, some of which are supplied unassembled in kit form. In general, the kit will

include a variety of body panels and may include a new chassis that must be

assembled. The mechanics (e.g. engine, motors, etc.) and trim are usually obtained

from another vehicle to enable the process to be completed. In most cases the

donor vehicle will be a vehicle already registered in the State, but no allowance is

made or granted in this respect when VRT payable on the completed kit car is being

calculated.

In the case of kit trikes, usually EU Category L (motor-cycles), the practice has been

to consider the age of the major components to decide the age reduction for the

purpose of VRT. However, it should be noted that trikes, as with kit cars built using a

new chassis, will be assigned a registration mark reflecting the year of entry into use

of the completed project.

It should also be noted that where a private individual acquires a newly-assembled

kit car abroad, the normal VAT rules should be applied, i.e. VAT is payable if the

vehicle is less than 6 months old or has travelled less than 6,000 km. Kit cars

assembled in the State are not liable for VAT where the sale/purchase invoice

indicates that it has been paid at the time of purchase of the kit.

4.3.8 "Q" Registered Vehicles

These vehicles are so-called because the first letter of the assigned UK registration

number is the letter "Q". These registration numbers are issued by the UK

registration authorities where the age or origin of a vehicle, for whatever reason,

cannot be determined. These vehicles require special treatment when they are

presented for registration in the State. This treatment includes the assignment of an

appropriate statistical code, the assessment of an OMSP, where applicable, and the

assignment of a unique index mark which indicates the year in which the vehicle was

first brought into use.

The NCTS Centre will forward all the details relating to the vehicle to the NVRTS

where a statistical code and OMSP will be assigned for the vehicle. Once a statistical

code has been assigned by the NVRTS, an OMSP determined and a VIN assigned

(where necessary), registration can proceed in the normal way.

Tax and Duty Manual Vehicle Registration Tax Manual Section 1 - Part A

17

5 Basis of VRT Charge

5.1 VRT Categories A and B

In the case of VRT Categories A and B vehicles, supplied by authorised distributors,

VRT is charged on an ad valorem basis as a percentage of the Open Market Selling

Price. The OMSP is the price, inclusive of all taxes and duties, which, in the opinion

of the distributor, a new vehicle of the model and specification, including

factory/distributor-fitted enhancements and accessories, would fetch on a first arm's

length, retail sale in the open market in the State (Section 133(2)(a), Finance Act,

1992, as amended).

Where a new vehicle (for VRT purposes, this means a vehicle which has not

previously been registered or recorded on a permanent basis in another state, and

has been acquired under general conditions of taxation in force in the domestic

market) is supplied by a manufacturer or distributor, a declaration of OMSP must be

made by the manufacturer or distributor to the NVRTS at least 21 days prior to the

release of the vehicle from the distributor's premises (Regulation 13, S.I. No. 318 of

1992).

This declaration is subject to verification by the NVRTS against the average price

being achieved in the marketplace. It is important to note that where the declared

OMSP does not reflect the market price, it may be determined by the Commissioners

(Section 133(2)(c), Finance Act, 1992, as amended).

5.2 Other VRT Category Vehicles

VRT Category C vehicles: a flat rate of €200.

VRT Category D vehicles: charged at a Nil rate.

VRT Category motor-cycles: €2 per cc up to 350cc and €1 per cc thereafter.

Tax and Duty Manual Vehicle Registration Tax Manual Section 1 - Part A

18

6 Declaration and Payment of VAT for New and Used Vehicles

VAT as assessed by Revenue will be collected at NCTS centres, on registration of

vehicles (where applicable) on Revenue’s behalf.

VAT will be charged on the purchase price declared on the invoice for the vehicle.

For VAT purposes a “new means of transport” is a goods or passenger vehicle that

meets either one of the two following criteria:

It is a new means of transport if it is a motor vehicle or motor-cycle supplied

six months or less after the date of its first entry into service;

It is a new means of transport if it is a motor vehicle or motor-cycle that has

travelled 6,000 kilometres or less at the time the vehicle is first presented for

registration.

If the vehicle meets either of these criteria the vehicle is treated as a new means of

transport for VAT purposes, and VAT is chargeable at registration. In this context

"entry into service" means registration in another jurisdiction. If not previously

registered the vehicle is new.

Example

Vehicle 5 months old with 8,000km - chargeable to VAT

Vehicle 7 months old with 5,000km - chargeable to VAT

Vehicle 7 months old with 8,000km - not chargeable to VAT

The date of a vehicle's first entry into service, i.e. the registration date, determines

the age of the vehicle for VAT purposes. The mileage is the odometer mileage when

first presented for registration in the State.

6.1 Payment of VAT

VAT must be charged and paid, with the VRT, at the time of registration of a new

means of transport, acquired in another EU Member State, where the declared

owner is a person who is not registered for VAT, or is a VAT-registered person who is

not entitled to claim a VAT input credit in respect of the acquisition. This is the case

even where there is evidence, e.g. an invoice, showing that VAT was previously paid

in the MS of acquisition.

6.2 VAT-registered persons

VAT-registered persons who are entitled to claim a VAT input credit in respect of the

acquisition of the vehicle concerned are not required to pay VAT at the time of

registration. In such cases, it will be enough for the declared owner to quote their

VAT registration number on the VRT declaration form at registration. This applies

where:

Tax and Duty Manual Vehicle Registration Tax Manual Section 1 - Part A

19

The vehicle is being acquired as stock-in-trade for resale in the course of

business,

The vehicle is being acquired for use as part of a driving or car-hire business,

or

The vehicle is an EU Category M2, M3, N1, N2, N3, (VRT Categories B or C)

vehicle that is for general use in a business, e.g. for haulage or transport

purposes etc.

In such cases, VAT due in respect of the vehicles will be accounted for through the

declared owner's VAT returns. In cases where a vehicle declared as a deductible EU

Category M2, M3, N1, N2, N3, (VRT Categories A, B or C) is subsequently converted

to non-deductible EU Category M1 (VRT Category A) vehicle, the declared owner will

also be required to account for VAT on self-supply of the EU Category M1 (VRT

Category A) vehicle.

6.3 Purchase Invoices

It should be noted that in calculating the length of time since first registration in

another MS, the critical date is the date on which the vehicle was supplied in the

other MS, i.e. the date of the purchase invoice.

Delaying registration in the State until six months or more after entry into service

does not remove the liability to VAT. It is the date of supply and not the date of

declaration that determines liability to VAT and, where possible, customers should

be advised accordingly.

6.4 Value for VAT Purposes

The value for calculating the VAT payable is the amount invoiced in the MS of

acquisition (converted to Euro where applicable). VAT charged in another MS and

shown as such on the invoice is not to be included in the taxable amount for Irish

VAT purposes. In the absence of an invoice or other sales documentation, the OMSP

for VRT purposes may be used as a basis for the calculation of the VAT due. The

value for VAT purposes would be the OMSP less the VRT and VAT included.

6.5 Vehicles not regarded as means of transport for VAT purposes

In the context of registration, these vehicles include all-terrain vehicles (ATVs) and

mobile machinery etc. However, there may be some inconsistency as regards the

treatment of these vehicles for VAT purposes in other Member States. As a general

rule, VAT should be charged and collected where the declarant cannot show that

VAT has already been paid in the Member State of purchase.

6.6 Vehicles that are "not new" for VAT purposes

A vehicle that, for VAT purposes, is a used (not new) vehicle acquired in another MS,

is not subject to the payment of VAT at the time of registration under any

circumstances, even where it has been removed from an exemption regime, e.g.

diplomatic exemption, in another MS.

Tax and Duty Manual Vehicle Registration Tax Manual Section 1 - Part A

20

6.7 Vehicles from outside the EU

In the case of a new or used motor vehicle imported from outside the EU, VAT must

be paid at the time of entry into free circulation and before release from Customs

control. Where such a vehicle is subsequently presented for registration by a private

(non-authorised) individual, proof of payment of VAT and Customs Duty must be

shown before the vehicle is registered.

Tax and Duty Manual Vehicle Registration Tax Manual Section 1 - Part A

21

7 Type-Approval

EU regulations require that vehicles intended for the carriage of passengers or goods

must comply with certain mandatory technical requirements before they are

allowed on the roads. Vehicles must, therefore, be subjected to a series of

standardised tests to ensure they reach the required standards. The legislation for

type-approval is Regulation (EU) 2018/858.

7.1 Type-Approval and CO2

Among the tests required is one to measure the CO

2

emissions from a vehicle. While

it is not necessary to subject each individual vehicle to the test, the directives and

regulations are quite specific regarding the method of carrying out the tests and the

actual models to which the results can be applied. For example, a test may cover a

particular model that has a number of variants and/or versions. In this case a single

CO

2

figure can be provided for that model provided that the figure given is based on

the variant and/or version with the highest official CO

2

emissions within the range.

This prevents a manufacturer submitting the most fuel-efficient vehicle to the test

and then including less efficient variants, e.g. those with automatic transmission, as

the official CO

2

emissions for the range. Following the test, the official emissions of

CO

2

are quoted to the nearest whole number in grams per kilometre (g/km).

Prior to the 2018 Finance Act, CO

2

emissions for passenger and light duty vehicles

were measured in accordance with the New European Drive Cycle (NEDC).

However, NEDC was replaced on a phased basis by the World Harmonised Light

Vehicle Testing Procedure (WLTP). From 1 September 2018, it became mandatory

for all new vehicles to be tested under WLTP. To aid the transition from NEDC to

WLTP, the Commission introduced a conversion tool known as C0

2

MPAS, which can

derive an NEDC figure from a WLTP figure.

This changed the way in which vehicle CO

2

emissions were calculated and therefore

affected all Member States who apply vehicle taxes based on CO

2

emissions. As

such, the definition of CO

2

emissions in the legislation has been revised to distinguish

between the various types of CO

2

emissions: NEDC, WLTP, and CO

2

MPAS-derived

NEDC.

From 1 January 2021, VRT on Category A vehicles is mainly calculated using the CO

2

emissions produced under the WLTP measuring system. This replaces the NEDC

measuring system. It will still be possible to register cars measured under the NEDC

system by applying a conversion factor prior to registration.

A new structure of rates and bands was introduced for VRT in January 2021, with the

full implementation of WLTP. For calculating the CO

2

component of VRT, there was

an increase in the number of bands to 20, with a wider gap between the lowest and

highest VRT rate. From 1 January 2022, the lowest and highest rates for calculating

the CO

2

component of VRT stand at 7% and 41% respectively.

Tax and Duty Manual Vehicle Registration Tax Manual Section 1 - Part A

22

7.2 Nitrogen Oxide (NOx) Emissions

From January 2020 VRT will also be charged on the NOx emissions of all Category A

vehicles including conventional and plug-in hybrid electrical vehicles. The NOx

charge will now form a component part of VRT and will be calculated at the point of

registration. NOx is measured in accordance with European Union regulations in

milligrams per kilometre or mg/km.

There are two tests for NOx which are based on either the old NEDC or new WLTP

test procedures. A certain number of N1 vehicles will also fall into the Category A

rate.

The NOx emissions figure can be obtained from the Certificate of Conformity of the

vehicle, or other type approval certificate. In the case of used vehicles most notably

UK imports the NOx value will be contained on the V5C at field V.3 for all V5C’s

issued prior to April 2019.

In the event that the previous registration certificate for the vehicle does not contain

a NOx emissions figure then a Certificate of Conformity or alternative statutory

documentation must be obtained.

7.3 Certificate of Conformity

When a manufacturer is granted type-approval for a vehicle, a Certificate of

Conformity (CoC) is issued that should accompany each vehicle manufactured in

conformity with the approved vehicle type. The CoC is, in effect, a statement by the

manufacturer that the vehicle conforms to the relevant EU type-approval

regulations.

From a VRT point of view, the CoC states that the vehicle at the date of manufacture

has a specific level of both CO

2

and NOx emissions. These are the levels that will be

used for taxation purposes and will not change regardless of post-production

modifications that might be made, modifications that might either marginally

increase or decrease the levels of emissions of the vehicle.

7.4 Procedure at Registration

The procedure to be adopted at the time of registration will depend on the person

making the declaration. Normally, a distributor or authorised dealer will use the e-

CoC pre-loaded on to the Revenue system (a legal requirement from 12 September

2016) and a private individual/unauthorised dealer will attend at an NCTS centre.

7.4.1 Declaration by an Authorised Person

New vehicles declared for registration through the established distributor/dealer

network can only be registered where an e-CoC is loaded on to the Revenue system.

7.4.2 Declaration by a Private Individual/Dealer at the NCTS Centre

New vehicles presented for registration by either a private individual or an

authorised person can only be registered where an e-CoC has been uploaded to the

Tax and Duty Manual Vehicle Registration Tax Manual Section 1 - Part A

23

Revenue system. In both cases above please refer to the Revenue website for

detailed information.

7.4.3 "Export" Vehicles from the UK

In addition to its normal registration series, the UK registration/licensing authorities

operate a registration system in a separate series for new means of transport which

are removed from the country either as Personal Exports or Direct Exports.

Registration numbers in the export series are distinguished from the normal UK

registration numbers by always starting with the letter “X” i.e. XB10 ABC.

Personal exports may be used on UK roads prior to export and are therefore

subjected to type-approval and insurance requirements in the UK at the time of

registration. They must also be licensed for road-tax purposes. Direct exports

cannot be used on UK roads and must be removed from the country on a car-

transporter/trailer etc.

The distinction between the two types is indicated by the colour of the log-book

issued by the UK authorities, i.e.:

personal exports are issued with a Pink log-book (VX302) endorsed with the

type-approval number, and

direct exports are issued with a Blue log-book (V308) and have no such

endorsement.

For the above reasons, vehicles previously registered in the UK in the export (X)

series and presented for registration at an NCTS centre:

do not qualify for exemption from type-approval by virtue of previous

registration in another EU member state, and

should not be registered unless accompanied by either a pink log-book (i.e.

personal exports) or a valid Certificate of Conformity.

7.4.4 Exempt/End-of-Series Vehicles

Type-approval standards are updated from time to time and these updates are

advised to Revenue by the Road Safety Authority. This updating can cause problems

for vehicles manufactured prior to each update, e.g. old stock, which, although they

may have conformed to all the relevant standards at the time they were built, due

to these updates they may now not meet all of the current requirements to allow

them to become registered - these vehicles are called end-of-series vehicles.

The End-of-Series Exemption Scheme allows vehicle manufacturers and distributors

to apply for a set period of additional time (12 months for complete vehicles and 18

months for completed (multistage) vehicles) to register and sell end-of-series

vehicles by granting exemptions from some of the latest changes to

directives/regulations.

The additional time begins on the date on which the changes were brought into law

– or, in other words, the date the vehicle lost its type approval validity.

Tax and Duty Manual Vehicle Registration Tax Manual Section 1 - Part A

25

8 EU Classification of Vehicles

M1

Category M1 is a vehicle designed and constructed for the carriage of passengers

and comprising of a maximum of 9 seating positions including the driver’s seating

position.

M2

Category M2 is a vehicle designed and constructed for the carriage of passengers

and comprising of more than 8 seating positions in addition to the driver’s seating

position, and having a maximum mass not exceeding 5 tonnes.

M3

Category M3 is a vehicle designed and constructed for the carriage of passengers

and comprising of more than 8 seating positions in addition to the driver’s seating

position, and having a maximum mass exceeding 5 tonnes.

N1

Category N1 is a vehicle designed and constructed for the carriage of goods and

having a maximum mass not exceeding 3.5 tonnes.

N2

Category N2 is a vehicle designed and constructed for the carriage of goods and

having a maximum mass exceeding 3.5 tonnes but not exceeding 12 tonnes.

N3

Category N3 is a vehicle designed and constructed for the carriage of goods and

having a maximum mass exceeding 12 tonnes.

L1e

Category L1e is a light 2 wheeled powered vehicle, having a maximum speed of

45km/h. There are 2 L1e subcategories:

1. L1e-A is a pedal assisted powered cycle having a maximum speed of 25km/h

and a maximum continuous rated or net power of 1,000 watts.

2. L1e-B is a 2 wheeled moped and is any other vehicle of the L1e category that

cannot be classified according to the criteria for a L1e-a vehicle.

L2e

Category L2e is a 3 wheeled moped, having a maximum speed of 45km/h.

L3e

Category L3e is a 2 wheeled motorcycle.

L4e

Category L4e is a 2 wheeled motorcycle with a sidecar.

Tax and Duty Manual Vehicle Registration Tax Manual Section 1 - Part A

26

L5e

Category L5e is a powered tricycle.

L6e

Category L6e is a light quadricycle with a maximum speed of 45km/h.

L7e

Category L7e is a heavy quadricycle.

T1

Category T1 is a wheeled tractor with the closest axle to the driver having a

minimum track width of not less than 1,150mm, with an unladen mass, in running

order, of more than 600kg and a ground clearance of not more than 1,000mm.

T2

Category T2 is a wheeled tractor with a minimum track width of less than 1,150mm,

with an unladen mass, in running order, of more than 600kg and with a ground

clearance of not more than 600mm. If the height of the centre of gravity of the

tractor

(measured in relation to the ground) divided by the average minimum track

for each axle exceeds 0,90, the maximum design speed is restricted to 30km/h.

T3

Category T3 is a wheeled tractor with an unladen mass, in running order, of not

more than 600kg.

T4

Category T4 is a special purpose wheeled tractor.

Tax and Duty Manual Vehicle Registration Tax Manual Section 1 - Part A

27

EU Bodyworks

Motor vehicles of category M1

AA

Saloon

AE

Convertible

AB

Hatchback

AF

Multi-purpose vehicle

AC

Station wagon

AG

Truck station wagon

AD

Coupé

Motor vehicles of category M2 and M3

CA

Single deck vehicle

CG

Articulated low-floor single deck

vehicle

CB

Double deck vehicle

CH

Articulated low-floor double deck

vehicle

CC

Single-deck articulated

vehicle

CI

Open top single deck vehicle

CD

Double-deck articulated

vehicle

CJ

Open top double deck vehicle

CE

Low-floor single deck vehicle

CX

Bus chassis

CF

Low-floor double deck

vehicle

Motor vehicles of category N

BA

Lorry

BD

Road tractor

BB

Van

BE

Pick-up truck

BC

Tractor unit for semi-trailer

BX

Chassis-cab or chassis-cowl

For further details please refer to Regulation (EU) 2018/858.

Tax and Duty Manual Vehicle Registration Tax Manual Section 1 - Part A

28

9 Process for vehicles presented as N1 from 31 July 2018

Where a vehicle is presented at an NCTS centre for registration as a N1 the operator

should undertake the following steps:

1. Establish the particulars of the vehicle through a documentary check

2. Establish the number of seats in the vehicle

3. Ensure a figure for CO

2

and NOx

emissions is available where a vehicle is

deemed to be a Category A vehicle. If the CO

2

value is not supplied the

system will assign a CO

2

level of 999, resulting in the highest VRT charge of

41%. The level of CO

2

emissions declared to Revenue must be supported by

acceptable documentation. If the NOx value is not supplied the system will

assign the maximum charge of €4,850 for diesel vehicles and €600 for all

others.

4. Where the vehicle has 4 seats or more conduct a visual examination of the

vehicle to determine whether the passenger and cargo/functional areas are

contained in a single unit. Tables 1.A and 1.B below will be of assistance in

determining this

5. Take side and rear exterior profile photographs as well as interior

photographs of any partitions

6. When a vehicle has a bodywork code of BA, BB or BE with 4 or more seats

and is seeking the Cat B rate, it must fall into one of the body-types listed in

table 2 below*

7. Vehicles which fall in the circumstances outlined in point 6 will be classified

by Revenue.

*Please note a Crew Cab body type will only be assigned when the vehicle has two

completely separate compartments.

Where an N1 vehicle, with more than 3 seats, has seating and the cargo/functional

area in a single unit, even if the seating and cargo/functional area are separated by a

partition, the body type must be “Van”, and the vehicle will be classified as VRT

category A.

Tax and Duty Manual Vehicle Registration Tax Manual Section 1 - Part A

29

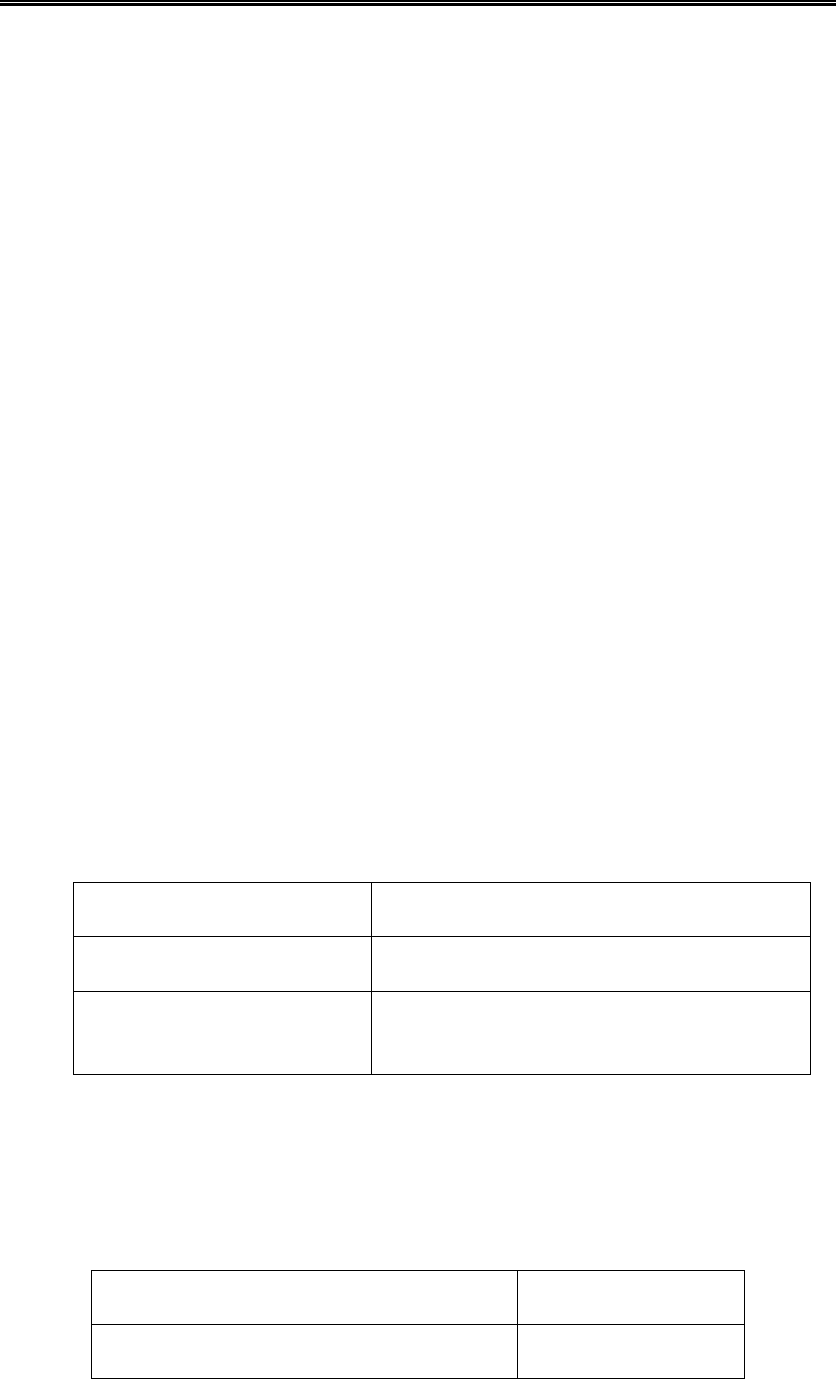

Table 1.A.:

Example of vehicles which are contained within a single unit

SUV (M1), improbable that

it would qualify for N1.

Seating and cargo area are

in a single unit. A partition

would not alter this.

VRT

Category A

SUV (M1), improbable that

it would qualify for N1.

Seating and cargo area are

in a single unit. A partition

would not alter this. Also

vehicle would not have

been assigned a body code

of BA, BB or BE on the

original certificate of

conformity.

VRT

Category A

N1. 2

nd

row of seating and

cargo area are in a single

unit, even though

partitioned. The base

vehicle is single-cab and

could not accommodate

the 2

nd

row of seats.

VRT

Category A

N1 6 seater crew cab.

Whilst there is a partition

between the

compartments they are

contained in a single unit.

VRT

Category A

Tax and Duty Manual Vehicle Registration Tax Manual Section 1 - Part A

30

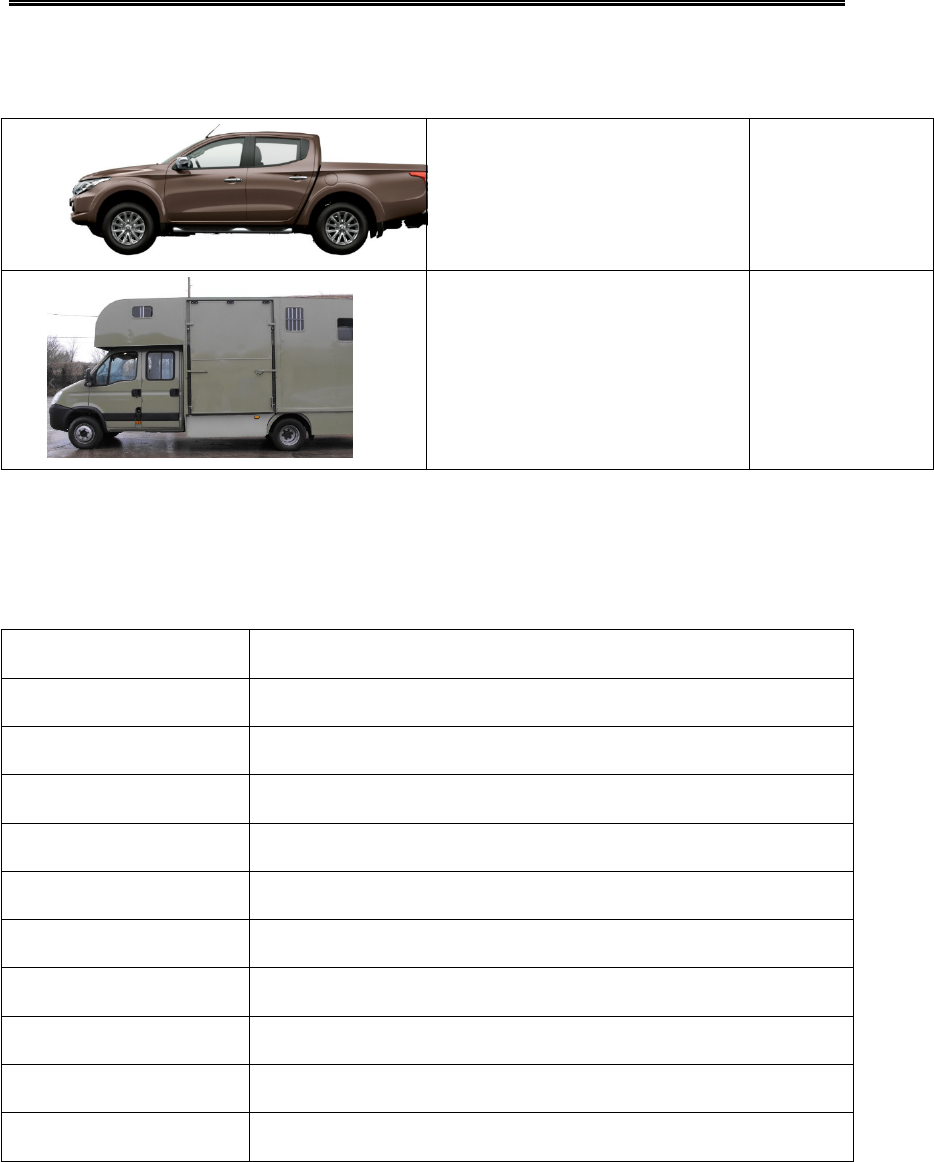

Table 1.B.:

Examples of vehicles where the compartments are in separate units

N1. Seating and cargo

areas are in separate

units.

VRT

category B,

13.3% rate

N1. Seating and cargo

areas in separate units.

The base vehicle is

double-cab and

accommodates the 2

nd

row of seats.

VRT

category B,

13.3% rate

Table 2:

Eligible body-types where the bodywork code is not BE for consideration as

Category B

Code

Description

07

Open Lorry and Container

08

Open Lorry Only

23

Tanker

24

Concrete Mixer

30

Refuse Collector

48

Pick-up

52

Box Van

60

Recovery Vehicle

82

Crew Cab

87

Tipper