Copies of this publication may be obtained by calling 651-296-6753. This document can be made available in

alternative formats for people with disabilities by calling 651-296-6753 or the Minnesota State Relay Service at

711 or 1-800-627-3529 (TTY). Many House Research Department publications are also available on the

Internet at: www.house.mn/hrd/.

INFORMATION BRIEF

Research Department

Minnesota House of Representatives

600 State Office Building

St. Paul, MN 55155

Nina Manzi, Legislative Analyst, 651-296-5204

Joel Michael, Legislative Analyst Updated: June 2017

Income Tax Deductions and Credits for

Public and Nonpublic Education in Minnesota

Minnesota has had an income tax credit for public and nonpublic education-

related expenses since 1998 and a dependent education expense deduction since

1955. This information brief discusses the deduction and credit and their effects

on tax liability.

Contents

Executive Summary .......................................................................................................................2

Dependent Education Expense Deduction ...........................................................................2

Education Tax Credit ...........................................................................................................2

Dependent Education Deduction ..................................................................................................4

Description ...........................................................................................................................4

Effect on Tax Liability .........................................................................................................7

Education Tax Credit ....................................................................................................................8

Description ...........................................................................................................................8

Effect on Tax Liability .......................................................................................................11

Appendix: 1971-1973 Education Credit.....................................................................................13

House Research Department Updated: June 2017

Income Tax Deductions and Credits for Public and Nonpublic Education in Minnesota Page 2

Executive Summary

Dependent Education Expense Deduction

Minnesota has allowed an income tax deduction for dependent education expenses paid to others

since 1955. Taxpayers may deduct up to $1,625 for students in grades K-6, and up to $2,500 for

students in grades 7-12. Expenses qualifying for the deduction include tuition, transportation,

textbooks, instructional materials, tutoring, academic summer school and camps, and up to $200

of the cost of a computer or education-related software. The U.S. Supreme Court upheld

Minnesota’s deduction in 1983.

A deduction reduces the amount of income subject to tax; the benefit a taxpayer receives equals

the taxpayer’s marginal tax rate times the amount of the deduction. Most Minnesota taxpayers

are in the 7.05 percent bracket, where a $2,500 deduction decreases taxes by $176.25.

Education Tax Credit

Minnesota allows a refundable education tax credit, equal to 75 percent of qualifying expenses.

Because credits directly offset tax liability, the credit decreases a taxpayer’s liability dollar-for-

dollar. If the credit exceeds a taxpayer’s liability, the excess is paid to the taxpayer as a refund

since the credit is refundable. Taxpayers may claim the credit for all expenses allowed under the

deduction, with the exception of nonpublic school tuition. The maximum credit is $1,000 per

child. The credit was enacted in the 1997 first special session

1

and was initially equal to 100

percent of qualifying expenses. In tax year 1998, the credit was available only to families with

incomes under $33,500;

2

the 1999 Legislature provided for the credit to phase out for families

with incomes between $33,500 and $37,500.

3

The 2001 Legislature limited the credit to 75

percent of qualifying expenses, effective in tax year 2002.

4

The 2005 Legislature eliminated the

so-called family cap and allowed families to claim the $1,000 credit for an unlimited number of

children in grades K-12.

5

Prior to tax year 2005 the maximum credit per family was $2,000,

effectively limiting the credit to two children per family.

6

1

Laws 1997, 1

st

spec. sess., ch. 4, art. 13.

2

The income measure used is the same as for determining the property tax refund and the child care credit; it is

a broad measure that includes welfare benefits, tax-exempt interest, and nontaxable Social Security.

3

Laws 1999, ch. 243, art. 2, § 14.

4

Laws 2001, 1

st

spec. sess., ch. 5, art. 9.

5

Laws 2005, 1

st

spec. sess., ch. 3, art. 3.

6

Minnesota allowed a refundable tax credit for nonpublic school tuition from 1971 to 1973. Pupil unit

weighting made the $100-credit worth $50 for kindergarten students, $100 for students in grades 1 to 6, and $140 for

students in grades 7 to 12. In 1974, the Minnesota Supreme Court, following a U.S. Supreme Court decision that

invalidated a similar New York tax credit, struck down the Minnesota credit. The appendix describes the 1971-1973

credit.

House Research Department Updated: June 2017

Income Tax Deductions and Credits for Public and Nonpublic Education in Minnesota Page 3

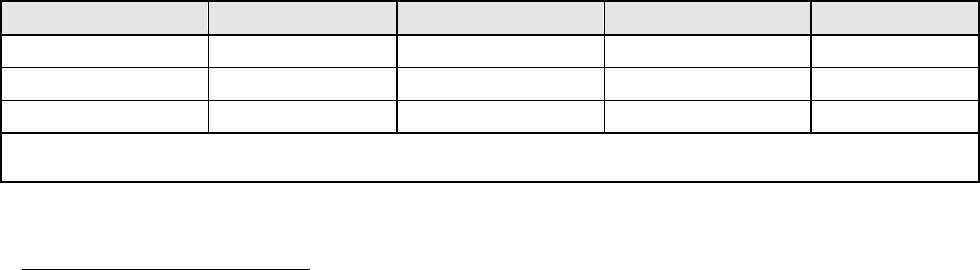

Table 1 shows the number of taxpayers claiming the deduction and credit in tax year 2015.

Table 1

Fiscal Impact of Dependent Education Expense

Deduction and Education Credit, Tax Year 2015

Cost (millions)

Number of Taxpayers

Affected

Deduction $17.8 207,000

Credit $12.4 48,787

Source: Minnesota Department of Revenue, Tax Expenditure Budget, Fiscal

Years 2016-2019; and report on refundable income tax credits.

House Research Department

House Research Department Updated: June 2017

Income Tax Deductions and Credits for Public and Nonpublic Education in Minnesota Page 4

Dependent Education

Deduction

Description

Minnesota allows a deduction

7

for education-

related expenses of up to $2,500 for each

dependent in grades 7 to 12, and up to $1,625

for each dependent in grades K to 6. The

dollar limits for the deduction were increased

from $1,000 and $650 to the current levels in

1998.

8

When first enacted in 1955, the

deduction was limited to $200 per dependent,

regardless of grade.

9

The accompanying box

shows the history of the deduction.

The deduction applies to the following

categories of expenses:

• tuition, including tutoring and

academic summer school and camps

• textbooks, including instructional

materials, supplies, and equipment

• transportation

Tuition. Taxpayers may claim the deduction

for tuition paid for instruction at nonpublic

schools. The 1997 legislation added tutoring

and academic summer school and camps to the

list of items qualifying as “tuition.” Tutoring and academic summer school and camps must help

to improve knowledge of academic standards required to graduate, including world languages, in

order to qualify for the deduction.

Textbooks. Textbooks include instructional materials and equipment. The law excludes books

and materials used to teach religious tenets, doctrines, and worship. The 1997 legislation added

7

A deduction reduces tax liability by an amount equal to the taxpayer’s marginal tax rate times the amount of

the deduction. The greatest tax decrease possible for the maximum $2,500 deduction is $246.25, which goes to

higher income taxpayers in the 9.85 percent bracket. Taxpayers in the 5.35 percent bracket receive a tax decrease of

$133.75 for a $2,500 deduction. Those with no tax liability receive no benefit from a deduction.

8

Laws 1997, first special session, chapter 4, article 13, made the expanded deduction contingent on

adequate

revenue being available in the November 1997 economic forecast for the expanded deduction, the new

education credit, and an increase in the working family credit. Adequate revenue was available so the three items

took effect in tax year 1998.

9

Laws 1955, ch. 741, § 1.

Timeline: Dependent Education Expense

Deduction

1955* $200 per dependent, for tuition and

transportation expenses paid to

others

1975 Amount increased to $500 for grades

K-6 and $700 for dependents in

grades 7-12. Deduction allowed for

nonreligious textbooks, instructional

materials, and equipment

1978 Deduction not allowed for

extracurricular activities

1983

U.S. Supreme Court upholds

deduction in Mueller v. Allen

463 U.S. 388 (1983)

1985 Amount increased to $650 for grades

K-6 and $1,000 for grades 7-12

1998 Amount increased to $1,625 for

grades K-6 and $2,500 for grades 7-

12. Deduction allowed for tutoring,

academic summer school and camp,

and computers

2001 Deduction allowed for purchase of

musical instruments

* Years shown are effective years

House Research Department Updated: June 2017

Income Tax Deductions and Credits for Public and Nonpublic Education in Minnesota Page 5

computers and education-related software to the definition. However, only $200 per year per

family may be deducted for computer equipment and software.

Transportation. This includes the cost of transporting children to school during the regular

school year, but not to summer school or camps.

Extracurricular activities, such as sporting events, music, and drama and speech activities, do not

qualify.

The list of expenses qualifying for the deduction has expanded since the credit was enacted.

Tutoring, academic summer school and camps, and up to $200 of computer hardware and

educational software first qualified in 1998. Beginning in 1999, parents could deduct tuition

paid to teachers who are members of the Minnesota Music Teachers Association. Rental of

musical instruments has long qualified for the deduction; purchase of instruments first qualified

in tax year 2001. Each year the Department of Revenue provides information on what expenses

qualify for the deduction. The information in Table 3 is from the 2016 income tax instructions

and gives examples of expenses that do and do not qualify for the deduction. Note that fees for

all-day kindergarten may be used to claim the K-12 education expense deduction and credit, or

the dependent care credit, but not both.

Table 3

Qualifying Educational Expenses: Dependent Education Deduction and Credit

Educational expense Qualifies for:

Credit Deduction

Private school tuition X

Tuition for college courses used to meet high school

graduation requirements

X

Fees for after-school enrichment programs X X

Tuition for academic summer camps X X

Instructor fees for driver’s education if offered as part

of school curriculum

X X

Fees for all-day kindergarten X X

Tutoring X X

Music lessons X X

Purchase of required educational material for use

during regular public, private, or homeschool day

X X

Purchase or rental of musical instruments used during

regular school day

X X

Fees paid to others for transportation to/from school

or for field trips during the normal school day

X X

Home computer hardware and educational software

(up to $200 for credit and $200 for deduction)

X X

House Research Department Updated: June 2017

Income Tax Deductions and Credits for Public and Nonpublic Education in Minnesota Page 6

Expenses that do not qualify:

• Costs to drive your child to/from school, tutoring, enrichment programs, or camps that are not

part of the school day

• Travel expenses, lodging, and meals for overnight class trips

• Fees for materials and textbooks purchased for use in religious teachings

• Sports camps or lessons

• Books and materials used for tutoring, enrichment programs, academic camps, or after-school

activities

• Tuition and expenses for preschool or post-high school classes

• Costs of school lunches

• Costs of uniforms used for school, band, or sports

• Monthly Internet fees

• Noneducational software

Source: Instructions for 2016 Form M-1, the standard Minnesota income tax form, Minnesota Department of Revenue

House Research Department

Taxpayers are not required to claim itemized deductions to claim the dependent education

expense deduction. Taxpayers may claim either a standard deduction amount, which is indexed

annually for inflation, or the sum of a list of itemized deductions, whichever benefits them

most.

10

Before 1998, only taxpayers who claimed itemized deductions were allowed to claim the

dependent education expense deduction.

11

The cost of the deduction in foregone revenue is estimated at $17.8 million in tax year 2015

(fiscal year 2016) and was claimed by about 207,000 filers.

12

The number of filers claiming

the deduction roughly doubled from 1997 to 1998, from about 73,000 to 144,000.

13

The substantial increase in both the number of taxpayers claiming deductions and the dollar

value of deductions is due to the 1997 legislation that:

• increased the amount of the deduction;

• expanded the list of eligible expenses to include tutoring, academic summer schools and

camps, and limited computer hardware and software purchases; and

10

The decision to itemize or claim the standard deduction is made under the federal income tax and flows

through to the Minnesota income tax as part of federal taxable income. See note 11 for background on this.

Taxpayers who own their homes are more likely to itemize than those who rent, since deductions are allowed for

property taxes and mortgage interest paid. Other itemized deductions include medical expenses and casualty/theft

losses that exceed a percentage of income, state income taxes, charitable contributions, and certain business-related

expenses.

11

When the deduction was enacted in 1955, Minnesota’s income tax was not as closely tied to the federal

income tax as it is today. For many years Minnesota allowed taxpayers to claim either a state standard deduction

amount or state itemized deductions. The dependent education expense deduction was allowed as a state deduction,

but was not allowed for taxpayers who claimed the Minnesota standard deduction amount. In the 1987 legislative

session, Minnesota responded to the Federal Tax Reform Act of 1986 by conforming to the federal definition of

income after deductions, but continued to allow the dependent education expense deduction in addition to itemized

deductions allowed at the federal level. Laws of Minnesota, First Special Session 1997 chapter 4, article 13,

section 1, eliminated the requirement that taxpayers itemize in order to claim the deduction.

12

Minnesota Department of Revenue, Tax Expenditure Budget, Fiscal Years 2016-2019, 64 (February 2016).

13

Minnesota Department of Revenue, estimates prepared during the 1997 Special Session and in 1999.

House Research Department Updated: June 2017

Income Tax Deductions and Credits for Public and Nonpublic Education in Minnesota Page 7

•

allowed the deduction to parents who claimed the federal standard deduction.

The U.S. Supreme Court upheld the constitutionality of the dependent education expense

deduction in a 1983 case, Mueller v. Allen.

14

The taxpayer plaintiffs claimed that the deduction

amounted to an establishment of religion in violation of the First Amendment because almost all

of the taxpayers using the deduction had children in parochial schools.

15

In a five-to-four

decision, the Court held that the deduction had a valid secular purpose, did not have a primary

purpose of advancing religion, nor did it create excessive church-state entanglement. As a result,

the Court concluded (over a vigorous dissent) that the deduction did not violate the

Establishment Clause of the First Amendment.

Effect on Tax Liability

The tax reduction a taxpayer sees from claiming the deduction depends on the taxpayer’s

income and the total amount deducted.

16

The value of an income tax deduction equals the

taxpayer’s marginal income tax rate times the amount of the deduction. Minnesota has a

progressive rate structure, with higher marginal rates for higher income taxpayers. Table 4

shows the income ranges, or brackets, and tax rates for tax year 2017 by filing status. The

income ranges shown are Minnesota taxable income, which equals income after federal

deductions and exemptions, and after Minnesota additions and subtractions. Taxable income is

significantly lower than gross income. For example, in tax year 2017 a typical married couple

with two dependents must have at least $32,950 in gross income before having any Minnesota

taxable income.

Table 4

Income Tax Rates and Brackets for Tax Year 2017

Filing Status 5.35 percent 7.05 percent 7.85 percent 9.85 percent

Married joint* $0 to $37,110 $37,111 to $147,450 $147,451 to $261,510 over $261,510

Single 0 to 25,390 25,391 to 83,400 83,401 to 156,910 over 156,910

Head of household** 0 to 31,260 31,261 to 125,600 125,601 to 209,210 over 209,210

* Brackets for married separate filers are half the brackets for married joint filers.

** Head of household filers are typically single parents.

House Research Department

14

463 U.S. 388 (1983). Mueller was a taxpayer challenge. In a 2011 case, the U.S. Supreme Court held that

taxpayer standing under the Flast v. Cohen rule for establishment clause challenges did not apply to tax

expenditures, such as a tax deduction or credit. Arizona Christian School Tuition Org. v. Winn, 131 S. Ct. 1436

(2011). As a result, the taxpayers in Mueller would now not have standing to bring suit in federal court; whether

taxpayers would have standing to file a challenge under the Minnesota Constitution is unclear.

15

The plaintiffs showed that more than 95 percent of Minnesota’s 91,000 nonpublic school students attended

parochial schools during the 1979-1980 school year. Plaintiffs also showed that while the 87,000 parochial school

students represented about 10 percent of the state’s total elementary and secondary school population, 71 percent of

the $2.4 million state revenue lost through the tuition deduction was due to taxpayers with children in parochial

schools; 820,000 students attended the state’s public schools at the time.

16

For more information on tax deductions, see the House Research Department publication Income Tax Terms:

Deductions and Credits, July 2015.

House Research Department Updated: June 2017

Income Tax Deductions and Credits for Public and Nonpublic Education in Minnesota Page 8

Tax deductions under a progressive income tax provide greater benefits to taxpayers in higher

tax brackets than to those in lower tax brackets, and no benefits to taxpayers who do not have

taxable income. A taxpayer who claims a $1,000-dependent education expense deduction and

whose top tax bracket is 5.35 percent will see a tax decrease of $53.50, or 5.35 percent of $1,000.

If the taxpayer’s income is high enough to reach the 9.85-percent bracket, the tax decrease will

be $98.50.

17

If the taxpayer’s income is low enough to be totally offset by the standard deduction

and exemptions ($28,900 for a family of four in 2017), a deduction provides no benefit at all.

Education Tax Credit

Description

Minnesota enacted an education tax credit in the first special session of 1997, with the credit

first available in tax year 1998.

18

Parents can claim the credit for all education-related expenses

that qualify for the dependent education expense deduction, except nonpublic school tuition.

Thus, the credit is allowed for transportation; tuition for academic summer school and summer

camps; tutoring; textbooks, defined to include instructional materials and equipment, including

the purchase of musical instruments; and up to $200 per family of computer hardware and

educational software.

The maximum credit per family is $1,000 multiplied by the number of children in the household

in grades K-12. The credit is refundable. Any amount that exceeds tax liability is paid to the

claimant as a refund. The credit equals 75 percent of qualifying expenses up to the maximum

per child.

19

A family with one child and $1,333 of expenses will qualify for the maximum

$1,000 credit ($1,000 is 75 percent of $1,333). A family with two children will need to spend

$2,667 on qualifying purchases in order to receive the maximum $2,000 credit.

Before 2005, the maximum credit per family was $2,000, effectively limiting families to

claiming the maximum $1,000 per child for only two children. Since 2005 families may claim

up to the maximum $1,000 per child for each child in kindergarten through grade 12, and

families may allocate qualifying expenses among children in grade K-12 as they choose. For

example, a family with two children in grades K-12 may claim the entire $2,000 credit ($1,000

times two children) for expenses related to one child.

20

This change made the credit more closely

17

Until tax year 1998, the deduction was available only to taxpayers who claim itemized deductions at the

federal level. Beginning in tax year 1998, taxpayers who claim the standard deduction are also allowed to claim the

dependent education expense deduction; however, many of those claiming the deduction will be itemizers. For

itemizers, the tax decrease realized at the state level is offset in part in the following year by a tax increase at the

federal level. This is because itemizers also deduct state income taxes in computing federal tax. The amount of the

federal offset will equal the tax value of the state deduction, multiplied by the taxpayer’s federal marginal tax rate.

Federal marginal rates for tax year 2010 range from 10 percent to 35 percent, depending on income.

18

Laws 1997, ch. 4, art. 13, § 3.

19

Laws 2001, first special session, chapter 5, article 9, reduced the credit from 100 percent to 75 percent of

qualifying expenses. This change was enacted in 2001 but did not take effect until tax year 2002, so as not to reduce

the expected credits of families who had already made qualifying expenditures in tax year 2001.

20

Laws 2005, 1

st

spec. sess., ch. 3, art. 3, § 10.

House Research Department Updated: June 2017

Income Tax Deductions and Credits for Public and Nonpublic Education in Minnesota Page 9

parallel the deduction, since there is no limit on the number of children for whom parents may

claim the deduction.

The credit phases out for taxpayers with incomes over $33,500. The $1,000 maximum for

one child phases out at a rate of $1 for each $4 of income over $33,500, and the maximum for

more than one child ($1,000 times the number of qualifying children) phases out at a rate of $2

for each $4 of income over $33,500. The credit phaseout took effect in tax year 1999;

21

in tax

year 1998 the credit was limited to claimants with incomes under $33,500 without a phaseout.

The 2005 legislation that eliminated the two-child “family cap” effectively extended the

phaseout by $2,000 for each additional child eligible for the credit. Thus, the credit is fully

phased out when income reaches $37,500 for families with two qualifying children, when

income reaches $39,500 for families with three qualifying children, at $41,500 for families with

four qualifying children, and so on. The income measure used to determine eligibility for the

credit is a broad measure that includes nontaxable interest, Social Security, and public welfare

benefits; the same income measure is used under the property tax refund and the dependent care

credit.

A total of 48,787 families claimed the education credit in tax year 2015, at an estimated

average benefit of $254 each, for a total of $12.4 million. Table 5 shows the credit amount

and number of recipients in tax years 1998 through 2015.

21

Laws 1999, ch. 243, art. 2, § 14.

House Research Department Updated: June 2017

Income Tax Deductions and Credits for Public and Nonpublic Education in Minnesota Page 10

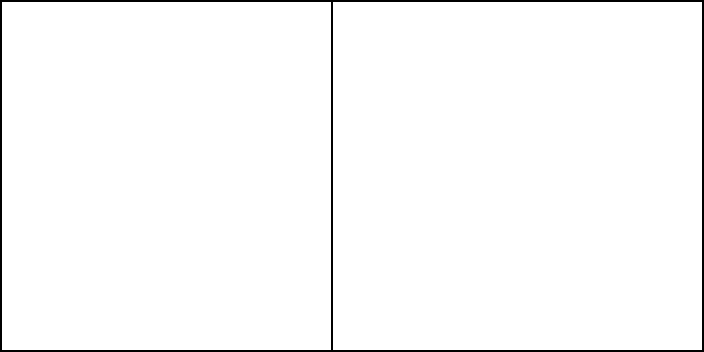

Table 5

Fiscal Impact of K-12 Education Credit

Tax Years 1998 to 2015

Tax Year

Cost

(millions)

Number of taxpayers

claiming credit

1998 $14.2 38,500

1999 $21.4 57,962

2000 $21.3 55,941

2001 $19.4 56,414

2002 $16.0 60,996

2003 $15.9 61,253

2004 $15.0 58,593

2005 $15.3 56,937

2006 $14.8 55,742

2007 $14.2 54,437

2008 $14.2 54,031

2009 $14.7 55,958

2010 $15.3 56,776

2011 $15.7 57,331

2012 $14.7 53,516

2013 $14.6 53,713

2014 $13.3 51,317

2015 $12.4 48,787

Source: Department of Revenue income tax processing file or

summary reports.

House Research Department

Families eligible for the credit may assign their anticipated refunds to participating

financial institutions and tax-exempt foundations. The organizations accepting assignment of

refunds will make loans to families, with the loan amount paid directly to a third-party vendor

for providing education-related products and services. Low-income families with perhaps only

small amounts of disposable income and savings can use the loans to obtain education-related

products and services in anticipation of qualifying for the tax credit when they file their tax

returns in the following year. The Department of Education must certify that the products and

services qualify for the credit, in order for the assignment to be valid. The third-party vendor

must disclose to the taxpayer the cost of products and services to be provided and information on

how to obtain repair or replacement of defective products. Taxpayers may not assign more than

the maximum credit of $1,000 per child or $2,000 per family. Refund assignment first became

House Research Department Updated: June 2017

Income Tax Deductions and Credits for Public and Nonpublic Education in Minnesota Page 11

available on a temporary basis in tax year 2002,

22

and has since been made permanent.

23

Very

few taxpayers have used the refund assignment option—fewer than ten per year from 2013 to

2015.

Assignments have last claim on income tax refunds, after claims for delinquent taxes, child

support, restitution, and revenue recapture. The Commissioner of Revenue may disclose the

aggregate amount of outstanding claims to participating organizations before the organization

decides to accept an assignment. Once an assignment exists, the Department of Revenue will

subtract delinquent taxes, child support, restitution, and revenue recapture claims from any

income tax refund amount due the taxpayer, and pay the remaining amount to the organization

that accepted the assignment, up to the amount of the assignment. Any refund amount in excess

of the assignment will be paid directly to the taxpayer.

Effect on Tax Liability

Tax credits directly offset tax liability, unlike deductions, which reduce taxable income.

The benefit of a refundable credit to the taxpayer exactly equals the amount of the credit

claimed. If a refundable credit exceeds a taxpayer’s income tax liability, the excess is refunded

to the taxpayer.

A refundable credit provides the same benefit to claimants with equal qualifying expenses,

regardless of income or tax liability. As a result, filers who claim an education tax credit of

$1,000 receive a $1,000 benefit. For those with tax liability, the benefit comes in the form of

reduced taxes. Filers without tax liability receive a $1,000 refund check. Since the credit equals

75 percent of qualifying expenses, a taxpayer must purchase $1,333 of qualifying products and

services in order to claim the maximum $1,000 credit.

Taxpayers may not claim the deduction and credit for the same expenses. Parents who qualify

for both the deduction and credit will receive the greatest benefit by first claiming up to the

maximum allowable under the credit, and then claiming any remaining expenses under the

deduction. Table 6 shows how the deduction and credit interact for a married couple with two

children who purchase a $1,000 computer and have $500 of tutoring expenses.

22

Laws 2001, 1

st

spec. sess., ch. 5, art. 9, § 12.

23

Laws 2003, ch. 127, art. 3, § 23.

House Research Department Updated: June 2017

Income Tax Deductions and Credits for Public and Nonpublic Education in Minnesota Page 12

Table 6

Education Deduction and Credit Example

Married Couple with Two Children, Tax Year 2017

Gross income $35,000

Taxable income $6,100

Education-related expenses $500 for tutoring

$1,000 for computer

Tax deduction $200 for computer

Tax decrease from deduction

$11 ($200 x 5.35% tax rate)

Tax credit $500 for tutoring

$200 for computer

Credit rate 75%

Tax decrease from credit

$525 ($700 x 75% credit rate)

Total tax decrease

$536

House Research Department

Claimants are limited to $200 in computer-related expenses for both the deduction and the credit.

Because this couple has $1,000 of computer expenses, they can claim $200 as a deduction and 75

percent of $200 as a credit. Combined with their $500 of tutoring expenses, which qualifies for

the credit at the 75 percent rate, the couple experiences a total tax decrease of $536.

House Research Department Updated: June 2017

Income Tax Deductions and Credits for Public and Nonpublic Education in Minnesota Page 13

Appendix

The 1971-1973 Education Credit

Minnesota enacted a nonpublic education tax credit in 1971.

24

The credit was allowed for

“education costs,” defined to include tuition, classroom instructional fees, and textbooks. The

statute used the same language as the deduction, specifying that the credit was not allowed for

purchase of textbooks used in the teaching of religious tenets, doctrines, or worship.

The credit was set at $100 per pupil unit for

1971 and 1972. The way Minnesota

weighted pupil units made the credit worth

$50 for kindergarten students, $100 for

students in grades 1 to 6, and $140 for

students in grades 7 to 12. For 1973 and

following years, the credit was adjusted by

the percentage growth in school foundation

aid.

Taxpayers claiming the credit had to

document their eligibility. Their income tax

returns had to include nonpublic school

receipts listing the following:

• the name and location of the

nonpublic school

• the amount paid for education costs

and textbooks and the date of payment

• the grade in which the student was

enrolled

• the student’s name and name of the

person who paid for tuition and

textbooks

The legislation also required taxpayers to

include certification from the nonpublic

school indicating the following:

• that the school satisfied the

requirements of compulsory attendance

• the restricted maintenance cost of education per pupil

25

• the total amount paid by the taxpayer for education costs

24

Laws 1971, ch. 944.

25

The statute defined “restricted maintenance cost” as 80 percent of the levy portion of school expenses.

Timeline: Education Tax Credit

(in effect from 1971 to 1973)

1971 $100 per pupil unit tax credit enacted

1972 Ramsey County District Court finds

state tax credit permissible under

then-existing law

Plaintiffs appeal district court

judgment

1973 Legislation restricts credit to

Minnesota residents

U.S. Supreme Court finds similar

New York credit unconstitutional in

Nyquist

1974 Minnesota Supreme Court follows

precedent set in Nyquist and strikes

down the Minnesota credit

State Department of Revenue

disallows the credit for tax year 1974

and following years

1980 Repeal of credit included in

Department of Revenue technical

legislation

House Research Department Updated: June 2017

Income Tax Deductions and Credits for Public and Nonpublic Education in Minnesota Page 14

•

the maximum allowable tax credit for each month of enrollment

26

• the student’s name and the number of months the student was enrolled

The tax credit was refundable, with any amount in excess of tax liability refunded to the

taxpayer. In addition, there was no limit on the number of students for whom a taxpayer could

claim the credit. However, only one credit could be claimed for each student, and taxpayers had

to choose between claiming the credit and claiming the already existing dependent education

expense deduction.

Department of Revenue records show that between 44,000 and 45,000 taxpayers claimed the

credit in each of the three years it was available. Taxpayers claimed $7.4 million in credits in

1971; $8.6 million in 1972; and $10.6 million in 1973. The average credit claimed increased

from about $170 in 1971 to about $240 in 1973.

27

In 1974, the Minnesota Supreme Court ruled the state’s education tax credit impermissible on

federal constitutional grounds. The state court relied on a 1973 U.S. Supreme Court decision

finding New York’s tuition reimbursement program unconstitutional under the federal

Establishment Clause because it had the effect of promoting religion. Taxpayers were allowed to

keep credits issued from 1971 to 1973. The court did not consider the constitutionality of 1974

state legislation that prohibited the Commissioner of Revenue from recovering credits paid in

previous years.

28

The credit was not allowed for 1974 and following years because it was found

unconstitutional before the end of the 1974 tax year. The tax credit remained in statute until

1980, when it was repealed in a Department of Revenue technical bill.

For more information about income tax credits, visit the income tax area of our website,

www.house.mn/hrd/.

26

The statute based the total claim for the credit on a ten-month school year, so that a taxpayer could claim 10

percent of the full credit amount for each month of student enrollment.

27

Available data on tuition costs suggest that the increase in the amount claimed per family resulted from

increased tuition at nonpublic schools.

28

Laws 1974, ch. 556, § 20.